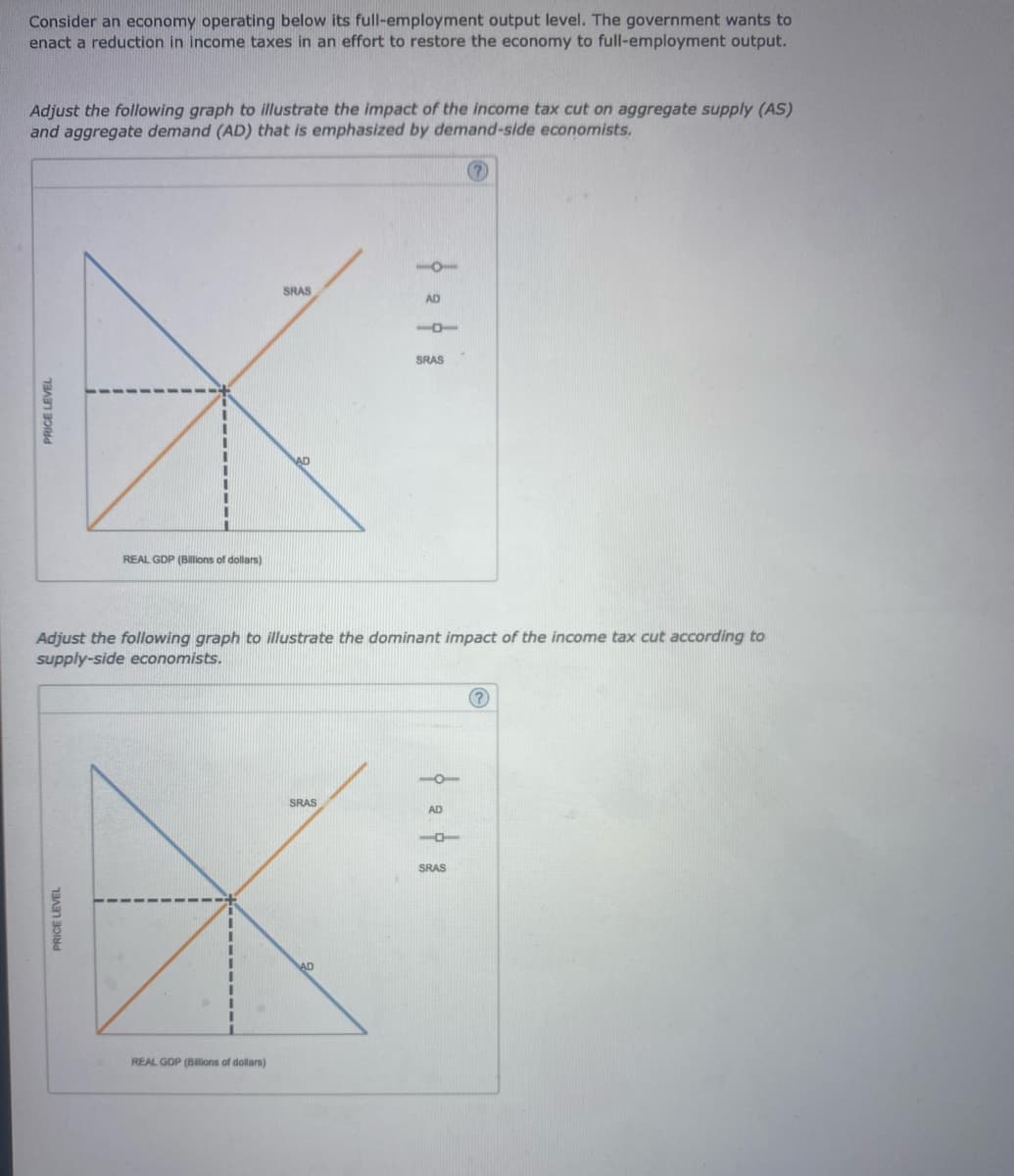

Consider an economy operating below its full-employment output level. The government wants to enact a reduction in income taxes in an effort to restore the economy to full-employment output. Adjust the following graph to illustrate the impact of the income tax cut on aggregate supply (AS) and aggregate demand (AD) that is emphasized by demand-side economists. PRICE LEVEL I PRICE LEVEL 1 11 REAL GDP (Billions of dollars) I T I I SRAS REAL GDP (Billions of dollars) AD Adjust the following graph to illustrate the dominant impact of the income tax cut according to supply-side economists. SRAS O AD AD 1 SRAS 10 AD - (?) SRAS ?

Consider an economy operating below its full-employment output level. The government wants to enact a reduction in income taxes in an effort to restore the economy to full-employment output. Adjust the following graph to illustrate the impact of the income tax cut on aggregate supply (AS) and aggregate demand (AD) that is emphasized by demand-side economists. PRICE LEVEL I PRICE LEVEL 1 11 REAL GDP (Billions of dollars) I T I I SRAS REAL GDP (Billions of dollars) AD Adjust the following graph to illustrate the dominant impact of the income tax cut according to supply-side economists. SRAS O AD AD 1 SRAS 10 AD - (?) SRAS ?

Chapter20: Monetary Policy

Section20.A: Policy Disputes Using The Self Correcting Aggregate Demand And Supply Model

Problem 2SQP

Related questions

Question

100%

Confused not sure how to answer

Transcribed Image Text:Consider an economy operating below its full-employment output level. The government wants to

enact a reduction in income taxes in an effort to restore the economy to full-employment output.

Adjust the following graph to illustrate the impact of the income tax cut on aggregate supply (AS)

and aggregate demand (AD) that is emphasized by demand-side economists.

PRICE LEVEL

REAL GDP (Billions of dollars)

PRICE LEVEL

I

I

1

1

I

SRAS

Adjust the following graph to illustrate the dominant impact of the income tax cut according to

supply-side economists.

REAL GDP (Billions of dollars)

AD

SRAS

AD

AD

1

SRAS

AD

-F

(?)

SRAS

?

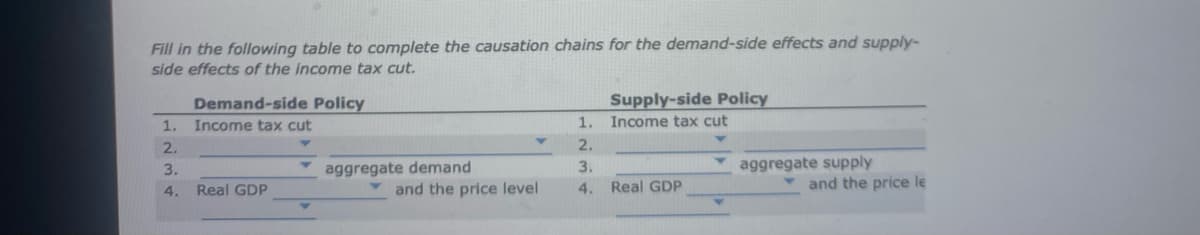

Transcribed Image Text:Fill in the following table to complete the causation chains for the demand-side effects and supply-

side effects of the income tax cut.

Demand-side Policy

1. Income tax cut

2.

3.

4. Real GDP

aggregate demand

and the price level

Supply-side Policy

Income tax cut

V

1.

2.

3.

4. Real GDP

aggregate supply

and the price le

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning