Claims Management Inc. provides claims processing services to several large health insurance providers. Customers who are covered by health insurance provided by one of Claims Management's partners submit their claims for health and dental services along with related documentation, and the employees at Claims Management compare their claims to the details of their benefit plans and calculate the value of the benefits owed. The company uses a predetermined variable overhead rate based on direct labour-hours. In the month of September, 15,000 claims were processed using 4,500 direct labour-hours. The company incurred a total of $4,950 in variable overhead costs. According to the company's standards, 0.25 direct labour-hours are required to process a claim, and the variable overhead rate is $1.20 per direct labour-hour. Required. 1-a. What variable overhead cost should have been incurred to process the 15,000 claims? Standard variable overhead cost 1-b. How much does this differ from the actual variable overhead cost? (Indicate the effect of variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).)

Claims Management Inc. provides claims processing services to several large health insurance providers. Customers who are covered by health insurance provided by one of Claims Management's partners submit their claims for health and dental services along with related documentation, and the employees at Claims Management compare their claims to the details of their benefit plans and calculate the value of the benefits owed. The company uses a predetermined variable overhead rate based on direct labour-hours. In the month of September, 15,000 claims were processed using 4,500 direct labour-hours. The company incurred a total of $4,950 in variable overhead costs. According to the company's standards, 0.25 direct labour-hours are required to process a claim, and the variable overhead rate is $1.20 per direct labour-hour. Required. 1-a. What variable overhead cost should have been incurred to process the 15,000 claims? Standard variable overhead cost 1-b. How much does this differ from the actual variable overhead cost? (Indicate the effect of variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).)

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter1: Introduction To Cost Accounting

Section: Chapter Questions

Problem 11P: Spokane Production Co. obtained the following information from its records for July: Required: 1....

Related questions

Question

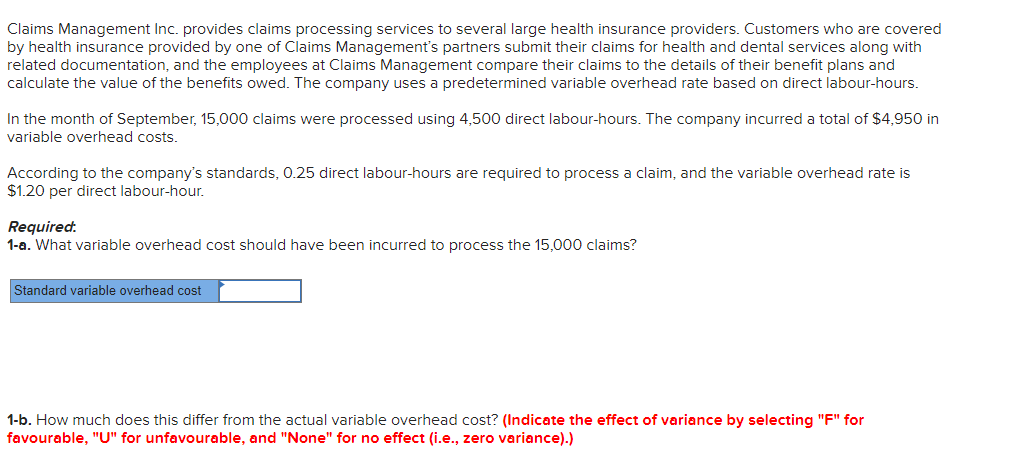

Transcribed Image Text:Total variable overhead variance

2. Break down the difference computed in requirement 1-b above into a variable overhead spending variance and a variable overhead

efficiency variance. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no

effect (i.e., zero variance). Do not round intermediate calculations.)

Variable overhead spending variance

Variable overhead efficiency variance

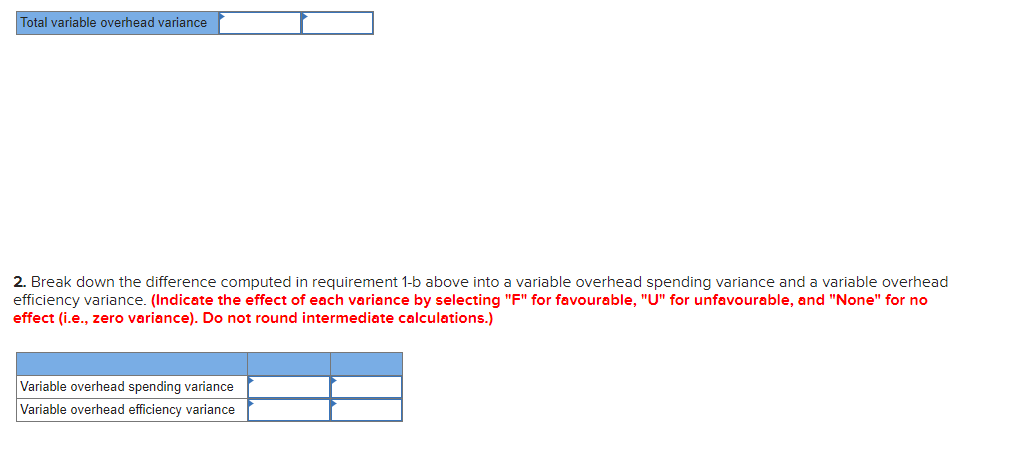

Transcribed Image Text:Claims Management Inc. provides claims processing services to several large health insurance providers. Customers who are covered

by health insurance provided by one of Claims Management's partners submit their claims for health and dental services along with

related documentation, and the employees at Claims Management compare their claims to the details of their benefit plans and

calculate the value of the benefits owed. The company uses a predetermined variable overhead rate based on direct labour-hours.

In the month of September, 15,000 claims were processed using 4,500 direct labour-hours. The company incurred a total of $4,950 in

variable overhead costs.

According to the company's standards, 0.25 direct labour-hours are required to process a claim, and the variable overhead rate is

$1.20 per direct labour-hour.

Required.

1-a. What variable overhead cost should have been incurred to process the 15,000 claims?

Standard variable overhead cost

1-b. How much does this differ from the actual variable overhead cost? (Indicate the effect of variance by selecting "F" for

favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning