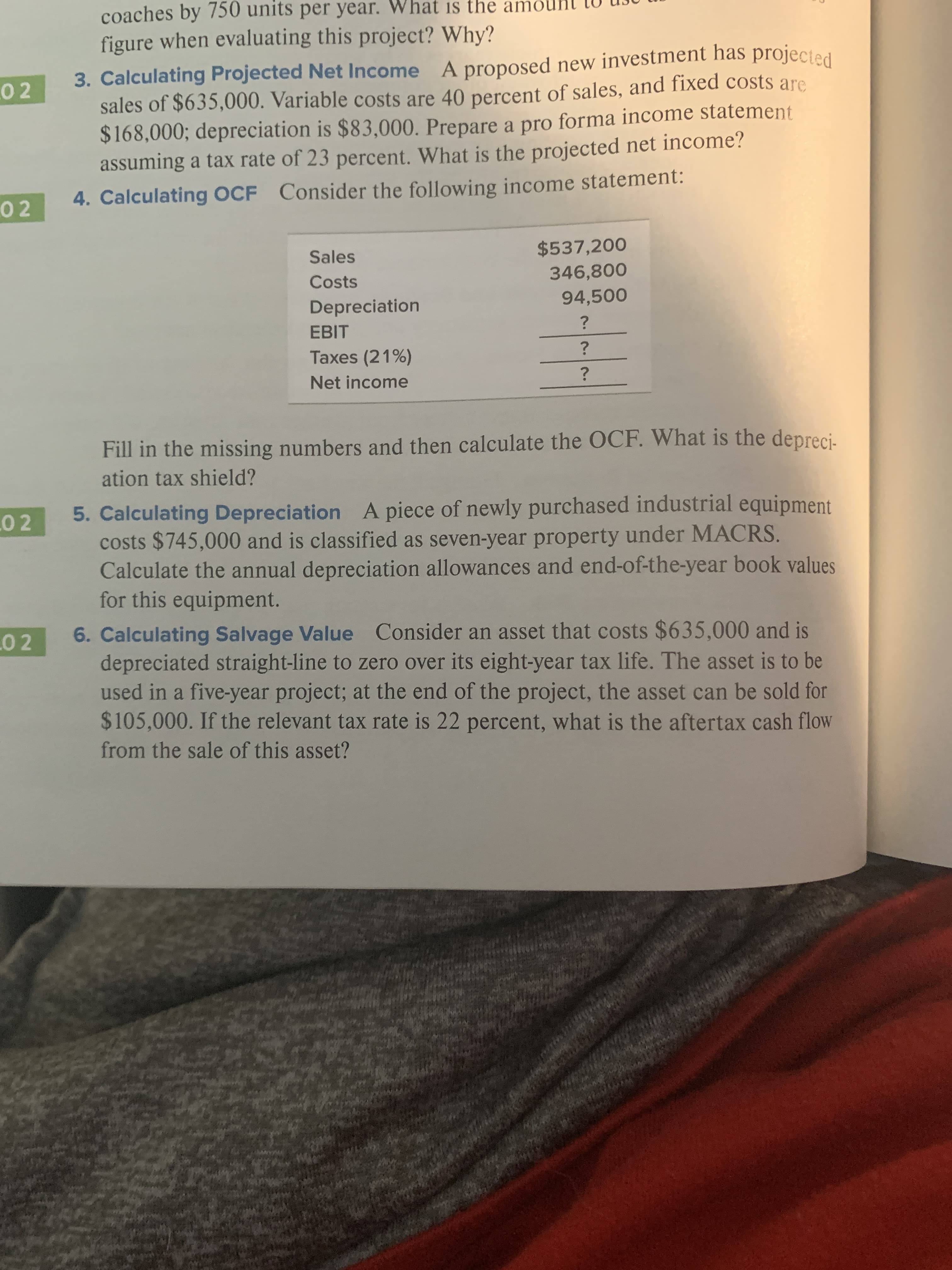

coaches by 750 units per year. What figure when evaluating this project? Why? 3. Calculating Projected Net Income A proposed new investment has projected sales of $635,000. Variable costs are 40 percent of sales, and fixed costs are $168,000; depreciation is $83,000. Prepare a pro forma income statement assuming a tax rate of 23 percent. What is the projected net income? is the amo 0 2 4. Calculating OCF Consider the following income statement: 02 $537,200 Sales 346,800 Costs 94,500 Depreciation ? EBIT ? Taxes (21%) Net income Fill in the missing numbers and then calculate the OCF. What is the depreci- ation tax shield? 5. Calculating Depreciation A piece of newly purchased industrial equipment costs $745,000 and is classified as seven-year property under MACRS. Calculate the annual depreciation allowances and end-of-the-year book values for this equipment. .0 2 6. Calculating Salvage Value Consider an asset that costs $635,000 and is depreciated straight-line to zero over its eight-year tax life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for $105,000. If the relevant tax rate is 22 percent, what is the aftertax cash flow 0 2 from the sale of this asset?

coaches by 750 units per year. What figure when evaluating this project? Why? 3. Calculating Projected Net Income A proposed new investment has projected sales of $635,000. Variable costs are 40 percent of sales, and fixed costs are $168,000; depreciation is $83,000. Prepare a pro forma income statement assuming a tax rate of 23 percent. What is the projected net income? is the amo 0 2 4. Calculating OCF Consider the following income statement: 02 $537,200 Sales 346,800 Costs 94,500 Depreciation ? EBIT ? Taxes (21%) Net income Fill in the missing numbers and then calculate the OCF. What is the depreci- ation tax shield? 5. Calculating Depreciation A piece of newly purchased industrial equipment costs $745,000 and is classified as seven-year property under MACRS. Calculate the annual depreciation allowances and end-of-the-year book values for this equipment. .0 2 6. Calculating Salvage Value Consider an asset that costs $635,000 and is depreciated straight-line to zero over its eight-year tax life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for $105,000. If the relevant tax rate is 22 percent, what is the aftertax cash flow 0 2 from the sale of this asset?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.15E

Related questions

Question

Number 6

Transcribed Image Text:coaches by 750 units per year. What

figure when evaluating this project? Why?

3. Calculating Projected Net Income A proposed new investment has projected

sales of $635,000. Variable costs are 40 percent of sales, and fixed costs are

$168,000; depreciation is $83,000. Prepare a pro forma income statement

assuming a tax rate of 23 percent. What is the projected net income?

is the amo

0 2

4. Calculating OCF Consider the following income statement:

02

$537,200

Sales

346,800

Costs

94,500

Depreciation

?

EBIT

?

Taxes (21%)

Net income

Fill in the missing numbers and then calculate the OCF. What is the depreci-

ation tax shield?

5. Calculating Depreciation A piece of newly purchased industrial equipment

costs $745,000 and is classified as seven-year property under MACRS.

Calculate the annual depreciation allowances and end-of-the-year book values

for this equipment.

.0 2

6. Calculating Salvage Value Consider an asset that costs $635,000 and is

depreciated straight-line to zero over its eight-year tax life. The asset is to be

used in a five-year project; at the end of the project, the asset can be sold for

$105,000. If the relevant tax rate is 22 percent, what is the aftertax cash flow

0 2

from the sale of this asset?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT