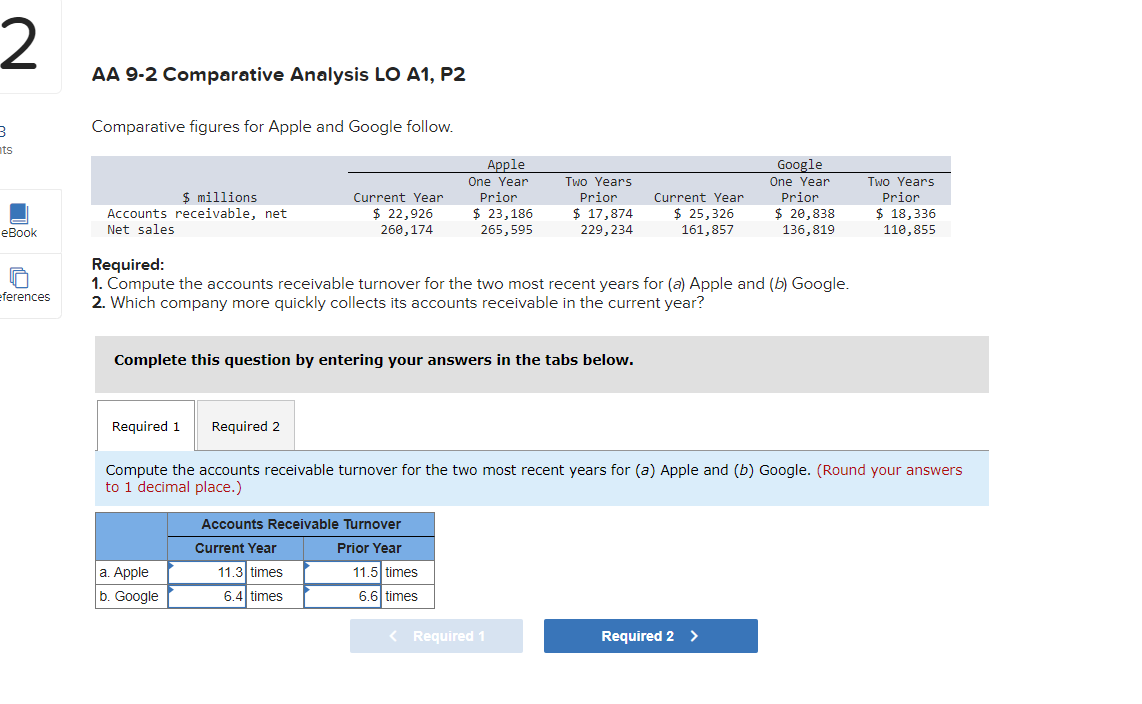

Comparative figures for Apple and Google follow. Аpple Google Two Years Prior Two Years One Year One Year Prior $ millions Accounts receivable, net Current Year Prior Current Year Prior $ 22,926 260,174 $ 23,186 265,595 $ 17,874 229,234 $ 25,326 161,857 $ 20,838 136,819 $ 18,336 110,855 Net sales Required: 1. Compute the accounts receivable turnover for the two most recent years for (a) Apple and (b) Google. 2. Which company more quickly collects its accounts receivable in the current year? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the accounts receivable turnover for the two most recent years for (a) Apple and (b) Google. (Round your answers to 1 decimal place.) Accounts Receivable Turnover Current Year Prior Year а. Аpple b. Google 11.5 times 6.6 times 11.3 times 6.4 times

Comparative figures for Apple and Google follow. Аpple Google Two Years Prior Two Years One Year One Year Prior $ millions Accounts receivable, net Current Year Prior Current Year Prior $ 22,926 260,174 $ 23,186 265,595 $ 17,874 229,234 $ 25,326 161,857 $ 20,838 136,819 $ 18,336 110,855 Net sales Required: 1. Compute the accounts receivable turnover for the two most recent years for (a) Apple and (b) Google. 2. Which company more quickly collects its accounts receivable in the current year? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the accounts receivable turnover for the two most recent years for (a) Apple and (b) Google. (Round your answers to 1 decimal place.) Accounts Receivable Turnover Current Year Prior Year а. Аpple b. Google 11.5 times 6.6 times 11.3 times 6.4 times

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.1EX: Vertical analysis of income statement Revenue and expense data for Innovation Quarter Inc. for two...

Related questions

Question

I am computing accounts receivable turnover and am using:

Net Sales over current assets for each of the questions.

I got - a.) 11.3% - correct but not the rest. I am using the same formula for all of them.

What am I doing wrong?

Peggy

I have attached the image.

Transcribed Image Text:AA 9-2 Comparative Analysis LO A1, P2

Comparative figures for Apple and Google follow.

ts

Apple

Google

Two Years

Two Years

Prior

$ 17,874

One Year

One Year

$ millions

Current Year

Prior

Current Year

Prior

Prior

$ 23,186

265,595

$ 20,838

$ 25,326

Accounts receivable, net

Net sales

$ 22,926

260,174

$ 18,336

110,855

еВook

229, 234

161,857

136,819

Required:

1. Compute the accounts receivable turnover for the two most recent years for (a) Apple and (b) Google.

2. Which company more quickly collects its accounts receivable in the current year?

eferences

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Compute the accounts receivable turnover for the two most recent years for (a) Apple and (b) Google. (Round your answers

to 1 decimal place.)

Accounts Receivable Turnover

Current Year

Prior Year

а. Аple

b. Google

11.3 times

11.5 times

6.4 times

6.6 times

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning