Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 21P

Related questions

Question

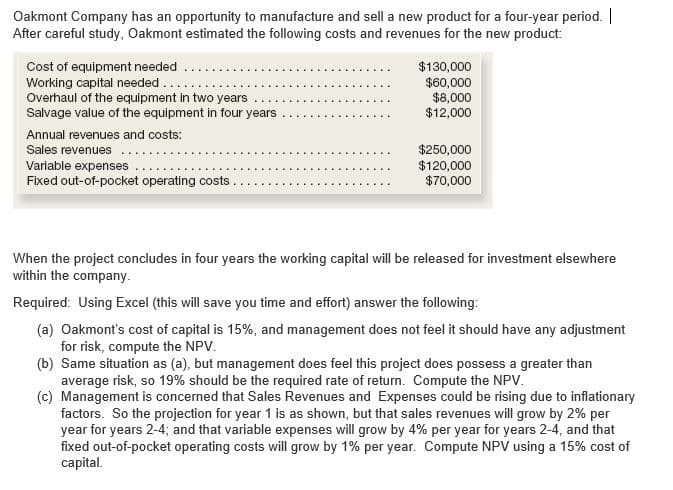

Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. After careful study, Oakmont estimated the following costs and revenues for the new product:

When the project concludes in four years the working capital will be released for investment elsewhere within the company.

Required: Using Excel (this will save you time and effort) answer the following:

- Oakmont’s cost of capital is 15%, and management does not feel it should have any adjustment for risk, compute the

NPV . - Same situation as (a), but management does feel this project does possess a greater than average risk, so 19% should be the required

rate of return . Compute the NPV. - Management is concerned that Sales Revenues and Expenses could be rising due to inflationary factors. So the projection for year 1 is as shown, but that sales revenues will grow by 2% per year for years 2-4; and that variable expenses will grow by 4% per year for years 2-4, and that fixed out-of-pocket operating costs will grow by 1% per year. Compute NPV using a 15% cost of capital.

Transcribed Image Text:Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. |

After careful study, Oakmont estimated the following costs and revenues for the new product:

Cost of equipment needed

Working capital needed..

Overhaul of the equipment in two years

Salvage value of the equipment in four years

$130,000

$60,000

$8,000

$12,000

Annual revenues and costs:

$250,000

$120,000

$70,000

Sales revenues

Variable expenses

Fixed out-of-pocket operating costs.

When the project concludes in four years the working capital will be released for investment elsewhere

within the company.

Required: Using Excel (this will save you time and effort) answer the following:

(a) Oakmont's cost of capital is 15%, and management does not feel it should have any adjustment

for risk, compute the NPV.

(b) Same situation as (a), but management does feel this project does possess a greater than

average risk, so 19% should be the required rate of return. Compute the NPV.

(c) Management is concerned that Sales Revenues and Expenses could be rising due to inflationary

factors. So the projection for year 1 is as shown, but that sales revenues will grow by 2% per

year for years 2-4; and that variable expenses will grow by 4% per year for years 2-4, and that

fixed out-of-pocket operating costs will grow by 1% per year. Compute NPV using a 15% cost of

capital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning