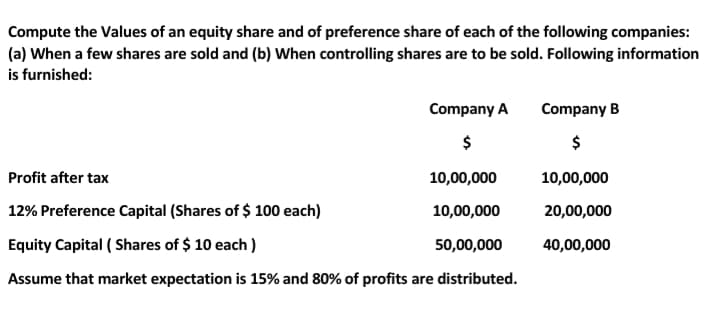

Compute the Values of an equity share and of preference share of each of the following companies: (a) When a few shares are sold and (b) When controlling shares are to be sold. Following information is furnished: Company A Company B $ $ Profit after tax 10,00,000 10,00,000 12% Preference Capital (Shares of $ 100 each) 10,00,000 20,00,000 Equity Capital ( Shares of $ 10 each ) 50,00,000 40,00,000 Assume that market expectation is 15% and 80% of profits are distributed.

Compute the Values of an equity share and of preference share of each of the following companies: (a) When a few shares are sold and (b) When controlling shares are to be sold. Following information is furnished: Company A Company B $ $ Profit after tax 10,00,000 10,00,000 12% Preference Capital (Shares of $ 100 each) 10,00,000 20,00,000 Equity Capital ( Shares of $ 10 each ) 50,00,000 40,00,000 Assume that market expectation is 15% and 80% of profits are distributed.

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 12MC: A corporation issued 100 shares of $100 par value preferred stock for $150 per share. The resulting...

Related questions

Question

Transcribed Image Text:Compute the Values of an equity share and of preference share of each of the following companies:

(a) When a few shares are sold and (b) When controlling shares are to be sold. Following information

is furnished:

Company A

Company B

$

Profit after tax

10,00,000

10,00,000

12% Preference Capital (Shares of $ 100 each)

10,00,000

20,00,000

Equity Capital ( Shares of $ 10 each )

50,00,000

40,00,000

Assume that market expectation is 15% and 80% of profits are distributed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT