Compare the monthly payments and total loan costs for the following pairs of loan options. Assume that bot have the same closing costs. You need a $160,000 loan. Option 1: a 30-year loan at an APR of 9%. Option 2: a 15-year loan at an APR of 8.5%. ... Find the monthly payment for each option. The monthly payment for option 1 is $ The monthly payment for option 2 is $ (Do not round until the final answer. Then round to the nearest cent as needed.) Find the total amount paid for each option. The total payment for option 1 is $ The total payment for option 2 is $ (Use the answers from the previous step to find this answer. Round to the nearest cent as needed.) Compare the two options. Which appears to be the better option? OA. Option 1 is the better option, but only if the borrower plans to stay in the same home for the entire term of the loan. OB. Option 1 will always be the better option.

Compare the monthly payments and total loan costs for the following pairs of loan options. Assume that bot have the same closing costs. You need a $160,000 loan. Option 1: a 30-year loan at an APR of 9%. Option 2: a 15-year loan at an APR of 8.5%. ... Find the monthly payment for each option. The monthly payment for option 1 is $ The monthly payment for option 2 is $ (Do not round until the final answer. Then round to the nearest cent as needed.) Find the total amount paid for each option. The total payment for option 1 is $ The total payment for option 2 is $ (Use the answers from the previous step to find this answer. Round to the nearest cent as needed.) Compare the two options. Which appears to be the better option? OA. Option 1 is the better option, but only if the borrower plans to stay in the same home for the entire term of the loan. OB. Option 1 will always be the better option.

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

100%

Transcribed Image Text:K

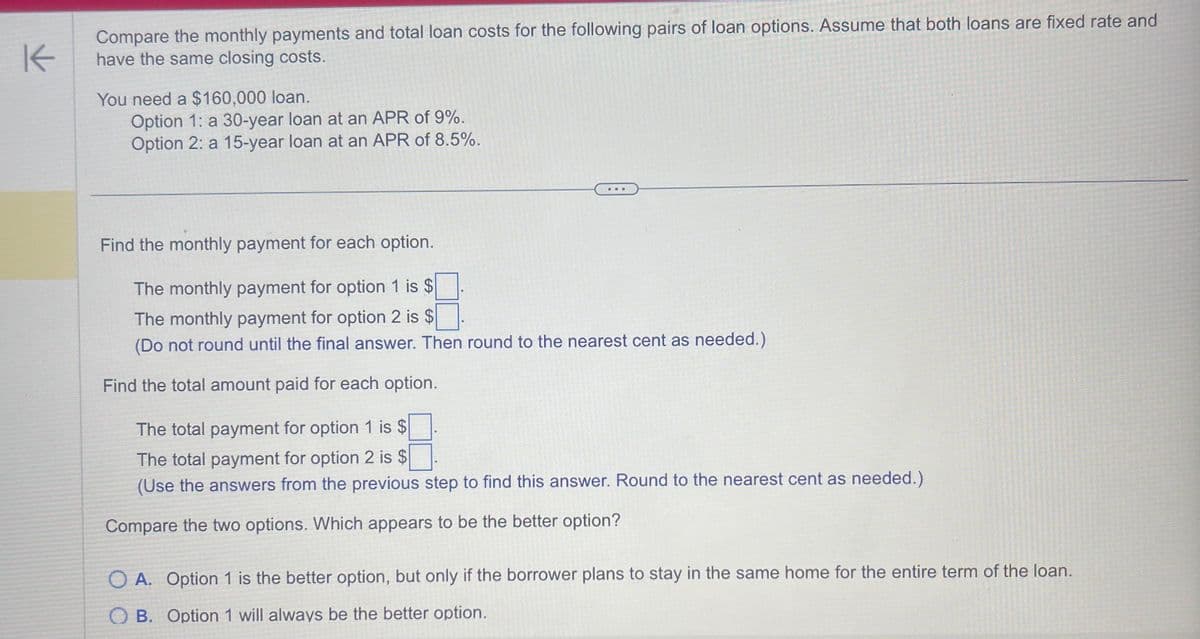

Compare the monthly payments and total loan costs for the following pairs of loan options. Assume that both loans are fixed rate and

have the same closing costs.

You need a $160,000 loan.

Option 1: a 30-year loan at an APR of 9%.

Option 2: a 15-year loan at an APR of 8.5%.

Find the monthly payment for each option.

The monthly payment for option 1 is $

The monthly payment for option 2 is $

(Do not round until the final answer. Then round to the nearest cent as needed.)

Find the total amount paid for each option.

The total payment for option 1 is $

The total payment for option 2 is $

(Use the answers from the previous step to find this answer. Round to the nearest cent as needed.)

Compare the two options. Which appears to be the better option?

OA. Option 1 is the better option, but only if the borrower plans to stay in the same home for the entire term of the loan.

OB. Option 1 will always be the better option.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning