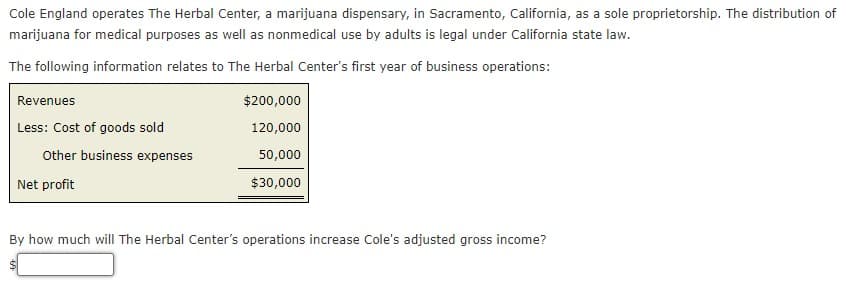

Cole England operates The Herbal Center, a marijuana dispensary, in Sacramento, California, as a sole proprietorship. The distribution of marijuana for medical purposes as well as nonmedical use by adults is legal under California state law. The following information relates to The Herbal Center's first year of business operations: Revenues Less: Cost of goods sold Other business expenses Net profit $200,000 120,000 50,000 $30,000 By how much will The Herbal Center's operations increase Cole's adjusted gross income?

Q: On October 1, 2024, Wildhorse Corporation ordered some equipment from a supplier for 322,000 euros.…

A: Investors may be able to profit from price changes in the underlying asset by using forward…

Q: Aracel Engineering completed the following transactions in the month of June. J. Aracel, the owner,…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: 5.The following information was gathered for Big Dawg Corp. for the year ending 2021. Budgeted…

A: Overheads: These refers to the expenses incurred by the business with respect to the routine or…

Q: Exercise 4-6A (Algo) Allocating overhead costs among products LO 4-3 Rooney Company makes three…

A: Allocation rate :— It is the rate used to allocate manufacturing overhead to cost object. It is…

Q: On May 1, 2023, Kingbird Limited issued 1,860 $1,000 bonds at 103. Each bond was issued with one…

A: The bonds are generally issued by the government or corporation to raise money. The bonds are…

Q: o companies like Walmart use accru

A: Many large organizations, including Walmart, prefer to adopt accrual basis accounting over cash…

Q: An annual report for National Paper Company included the following note: The last-in, first-out…

A: The LIFO method, also known as Last-In, First-Out, is an inventory valuation method used in…

Q: Laker Company reported the following January purchases and sales data for its only product. The…

A: The first things acquired are presumed to be the first goods sold in the first in, first out (FIFO)…

Q: Required: Prepare an income statement for Shannon Company that uses the contribution format and is…

A: The divisional income statement is the financial statement that describes the financial performance…

Q: Tanner-UNF Corporation acquired as an investment $250 million of 8% bonds, dated July 1, on July 1,…

A: Bonds are the debt instrument generally issued by the government or corporations to raise money. The…

Q: Tomasini Corporation has provided the following data from its activity-based costing accounting…

A: ACTIVITY BASED COSTINGActivity Based Costing is a Powerful tool for measuring…

Q: Use the following to answer questions 1-4 Determine whether the firm reports each of the following…

A: A bank reconciliation statement aligns an organization's bank account with its financial documents…

Q: Outback Expeditions provides guided tours in scenic mountainous areas. After the first 11 months of…

A: Since you have posted a question with multiple sub-parts, we will do the first three sub-parts for…

Q: Which of the following is incorrect? a. Contributions to a traditional IRA are a deduction for AGI.…

A: Gross income less adjustments to income is known as adjusted gross income (AGI). Your earnings,…

Q: Vulcan Service Company experienced the following transactions for Year 1, its first year of…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period. The…

Q: Hampton Company reports the following information for its recent calendar year. $ 73,000 Selected…

A: CASH FLOW STATEMENTCash flow statement is additional information to user of financial statement.…

Q: Wildhorse's Style manufactures dining room tables for both home and restaurant locations. Kevin…

A: The variance is the difference between the standard and actual production cost data. The fixed…

Q: March 1: Owner borrowed $125,000 to fund/start the business. The loan term is 5 years. March 1:…

A: Based on the given data the problem has been solved and compared with the answer given

Q: When the equity method is applied, what disclosures should be made in the investor's financial…

A: An approach to accounting that is used by businesses to determine how much money they have made from…

Q: C. Bank Reconciliation Lidia has the following information from her books and her August bank…

A: The bank reconciliation statement is prepared to equate the balances of cash book and pass book with…

Q: Rene owns four small businesses. Rene spends the following number of hours this year working in…

A: Material participation refers to the level of active involvement an individual has in a business or…

Q: overhead applied to jobs in Week 1?

A: SolutionThe amount of fixed cost applied to the job in week 1 is £12000

Q: Chloe's Cafe bakes croissants that it sells to local restaurants and grocery stores. The average…

A: Variable cost will remain constant per unit.It increases on basis of increase in production.Where's…

Q: Required: Complete the consolidation working papers for Investor and subsidiary

A: On 01.01.2009,Patty corporation acquired interest in Sue corporation = 75%Purchase consideration =…

Q: Saxton Enterprises sells a supercomputer package to customers. The components of this package are as…

A: A performance obligation is a promise to transfer goods or services to a customer.

Q: Required information [The following information applies to the questions displayed below.] Jorgansen…

A: The inventory can be valued using various methods as variable costing and absorption costing. The…

Q: Joos Corporation uses the weighted-average method in its process costing system. Data concerning the…

A: The total cost of producing a product, including raw materials and operating costs, is detailed in a…

Q: 不 Baldwin Company had the following balances and transactions during 2019: Beginning Merchandise…

A: FIFO method follows First in First out Basis, means beginning inventory and units purchased first…

Q: The following data are for the Evans Company, which sells just one product: Units Unit Cost 200 500…

A: Periodic inventory system :It is an inventory system where the entire material is physically…

Q: Exercise 3-2 (Static) Prepare T-Accounts [LO3-2, LO3-4] Jurvin Enterprises is a manufacturing…

A: As per dual concept of accounting, every transaction has dual impact on the books of…

Q: Antioch Company makes eBook readers. The company had the following amounts at the beginning of Year…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: The general ledger of Black Cloud Cleaners at January 1, 2024, includes the following account…

A: An adjusted trial balance is a financial statement that lists all the accounts of a company after…

Q: Direct material price variance Direct material quantity variance Direct labor rate variance Direct…

A: Variance analysis is a very important technique used in management accounting, in which actual costs…

Q: . On April 22, 2023, Sunlight Enterprises purchased equipment for $134,400. The company expects to…

A: a)depreciable amount is as under:Cost of assets134400Less: residual value12500Depreciable…

Q: Swiss Inc. sold 20-year bonds with a total face amount of $401,000 and a stated rate of 7.5%. The…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: d. Calculate the net income (or loss) for the year ended December 31, 2022 e. What was the average…

A: Income statement shows company's income and expenses over a period of time.Revenues, Expenses, and…

Q: Your friend, Suzie Chang, has designed a new type of outdoor toy that helps children learn basic…

A: The direct costs incurred in producing a product are known as product costs. expenses that are…

Q: On June 30, Purl Corp. issued 150,000 shares of its $20 par common stock for which it received all…

A: Consolidation can be defined as the process of combining the financial reports of two entities, the…

Q: Mo Miller and Molly Moore operate separate hobby shops. On April 8, 2024, they decide to combine…

A: A partnership seems a commercial arrangement whereby two or more people or entities join together…

Q: van, a single individual, operates a service business that earned $110,000 (after all applicable…

A: According to the question given, we need to compute the QBI deduction. According to the IRS,…

Q: Dividends Per Share Windborn Company has 10,000 shares of cumulative preferred 1% stock, $150 par…

A: Preferred Dividend :— It is calculated by multiplying face value of preferred stock with dividend…

Q: Incremental income (loss) Kingbird Co. LA ✓the

A: Special order means one-time order that is received from not a regular customer. Special order…

Q: Prepare a multiple-step income statement. Per Share of Common Stock V V Oriole Corporation INCOME…

A: Income statement is the financial statement that records all the income and expenses of the business…

Q: Depreciation by three methods; partial years Perdue Company purchased equipment on April 1 for…

A: Business entities are required to charge the depreciation expense in the accounting books so that…

Q: Caitlin, Chris, and Molly are partners and share income and losses in a 3:4:3 ratio (in ratio form:…

A: Partnership refers to an agreement where two or more people come together for a common goal. The…

Q: [The following information applies to the questions displayed below] Carlberg Company has two…

A: Using FIFO method, the cost of units completed include the cost of beginning WIP, Cost of completing…

Q: Ocean Corp.'s comprehensive insurance policy allows its assets to be replaced at current value. The…

A: Given,Deductible clause- $50,000Dismantling cost- $20,000Tax Rate - 30%To be determined,The amount…

Q: Margaret, a married taxpayer filing a joint return, engaged in two business activities this year.…

