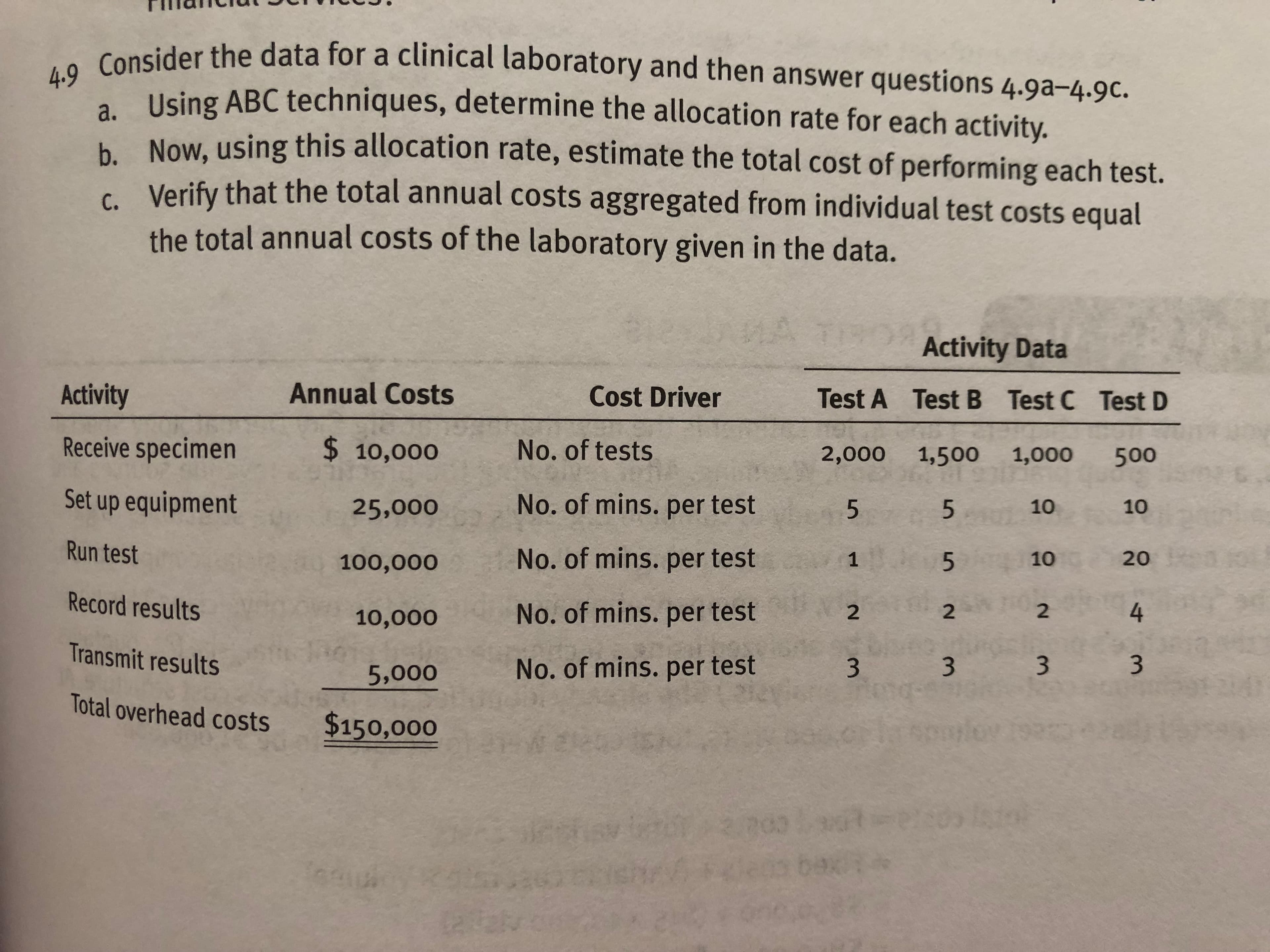

Consider the data for a clinical laboratory and then answer questions 4.9a-4.9c. Using ABC techniques, determine the allocation rate for each activity. Now, using this allocation rate, estimate the total cost of performing each test. Verify that the total annual costs aggregated from individual test costs equal the total annual costs of the laboratory given in the data. b. Activity Data Test A Test B Test C Test D 2,000 1,500 1,000 500 Cost Driver Annual Costs Activity Receive specimen Set up equipment Run test Record results No. of tests No. of mins. per test No. of mins. per test No. of mins. per test No. of mins. per test $ 10,000 25,000 100,000 10,000 Transmit results5,000 Total overhead costs $150,000 1010 20 4 3 10 1 2 2 2 3

Consider the data for a clinical laboratory and then answer questions 4.9a-4.9c. Using ABC techniques, determine the allocation rate for each activity. Now, using this allocation rate, estimate the total cost of performing each test. Verify that the total annual costs aggregated from individual test costs equal the total annual costs of the laboratory given in the data. b. Activity Data Test A Test B Test C Test D 2,000 1,500 1,000 500 Cost Driver Annual Costs Activity Receive specimen Set up equipment Run test Record results No. of tests No. of mins. per test No. of mins. per test No. of mins. per test No. of mins. per test $ 10,000 25,000 100,000 10,000 Transmit results5,000 Total overhead costs $150,000 1010 20 4 3 10 1 2 2 2 3

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter3: Cost Behavior

Section: Chapter Questions

Problem 37P: Weber Valley Regional Hospital has collected data on all of its activities for the past 16 months....

Related questions

Question

How to determine the allocation rate for each activity?

Transcribed Image Text:Consider the data for a clinical laboratory and then answer questions 4.9a-4.9c.

Using ABC techniques, determine the allocation rate for each activity.

Now, using this allocation rate, estimate the total cost of performing each test.

Verify that the total annual costs aggregated from individual test costs equal

the total annual costs of the laboratory given in the data.

b.

Activity Data

Test A Test B Test C Test D

2,000 1,500 1,000 500

Cost Driver

Annual Costs

Activity

Receive specimen

Set up equipment

Run test

Record results

No. of tests

No. of mins. per test

No. of mins. per test

No. of mins. per test

No. of mins. per test

$ 10,000

25,000

100,000

10,000

Transmit results5,000

Total overhead costs $150,000

1010

20

4

3

10

1

2

2

2

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning