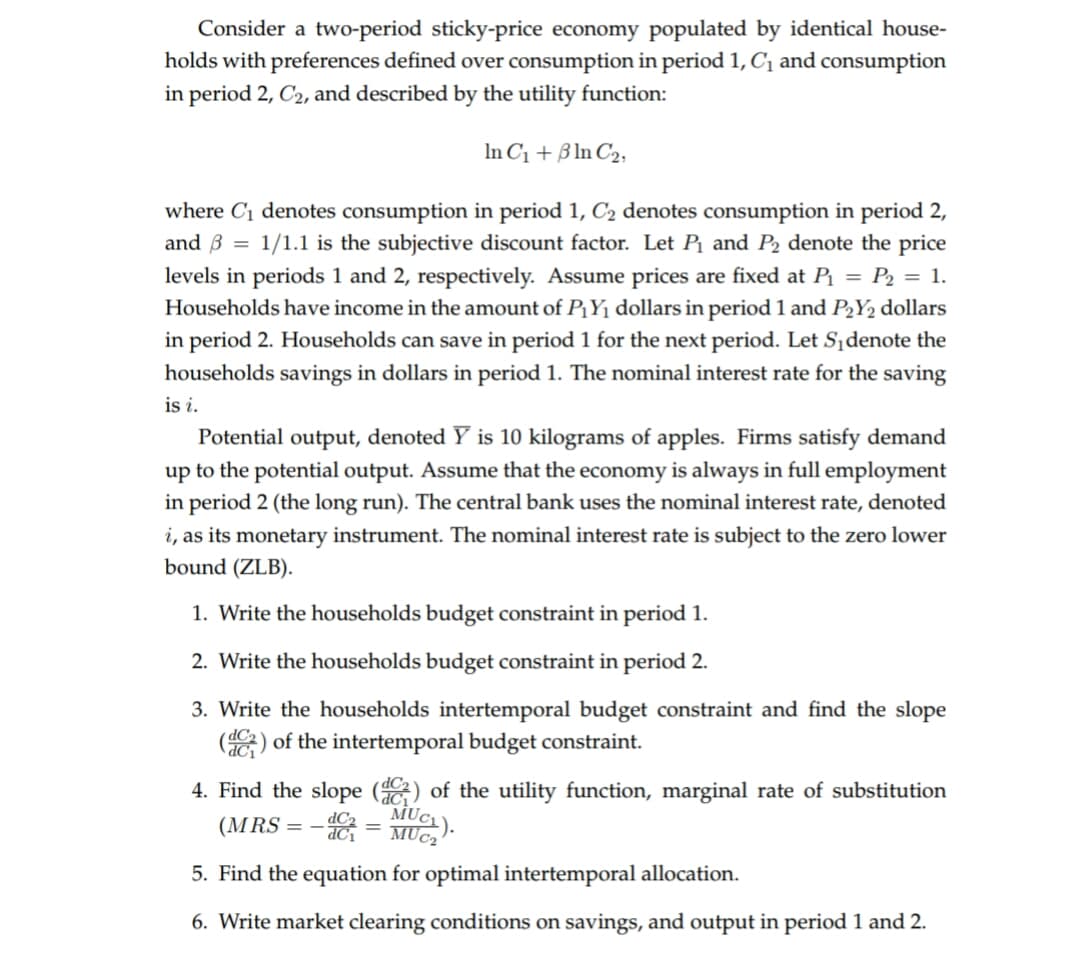

Consider a two-period sticky-price economy populated by identical house- holds with preferences defined over consumption in period 1, Ci and consumption in period 2, C2, and described by the utility function: In Ci Bn C2 where Ci denotes consumption in period 1, C2 denotes consumption in period 2, and B1/1.1 is the subjective discount factor. Let P and P2 denote the price levels in periods 1 and 2, respectively. Assume prices are fixed at P P2 = 1. Households have income in the amount of PYi dollars in period 1 and P2Y2 dollars in period 2. Households can save in period 1 for the next period. Let Sidenote the households savings in dollars in period 1. The nominal interest rate for the saving is i Potential output, denoted Y is 10 kilograms of apples. Firms satisfy demand up to the potential output. Assume that the economy is always in full employment in period 2 (the long run). The central bank uses the nominal interest rate, denoted i, as its monetary instrument. The nominal interest rate is subject to the zero lower bound (ZLB). 1. Write the households budget constraint in period 1 2. Write the households budget constraint in period 2. 3. Write the households intertemporal budget constraint and find the slope (of the intertemporal budget constraint dC1 4. Find the slope ( of the utility function, marginal rate of substitution MUC dC2 (MRS = 5. Find the equation for optimal intertemporal allocation. 6. Write market clearing conditions on savings, and output in period 1 and 2

Consider a two-period sticky-price economy populated by identical house- holds with preferences defined over consumption in period 1, Ci and consumption in period 2, C2, and described by the utility function: In Ci Bn C2 where Ci denotes consumption in period 1, C2 denotes consumption in period 2, and B1/1.1 is the subjective discount factor. Let P and P2 denote the price levels in periods 1 and 2, respectively. Assume prices are fixed at P P2 = 1. Households have income in the amount of PYi dollars in period 1 and P2Y2 dollars in period 2. Households can save in period 1 for the next period. Let Sidenote the households savings in dollars in period 1. The nominal interest rate for the saving is i Potential output, denoted Y is 10 kilograms of apples. Firms satisfy demand up to the potential output. Assume that the economy is always in full employment in period 2 (the long run). The central bank uses the nominal interest rate, denoted i, as its monetary instrument. The nominal interest rate is subject to the zero lower bound (ZLB). 1. Write the households budget constraint in period 1 2. Write the households budget constraint in period 2. 3. Write the households intertemporal budget constraint and find the slope (of the intertemporal budget constraint dC1 4. Find the slope ( of the utility function, marginal rate of substitution MUC dC2 (MRS = 5. Find the equation for optimal intertemporal allocation. 6. Write market clearing conditions on savings, and output in period 1 and 2

Chapter4: Utility Maximization And Choice

Section: Chapter Questions

Problem 4.14P

Related questions

Question

100%

Only need the first three questions answered

Transcribed Image Text:Consider a two-period sticky-price economy populated by identical house-

holds with preferences defined over consumption in period 1, Ci and consumption

in period 2, C2, and described by the utility function:

In Ci Bn C2

where Ci denotes consumption in period 1, C2 denotes consumption in period 2,

and B1/1.1 is the subjective discount factor. Let P and P2 denote the price

levels in periods 1 and 2, respectively. Assume prices are fixed at P P2 = 1.

Households have income in the amount of PYi dollars in period 1 and P2Y2 dollars

in period 2. Households can save in period 1 for the next period. Let Sidenote the

households savings in dollars in period 1. The nominal interest rate for the saving

is i

Potential output, denoted Y is 10 kilograms of apples. Firms satisfy demand

up to the potential output. Assume that the economy is always in full employment

in period 2 (the long run). The central bank uses the nominal interest rate, denoted

i, as its monetary instrument. The nominal interest rate is subject to the zero lower

bound (ZLB).

1. Write the households budget constraint in period 1

2. Write the households budget constraint in period 2.

3. Write the households intertemporal budget constraint and find the slope

(of the intertemporal budget constraint

dC1

4. Find the slope (

of the utility function, marginal rate of substitution

MUC

dC2

(MRS

=

5. Find the equation for optimal intertemporal allocation.

6. Write market clearing conditions on savings, and output in period 1 and 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you