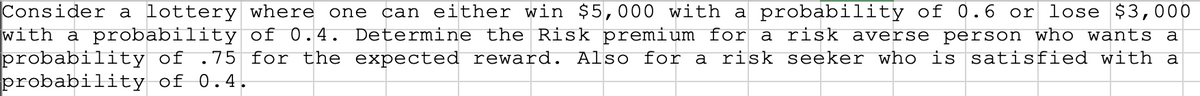

Consider a lottery where one can either win $5,000 with a probability of 0.6 or lose $3,000 with a probability of 0.4. Determine the Risk premium for a risk averse person who wants a probability of .75 for the expected reward. Also for a risk seeker who is satisfied with a probability of 0.4.

Q: One investment option will give a guaranteed income of $100,000. An alternative option is risky -…

A: Risk-averse: - it is a strategy or the nature of the person of avoiding risk involved in capital…

Q: In a final round of a MegaMillion TV show a contestant has a won $1 million and has a chance of…

A: Cost of play=$1 million Winning cost=$2 million

Q: Five of ten people earn $0, four earn $100, and one loses $100. What is the expected payoff? What is…

A: An average is the sum of the earnings divided by the number of observations. In this case, ten…

Q: Suppose that a firm offers an infinite warranty on a product that breaks down with probability 1/3…

A: GIVEN Suppose that a firm offers an infinite warranty on a product that breaks down with…

Q: As risk aversion increases, which direction does the certainty equivalent wealth move, holding the…

A: The certainty equivalent can be used by a business looking for investors to calculate how much more…

Q: A monthly pass for the Stockholm subway costs $100, and fare dodgers who are caught face a fine of…

A: Since there are multiple parts to this question, we are answering the first two for you. Given, A…

Q: ou have a 50 percent chance of making $0, a 40 percent chance of making $100, and a 10 percent…

A: Expected value = 50% x $0 + 40% x $100 - 10% x $100 = 0 + $40 - $10…

Q: If a risk‐neutral individual owns a home worth $200,000 and there is a three percent chance the home…

A: A risk-neutral is one who is neither a risk-averse nor a risk-lover. In other words, an individual…

Q: A risk averse individual will always choose the safe but less profitable activity instead of the…

A:

Q: Suppose that Mira has a utility function given by U=2I+10√I. She is considering two job…

A: Given; Mira has a utility function; U=2I+10I For first job:- Salary=$40000 for sure For Second job:-…

Q: ora has a monthly income of $20,736. Unfortunately, there is a chance that she will have an accident…

A: Leora has a monthly income of $20,736. If an Accident Happens then the cost is 10,736 Probability of…

Q: Beta and volatility differ as risk measures in that beta measures only non‑systematic risk, while…

A: Risk is the possibility of future profits or outcomes deviating from expectations. It is the level…

Q: Consider two investors A and B.If the Certainty-Equivalent end-of-period wealth of A is less than…

A: The tendency of a person to choose with low uncertainty to those with high uncertainty even if the…

Q: In the mean-standard deviation graph, the line that connects the risk-free rate and the market…

A: I have solved the questions below using CAPM

Q: Consider a lottery with three possible outcomes: $100 will be received with probability .1, $50 with…

A: 1) Expected value of lottery is given as E(U)= p1x1+p2x2+p3x3 Where pi is the probability of that…

Q: Let U(x) = 1 – e~** be the utility function of an investor. Find the Arow-Pratt risk aversion…

A: Risk aversion is the tendency of investors to prefer outcomes with low uncertainty to outcomes with…

Q: You are considering two portfolios. Portfolio A has an expected return of 15% and a standard…

A: A portfolio's certainty equivalent is the rate of return on a risk-free investment at which prudent…

Q: Burger Prince Restaurant is considering the purchase of a $100,000 fire insurance policy. The fire…

A: If Burger Prince restaurant wants to buy fire policy at neutral risk, then they have to pay the…

Q: You have a car valued at Gh60, 000. You estimate that there is a 0.1 percent chance that your car…

A: In Economics, Risk neutral preferences are preference that are neither risk averse nor risk lover. A…

Q: Exercise 3: Risky Investment Charlie has von Neumann-Morgenstern utility function u(x) = ln x and…

A: The joy or pleasure that customers get from intense a trade goods or service is remarked as utility.…

Q: Suppose that a person maximizes his expected utility, with the utility function given by v(z) = z12.…

A: We have two value of Z with equal probability. Which means Z can take 2 different values with…

Q: A risk-averse individual is always willing to pay a positive amount of money to scape a mean-zero…

A: Risk-averse: - it is a strategy or the nature of the person of avoiding risk involved in capital…

Q: You need to hire some new employees to staff your startup venture. You know that potential employees…

A: The expected value of hiring: Expected value of hiring = 0.1 35000 + 46000 +…

Q: Gary likes to gamble. Donna offers to bet him $54 on the outcome of a boat race. If Gary's boat…

A: The expected utility is determined by taking the weighted normal of all potential results in…

Q: Apple and Google are interested in hiring a new CEO. Both firms have the same set of final…

A: In game theory, a payout matrix is a table in which one player's strategies are written in rows, and…

Q: Sarah has a coefficient of risk aversion of 2. Sheng has a coefficient of risk aversion of 4. Given…

A: An indifference curve is a curve that provides information about the equal satisfaction gained by an…

Q: Adam is offered a performance based wage that will be equal to $4.200 with probability 1/3 or equal…

A:

Q: In a game, there are three values 1, 000, 2.500 and 5,000 and the cost of the game is 1, 500 . If…

A: Expected Value refers to the anticipated value for investment at some point in the future period. it…

Q: The indifference curves of two investors are plotted against a single portfolio budget line, where…

A: For two commodities, an indifference curve is a graph that shows the consumer's indifference curve…

Q: You need to hire some new employees to staff your startup venture. You know that potential employees…

A: When an employer does not know the full value an employee will add when they join, but the employee…

Q: An individual has 40,000 in income per year. The person will get sick with probability 0.1. If he…

A: A. To check if this individual is risk-neutral, risk-loving, or risk-averse we will first plot the…

Q: Consider an individual who maximizes his expected utility with the following utility function: U(x)…

A: Expected value is the product of weighted average where the weights are the probabilities and the…

Q: A film producer is evaluating a script by a new screenwriter. The producer knows that the…

A: Expected Value strategy refers to that strategy in which the agent takes decision based on the…

Q: Player 2 L 1,0 0,1 Player 1 0,1 1,0 Suppose Player 2 is using the following strategy: she plays L…

A: In-game theory, there are many distinct sorts of tactics, and they all revolve around the player's…

Q: Mike has a utility function expressed by U(W)= WO.5 where W stands for wealth (assuming wealth is…

A: Mike utility function is given below: U = W0.5 Where W is wealth ------- A person is said to be…

Q: An individual has 40,000 in income per year. The person will get sick with probability 0.1. If he…

A: Given, Income if person does not get sick = M = 40,000 Utility (M) = 200 Probability of getting sick…

Q: You participate in a coin-toss gamble with a weighted coin. The coin has a 70% chance of landing…

A: Expected utility refers to the aggregate economy utility due to which individuals can make…

Q: Nick is risk averse and faces a financial loss of $40 with probability 0.1. If nothing happens, his…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: A man purchased a $22,500, 1-yr term-life insurance policy for $695. Assuming that the probability…

A: The expected return (or expected gain) on a financial investment is the expected value of its return…

Q: What type of risk behavior does the person exhibit who is willing to bet $60 on a game where 20% of…

A: please find the answer below.

Q: Charlie has von Neumann-Morgenstern utility function u(x) = ln x and has wealth W = 250, 000.…

A: von Neumann-Morgenstern utility function, an augmentation of the hypothesis of purchaser…

Q: A lottery pays 0 or 108 with equal probability. Calculate the risk premium for an individual with a…

A:

Q: Derive the coefficients of absolute and relative risk aversion of the following functions, and point…

A: here we calculate the coefficients of absolute and relative risk aversion of the following functions…

Q: Apple and Google are interested in hiring a new CEO. Both firms have the same set of final…

A:

Q: Clancy has $5,000. He plans to bet on a boxing match between Sullivan and Flanagan. He finds that he…

A: Money = 5,000 If Sullivan Wins Coupon = $3 with payoff$10 If Flanagan wins Coupon = $1 with…

Q: A moderately risk-averse investor has 50% of her portfolio invested in stocks and 50% in risk-free…

A: A budget imperative addresses every one of the blends of labor and products that a customer might…

Q: Consider an individual who has a healthy state income of $10,000 and a sick state income of $2,000.…

A: People get health insurance in order to prevent themselves against the risk of getting sick by…

Q: Suppose that • The employee has an outside offer to work for $27 per hour, for 1500 hours per year…

A: Outside Offer $27/hour work for 1500 hours/year Current Work $20/hour work for 2000 hours/year…

neat and clean ANSWER dont copy from CHEGG or other websites

Step by step

Solved in 2 steps

- Consider an individual with an expected utility function of the form u(w) = √wwhere wrep-resents this individual’s wealth. This individual currently has wealth of $100. This individualfaces a risk of losing $64 with a probability of (1/2). The maximum price that this individualwould pay for insurance that covers the entire $64 loss is?Suppose that the consumer is asked to contemplate a gamble with a probability of 60% of winning Birr 10,000 with a utility of 10 utils, and a 40% probability of winning Birr 15,000 with a utility of 12 utils. A. What will be the expected income and expected utility of the consumer? B. If the utility of this consumer from a risk free alternative which gives him an income equal to the expected income of the risky alternative given above is equal to 11 utils, is this consumer risk lover or risk averse? Why? Illustrate your answer with the help of a diagramAssume that Rosemarie has the following utility function: U(W) = W1/2. She is selling her homeand believes that the house will sell for $250,000 with probability ¼ and $122,500 withprobability ¾.a. What is her expected utility?b. What is the risk premium (P) Rosemarie would pay to avoid bearing this risk?

