Company A has $100,000 in debt outstanding at a rate of 6% and 200,000 shares outstanding. The company's EBIT was $2,000,000 last year. The company pays 90 % of its earnings out as dividends. Because the company retains 10% of its earnings the company has a small growth rate of 2%. The company's tax rate is 35%. The company is considering issuing $2 million worth of bonds (at par) and using the proceeds for a stock repurchase. If issued, the bonds would have an estimated interest rate of 7%. The cost of equity is currently 10.5 percent and the new cost of equity would be 10.9%. Assume that the shares are repurchased at a price equal to the stock market price prior to the recapitalization. What would be the company's stock price following the recapitalization? Problem 2: Lyco produces premium textbooks that sell for 19.90 per book, and this year's sales are expected to be 13,000 units. Variable costs for the expected sales under present production methods are estimated at $165,000 and fixed production costs at present are $65,000. Lyco has $52,000 of debt outstanding at an interest rate of 6.5%. At the early days of Lyco, the board of trustees each bought shares in Lyco and there are currently 7,000 shares of common stock outstanding. The dividend payout ratio is 10 percent, and Lyco has a 30% federal plus state bracket. Lyco is considering investing $150,000 in new printing equipment. Sales would not be affected by the new printing equipment, however variable costs would be reduced by 10%. In addition, the new printing equipment would require less labor to operate and therefore fixed costs would decrease from 65,000 to 40,000. Lyco could raise the required capital by borrowing the $150,000 from a local bank at 8% or could issue new Lyco stock by selling 2,000 additional shares at $75 per share. What would be Lyco's EPS 1. under the old production process 2. under the new production process with debt financing 3. under the new production process with equity financing At what unit sales level would Lyco have the same EPS, assuming it undertakes the investment and finances it with debt or with stock?

Company A has $100,000 in debt outstanding at a rate of 6% and 200,000 shares outstanding. The company's EBIT was $2,000,000 last year. The company pays 90 % of its earnings out as dividends. Because the company retains 10% of its earnings the company has a small growth rate of 2%. The company's tax rate is 35%. The company is considering issuing $2 million worth of bonds (at par) and using the proceeds for a stock repurchase. If issued, the bonds would have an estimated interest rate of 7%. The cost of equity is currently 10.5 percent and the new cost of equity would be 10.9%. Assume that the shares are repurchased at a price equal to the stock market price prior to the recapitalization. What would be the company's stock price following the recapitalization? Problem 2: Lyco produces premium textbooks that sell for 19.90 per book, and this year's sales are expected to be 13,000 units. Variable costs for the expected sales under present production methods are estimated at $165,000 and fixed production costs at present are $65,000. Lyco has $52,000 of debt outstanding at an interest rate of 6.5%. At the early days of Lyco, the board of trustees each bought shares in Lyco and there are currently 7,000 shares of common stock outstanding. The dividend payout ratio is 10 percent, and Lyco has a 30% federal plus state bracket. Lyco is considering investing $150,000 in new printing equipment. Sales would not be affected by the new printing equipment, however variable costs would be reduced by 10%. In addition, the new printing equipment would require less labor to operate and therefore fixed costs would decrease from 65,000 to 40,000. Lyco could raise the required capital by borrowing the $150,000 from a local bank at 8% or could issue new Lyco stock by selling 2,000 additional shares at $75 per share. What would be Lyco's EPS 1. under the old production process 2. under the new production process with debt financing 3. under the new production process with equity financing At what unit sales level would Lyco have the same EPS, assuming it undertakes the investment and finances it with debt or with stock?

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 4P

Related questions

Question

Could you please solve these questions?

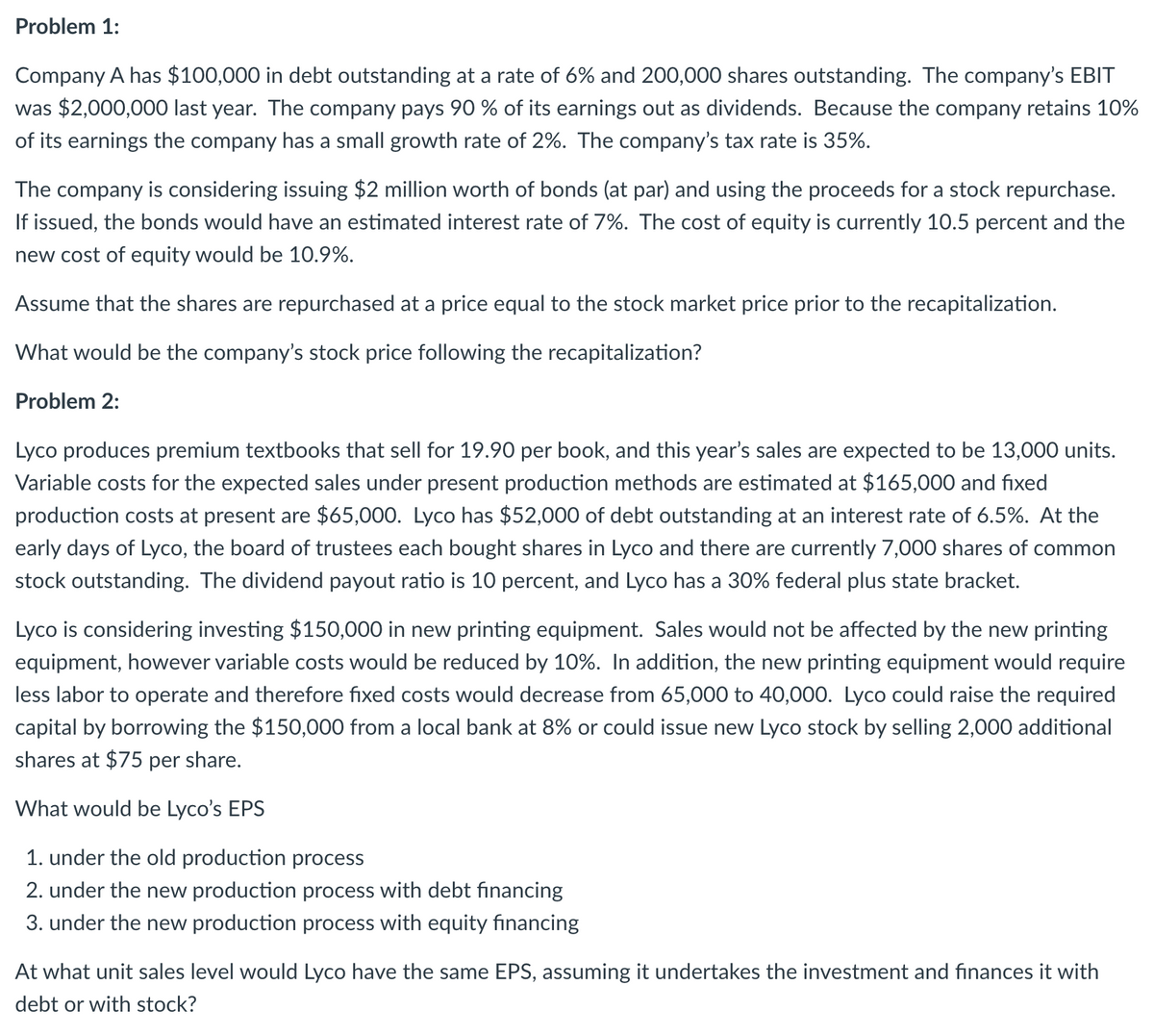

Transcribed Image Text:Problem 1:

Company A has $100,000 in debt outstanding at a rate of 6% and 200,000 shares outstanding. The company's EBIT

was $2,000,000 last year. The company pays 90 % of its earnings out as dividends. Because the company retains 10%

of its earnings the company has a small growth rate of 2%. The company's tax rate is 35%.

The company is considering issuing $2 million worth of bonds (at par) and using the proceeds for a stock repurchase.

If issued, the bonds would have an estimated interest rate of 7%. The cost of equity is currently 10.5 percent and the

new cost of equity would be 10.9%.

Assume that the shares are repurchased at a price equal to the stock market price prior to the recapitalization.

What would be the company's stock price following the recapitalization?

Problem 2:

Lyco produces premium textbooks that sell for 19.90 per book, and this year's sales are expected to be 13,000 units.

Variable costs for the expected sales under present production methods are estimated at $165,000 and fixed

production costs at present are $65,000. Lyco has $52,000 of debt outstanding at an interest rate of 6.5%. At the

early days of Lyco, the board of trustees each bought shares in Lyco and there are currently 7,000 shares of common

stock outstanding. The dividend payout ratio is 10 percent, and Lyco has a 30% federal plus state bracket.

Lyco is considering investing $150,000 in new printing equipment. Sales would not be affected by the new printing

equipment, however variable costs would be reduced by 10%. In addition, the new printing equipment would require

less labor to operate and therefore fixed costs would decrease from 65,000 to 40,000. Lyco could raise the required

capital by borrowing the $150,000 from a local bank at 8% or could issue new Lyco stock by selling 2,000 additional

shares at $75 per share.

What would be Lyco's EPS

1. under the old production process

2. under the new production process with debt financing

3. under the new production process with equity financing

At what unit sales level would Lyco have the same EPS, assuming it undertakes the investment and finances it with

debt or with stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College