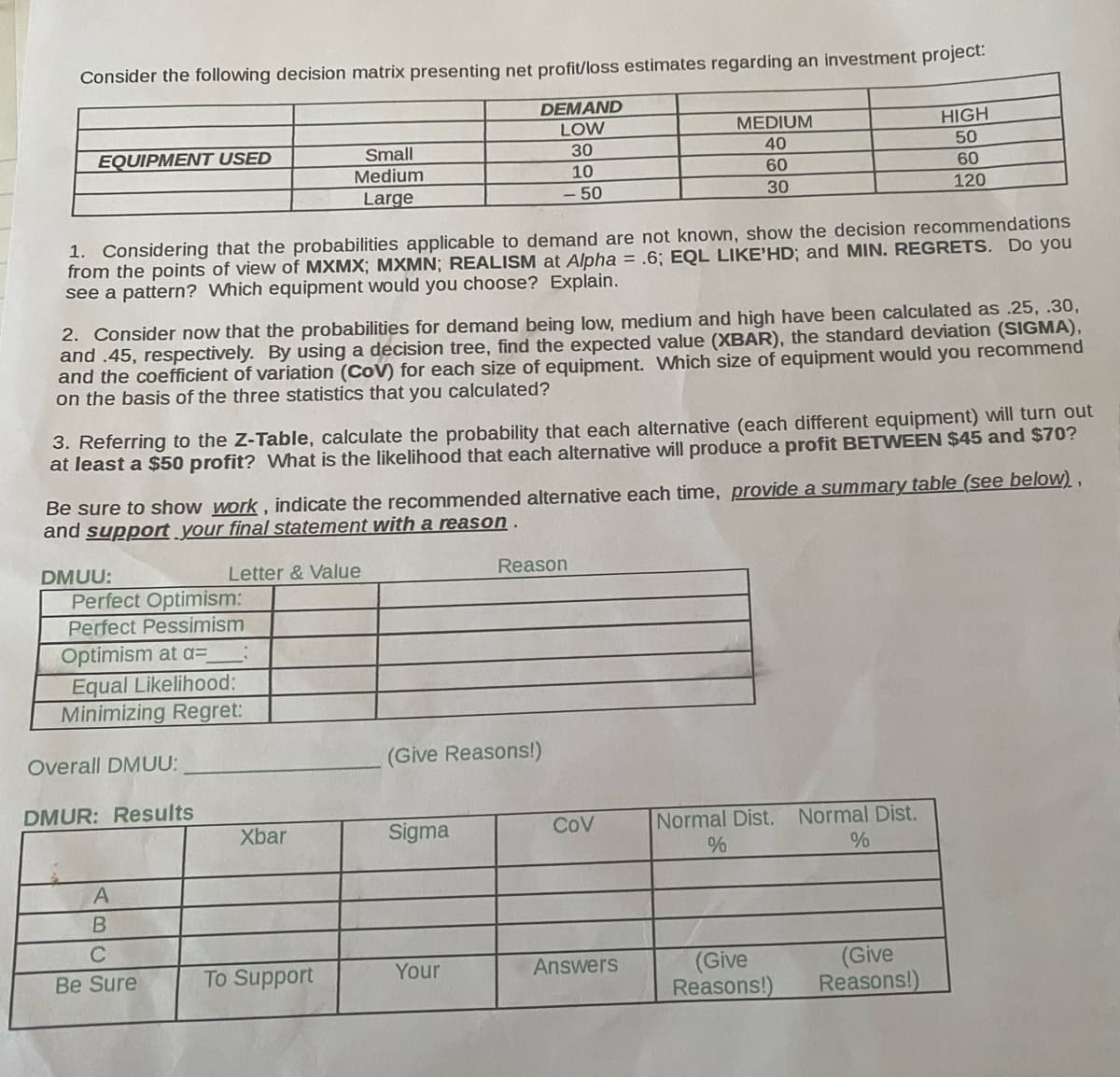

Consider the following decision matrix presenting net profit/loss estimates regarding an investment project: DEMAND LOW 30 10 -50 EQUIPMENT USED Small Medium Large MEDIUM 40 60 30 HIGH 50 60 120 1. Considering that the probabilities applicable to demand are not known, show the decision recommendations from the points of view of MXMX; MXMN; REALISM at Alpha = .6; EQL LIKE'HD; and MIN. REGRETS. Do you rn? Which equipment would you choose? Explain.

Consider the following decision matrix presenting net profit/loss estimates regarding an investment project: DEMAND LOW 30 10 -50 EQUIPMENT USED Small Medium Large MEDIUM 40 60 30 HIGH 50 60 120 1. Considering that the probabilities applicable to demand are not known, show the decision recommendations from the points of view of MXMX; MXMN; REALISM at Alpha = .6; EQL LIKE'HD; and MIN. REGRETS. Do you rn? Which equipment would you choose? Explain.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter9: Decision Making Under Uncertainty

Section9.2: Elements Of Decision Analysis

Problem 2P

Related questions

Question

100%

I need help with this please

Transcribed Image Text:Consider the following decision matrix presenting net profit/loss estimates regarding an investment project:

DEMAND

LOW

30

10

- 50

EQUIPMENT USED

1. Considering that the probabilities applicable to demand are not known, show the decision recommendations

from the points of view of MXMX; MXMN; REALISM at Alpha = .6; EQL LIKE'HD; and MIN. REGRETS. Do you

see a pattern? Which equipment would you choose? Explain.

2. Consider now that the probabilities for demand being low, medium and high have been calculated as .25, .30,

and .45, respectively. By using a decision tree, find the expected value (XBAR), the standard deviation (SIGMA),

and the coefficient of variation (CoV) for each size of equipment. Which size of equipment would you recommend

on the basis of the three statistics that you calculated?

DMUU:

3. Referring to the Z-Table, calculate the probability that each alternative (each different equipment) will turn out

at least a $50 profit? What is the likelihood that each alternative will produce a profit BETWEEN $45 and $70?

Perfect Optimism:

Perfect Pessimism

Optimism at a=

Be sure to show work, indicate the recommended alternative each time, provide a summary table (see below),

and support your final statement with a reason.

Letter & Value

Equal Likelihood:

Minimizing Regret:

Small

Medium

Large

Overall DMUU:

DMUR: Results

A

B

C

Be Sure

Xbar

To Support

(Give Reasons!)

Sigma

MEDIUM

40

60

30

Reason

Your

COV

Answers

HIGH

50

60

120

Normal Dist.

%

(Give

Reasons!)

Normal Dist.

%

(Give

Reasons!)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,