- James, whose Bernoulli utility function is given by u(w) = w0.5, participates in a lottery which pays him $4 with probability 0.3, $21 with probability 0.4, and $37 otherwise. What is his certainty equivalent?Deborah is at the casino and is considering playing Roulette. In Roulette, a ball drops into one of 36 slots on a spinning wheel. 17 of the slots are red, 17 are black, and 2 are green. Each slot is equally likely and occurs with probability 1/36. Deborah bets $1.00 on black. If the ball drops into a black slot she receives $2.00 and if it drops into a red or green slot, she receives nothing. a) The expected value of Deborah’s bet (after subtracting the $1.00 she bet) is $________________ b) Given that Deborah makes this bet, is she risk adverse, risk neutral, or risk loving?A risk-averse agent, Andy, has power utility of consumption with riskaversion coefficient γ = 0.5. While standing in line at the conveniencestore, Andy hears that the odds of winning the jackpot in a new statelottery game are 1 in 250. A lottery ticket costs $1. Assume his income isIt = $100. You can assume that there is only one jackpot prize awarded,and there is no chance it will be shared with another player. The lotterywill be drawn shortly after Andy buys the ticket, so you can ignore therole of discounting for time value. For simplicity, assume that ct+1 = 100even if Andy buys the ticket How large would the jackpot have to be in order for Andy to play thelottery? b) What is the fair (expected) value of the lottery with the jackpot youfound in (a)? What is the dollar amount of the risk premium that Andyrequires to play the lottery? Solve for the optimal number of lottery tickets that Andy would buyif the jackpot value were $10,000 (the ticket price, the odds of winning,and Andy’s…

- Microeconomics Wilfred’s expected utility function is px1^0.5+(1−p)x2^0.5, where p is the probability that he consumes x1 and 1 - p is the probability that he consumes x2. Wilfred is offered a choice between getting a sure payment of $Z or a lottery in which he receives $2500 with probability p = 0.4 and $3700 with probability 1 - p. Wilfred will choose the sure payment if Z > CE and the lottery if Z < CE, where the value of CE is equal to ___ (please round your final answer to two decimal places if necessary)Clancy has $4800. He plans to bet on a boxing match betweenSullivan and Flanagan. He finds that he can buy coupons for $6 thatwill pay off $10 each if Sullivan wins. He also finds in another storesome coupons that will pay off $10 if Flanagan wins. The Flanagantickets cost $4 each. Clancy believes that the two fighters each have aprobability of ½ of winning. Clancy is a risk averter who tries tomaximize the expected value of the natural log of his wealth. Whichof the following strategies would maximize his expected utility? (a) Don’t Gamble (b) Buy 400 S tickets and 600 F tickets(c) Buy exactly as many F tickets and S tickets (d) Buy 200 S and 300 F(e) Buy 200 S and 600 FConsider an individual who maximizes his expected utility with the following utility function: U(x) = logX He is faced with the lottery with the following probabilities and payoffs Probability Money 0.4 30 0.5 100 0.1 50 a. Find his expected utility b. Calculate the Certainty Equivalent c. Find the amount that the individual will be willing to pay in order to avoid the lottery (That is, the risk premium)

- Exercise 3: Risky Investment Charlie has von Neumann-Morgenstern utility function u(x) = ln x and has wealth W = 250, 000. She is offered the opportunity to purchase a risky project for price P = 160, 000. 1 1 With probability p = 2 the project will be a success and return V > 160, 000. With probability 1 −p = 2 the project will fail and be worthless (i.e. it returns 0). For simplicity assume there is no interest between the time of the investment and the time of its return, that is r = 0 . How large must V be in order for Charlie to want to purchase the risky project? [Hint: What is Charlie’s expected utility is she does not purchase the project? What is Charlie’s expected utility is she purchases the project?]Given u(x)=x^0.5 and Lottery A (below) Lottery A Probability 0.50 0.25 0.25 Outcome 64 16 0 For automatic grading, give all numerical answers to exactly two decimal places. Do not include currency signs 1) What is the expected value? (Give the answer as 36.00, not 36) 2) What is the expected utility? 3) What is the certainty equivalent? (Number only) 4) What is the risk premium? 5) Would this person rather receive 20 for sure than play Lottery A? (Answer should be Y or N for auto-grading to work) 6) (Harder) In many applications of expected utility, it is possible to lose money. The usual way of handling this is to interpret utility in terms of final wealth. Suppose it costs money to play this lottery. If starting wealth is 100, calculate the expected utility of playing lottery A if the price of playing is 15. Your answer should be to two decimal places. (Note: calculating the certainty equivalent of the lottery would be a little different than we've done in class. Squaring…Suppose that Mira has a utility function given by U=2I+10√I. She is considering two job opportunities. The first job pays a salary of $40,000 for sure. The second job pays a base salary of $20,000 but offers the possibility of a $40,000 bonus on top of your base salary. She believes that there is a probability of p=0.50 that she will earn the bonus. What is the expected salary of the second job? Which offer gives Mira a higher expected utility? Based on this information, is Mira risk adverse, risk neutral, or risk-loving?