A: Business loss refers to an amount paid higher as expenses over the earnings earned during the…

Q: Le following an applies to the questions displayed below.j Sweeten Company had no jobs in progress…

A: PREDETERMINED OVERHEAD RATEPredetermined rate means an indirect cost rate.Predetermined overhead…

Q: The cost of ending work in process inventory in the first processing department according to the…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

subject;account

Step by step

Solved in 3 steps

- Cole England operates The Herbal Center, a marijuana dispensary, in Sacramento, California, as a sole proprietorship. The distribution of marijuana for medical purposes as well as nonmedical use by adults is legal under California state law. The following information relates to The Herbal Center's first year of business operations: Revenues $200,000 Less: Cost of goods sold 120,000 Other business expenses 50,000 Net profit $30,000 By how much will The Herbal Center’s operations increase Cole's adjusted gross income?Peanut Queen and Lord of Ice are two competitors selling ice-cream. Below is the information pertaining to the two businesses for the financial year ended June 30, 2021. Peanut Queen Lord of Ice Net Profit ($) 105,000 280,000 Cost of Goods Sold ($) 100,000 1,000,000 Total Assets ($) 500,000 800,000 Total Liabilities 250,000 300,000 Gross Profit ($) 110,000 600,000 Lisa has capital to invest in one of the businesses. She likes peanut butter ice-cream but needs to consider the financial performance of the two businesses to make an informed investment decision. Required: In the table below, calculate Net Profit Margin, Asset Turnover, Financial Leverage, and Return on Equity (ROE) ratios for the two businesses. Peanut Queen Lord of Ice Net Profit Margin Asset Turnover Financial Leverage ROE Based on the financial performance alone, which one of the two businesses…Harold Dunn and his wife Evadne operate a successful snack packaging business, Healthy Snacks, in St. Mary. The bulk buying of the raw materials (nuts, dried fruits, etc), the packaging and delivery to corporate area shops are done by the members of the family. The accounts for Mr. Dunn's business at 31 December 207 showed a profit of $4,500,000 after charging: $180,000 depreciation of equipment and office furniture; $750,000 for salary to his wife Evadne who supervises the office, $496,000 to his 18 year old son Shane, and $1,720,000 to himself. $78,000 interest on a loan he had obtained tgexpand his busines 3 (a) Prepare a statement, with notes where applicable, of the Healthy for the year of assessment 2014 for Harold Dunn Snacks bustness showing the taxable prof b and income tax liability (b) Shane is a part time student at the University of the West Indies. What is his tax liability, if any?

- Shawn John and his wife operate a successful snack packaging business, Healthy Snacks, in St Mary, Jamaica. The bulk buying of the raw materials (nuts and dried fruits), the packaging and delivery to corporate area shops are done by the members of the family. The accounts for Mr. John’s business at 31st December 2015 showed a profit of $4,500,000 after charging: • $180,000 depreciation of equipment and office furniture; • $750,000 for salary to his wife who supervises the office, $496,000 to his 18 year old son Shane, and $1,720,000 to himself. • $78,000 interest on a loan he had obtained to expand his business 3 years ago. (a) Prepare a statement; with notes where applicable; of the Healthy Snacks business showing the taxable profits and income tax liability for the year of assessment 2015 for Shawn John (b) Shane is a part-time student at the University of the West Indies. What is his tax liability, if any?Tom’s Tax Services is a small accounting firm that offers tax services to small businesses and individuals. A local store owner has approached Tom about doing his taxes but is concerned about the fees Tom normally charges. The costs and revenues at Tom’s Tax Services follow: Tom’s Tax Services Annual Income Statement Sales Revenue 724,000 Costs Labor 457,000 Equipment Lease 48,000 Rent 42,500 Supplies 31,300 Tom’s Salary 73,800 Other Costs 21,400 Total Costs 674,900 Operating Profit (Loss) 49,100 If Tom gets the store’s business, he will incur an additional $59,200 in labor costs. Tom also estimates that he will have to increase equipment leases by about 5 percent, supplies by 5 percent, and other costs by 15 percent. Required: What are the differential costs that would be incurred as…party-time t-shirts sells t-shirts for parties at the local college. the company completed the first year of operations, and the shareholders are generally please with the operating results from the income statement: net sales revenue $350,000 cost of goods sold 210,000 gross profit 140,000 operating expenses: selling expense 40,000 administrative expens 25,000 net income $75,000 bill hildebrand, the controller, is considering how to expand the business. he proposes two ways to increas profits to $100,000 during 2018. a. hildebrand believes he should advertise more heavily. he believes additional advertising costing $20,000 will increase net sales by 30% and leave administrative expense unchanged. assume cost of goods sold will remain at the same percentage of net sales as in 2017, so if net sales increase in 2018, cost of goods sold will increase proportionately. b hildebrand proposes selling higher-margin merchandise, such as party dresses, in…

- In 2021 Terry Brady, the legendary athlete from Indiana, decided to leave his job as head football coach at Mattoon High School to open Brady Advantage, his own sporting goods store, in Terre Haute. By locating Brady Advantage halfway between St. Louis and Indianapolis, Brady hoped to attract customers from both large metropolitan markets. A partial income statement for Brady Advantage follows: 2021 Revenues Revenue from sales of goods and services........ $210,000 Operating costs and expenses: Cost of products and services sold.................... $82,000 Selling expenses.............................................. $6,000 Administrative expenses................................... $12,000 Total operating costs and expenses................ $100,000 Income from operations........................................ $110,000 Interest expense (bank loan)................................ $14,000…Assume Down, Incorporated, was organized on May 1 to compete with Despair, Incorporated—a company that sells de-motivational posters and office products. Down, Incorporated, encountered the following events during its first month of operations. Received $34,000 cash from the investors who organized Down, Incorporated Borrowed $19,000 cash and signed a note due in two years. Ordered equipment costing $16,000. Purchased $10,000 in equipment, paying $2,000 in cash and signing a six-month note for the balance. Received the equipment ordered in (c), paid for half of it, and put the rest on account. Prepare a classified balance sheet at May 31. Include Retained Earnings with a balance of zero.Gloden Company operates a retail store in Faith, Hope, and Love. Golden Company’s corporate headquarters is located in Manila, and the company uses responsibility accounting to evaluate performance. The following information relates to the Faith facility:· The store sold 100,000 units at P20.00 each, after having purchased the units from various suppliers for P13. Faith salespeople are paid a 10% commission based on gross sales pesos.· Faith’s sales manager oversees the placement of local advertising contracts, which cost P88,000 and 5% of gross sales pesos. Local property taxes amounted to P15,000.· The sales manager’s P95,000 salary is set by Faith’s store manager. In contrast, the store manager’s P120,000 salary is determined by National Company’s vice president.· Faith incurred P20,000 of other noncontrollable costs along with P10,000 of income tax expense.· Nontraceable (common) corporate overhead totaled P68,000.The income that will be used to evaluate the manager of Faith…

- In the current year, Big Burgers, Inc., expanded its fast-food operations by opening several new stores in Texas. The company incurred the following costs in the current year: market appraisal ($50,000), consulting fees ($72,000), advertising ($47,000), and traveling to train employees ($31,000). The company is willing to incur these costs because it foresees strong customer demand in Texas for the next several years. What amount should Big Burgers report as an expense in its income statement associated with these costs?At the beginning of the year, an audio engineer quit his job and gave up a salary of 175.00 per year to start his own business Sound Devices Inc. The company builds, installs and maintains custom audio equipment for a business that require high-quality audio-systems. A partial income statement for the first year of operation for Sound Devices Inc. is shown below: Revenue Revenue from sales of product and services $970,000 Operating cost and expenses Cost of products and services sold $355,000 Selling Expenses $155,000 Administrative Expenses $45,000 Total Operating cost and expenses 555,000 Income from operations $415,000 Interest expenses (Bank Loan) $45,000 Legal Expenses to start business $28,000 Income taxes $165,000 Net Income $177,000 To get started, the owner of Sound Devices spent $100,000 of his personal savings to pay for some of the capital equipment used in the business. During the first year of operation, the owner of Sound Devices Inc.…Melanie operates Mel's Bakery in Foxboro, Massachusetts, and has retail stores in Connecticut, Maine, Massachusetts, New Hampshire, and Rhode Island. Mel's Bakery also ships specialty breads nationwide upon request. Determine Mel's Bakery's sales tax collection responsibility and calculate the sales tax liability for Massachusetts, Connecticut, Maine, New Hampshire, Rhode Island, and Texas, based on the following information: Note: Leave no answer blank. Enter zero if applicable. The New Hampshire retail stores have $286,000 of dine-in sales. New Hampshire is one of five states with no sales tax. However, it has a room and meals tax rate of 8 percent. New Hampshire considers any food or beverage served by a restaurant for consumption on or off the premises to be a meal. Mel's Bakery's Rhode Island stores earn $336,000 in sales. The Rhode Island sales tax rate is 7 percent and its restaurant surtax is 1 percent. Rhode Island considers Mel's Bakery to be a restaurant because its retail…