Consider the following information about Elmwood Manufacturing Company: Estimated Estimated Factory Estimated Selling and Month Sales Overhead Administrative Expenses December Year 1 $4,000,000 $650,000 $1,230,000 January Year 2 3,500,000 700,000 1,270,000 February Year 2 10,600,000 650,000 1,330,000 March Year 2 4,000,000 680,000 1,220,000 April Year 2 1,550,000 610,000 1,255,000 The company has found that approximately 30 percent of sales are collected during the month the sale is made and the remaining 70 percent are collected during the month following the sale. Material purchases are 30 percent of next month's estimated sales, and payments lag these purchases by one month. Labor costs are 35 percent of next month's sales and are paid during the month incurred. Factory overhead and selling and administrative expenses are paid during the month incurred. In addition, a payment for new equipment of $1.2 million is due in February. Also, a tax payment of $1.9 million and a dividend payment of $660,000 are due in March. The company's projected cash balance at the beginning of January is $1.5 million. Furthermore, Elmwood desires to maintain a $750,000 cash balance at the end of each month. Prepare a cash budget for Elmwood Manufacturing Company for the first three months of Year 2. Enter your answers as positive values, but use minus sign to indicate the lack of available cash. Enter zero if necessary. Do not leave any cells blank. Round your answers to the nearest dollar. Cash Budget First Quarter, Year 2 December January February March April Sales 24 24 Projected cash balance, $ $ beginning of month

Consider the following information about Elmwood Manufacturing Company: Estimated Estimated Factory Estimated Selling and Month Sales Overhead Administrative Expenses December Year 1 $4,000,000 $650,000 $1,230,000 January Year 2 3,500,000 700,000 1,270,000 February Year 2 10,600,000 650,000 1,330,000 March Year 2 4,000,000 680,000 1,220,000 April Year 2 1,550,000 610,000 1,255,000 The company has found that approximately 30 percent of sales are collected during the month the sale is made and the remaining 70 percent are collected during the month following the sale. Material purchases are 30 percent of next month's estimated sales, and payments lag these purchases by one month. Labor costs are 35 percent of next month's sales and are paid during the month incurred. Factory overhead and selling and administrative expenses are paid during the month incurred. In addition, a payment for new equipment of $1.2 million is due in February. Also, a tax payment of $1.9 million and a dividend payment of $660,000 are due in March. The company's projected cash balance at the beginning of January is $1.5 million. Furthermore, Elmwood desires to maintain a $750,000 cash balance at the end of each month. Prepare a cash budget for Elmwood Manufacturing Company for the first three months of Year 2. Enter your answers as positive values, but use minus sign to indicate the lack of available cash. Enter zero if necessary. Do not leave any cells blank. Round your answers to the nearest dollar. Cash Budget First Quarter, Year 2 December January February March April Sales 24 24 Projected cash balance, $ $ beginning of month

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 22E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Question

(This is AFTER the screenshots)

| Loan repayment | $ | $ | $ | ||||

| Projected cash balance, | |||||||

| end of month | $ | $ | $ |

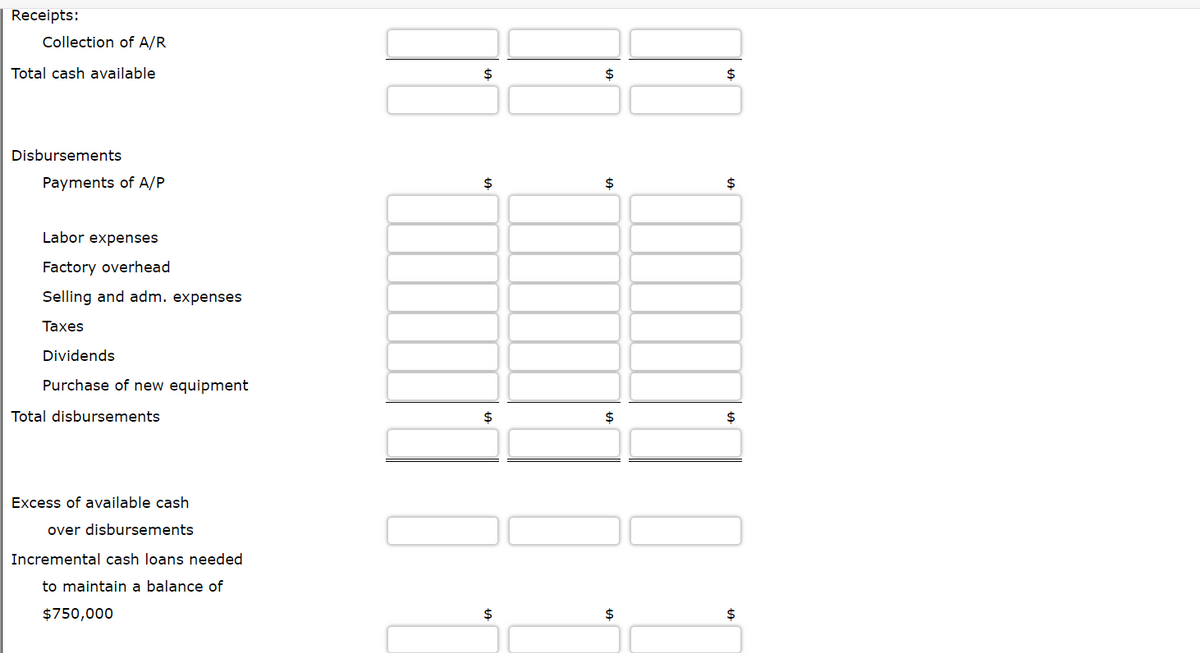

Transcribed Image Text:Receipts:

Collection of A/R

Total cash available

$

$

Disbursements

Payments of A/P

$

24

24

Labor expenses

Factory overhead

Selling and adm. expenses

Taxes

Dividends

Purchase of new equipment

Total disbursements

$

$

$

Excess of available cash

over disbursements

Incremental cash loans needed

to maintain a balance of

$750,000

$

$

24

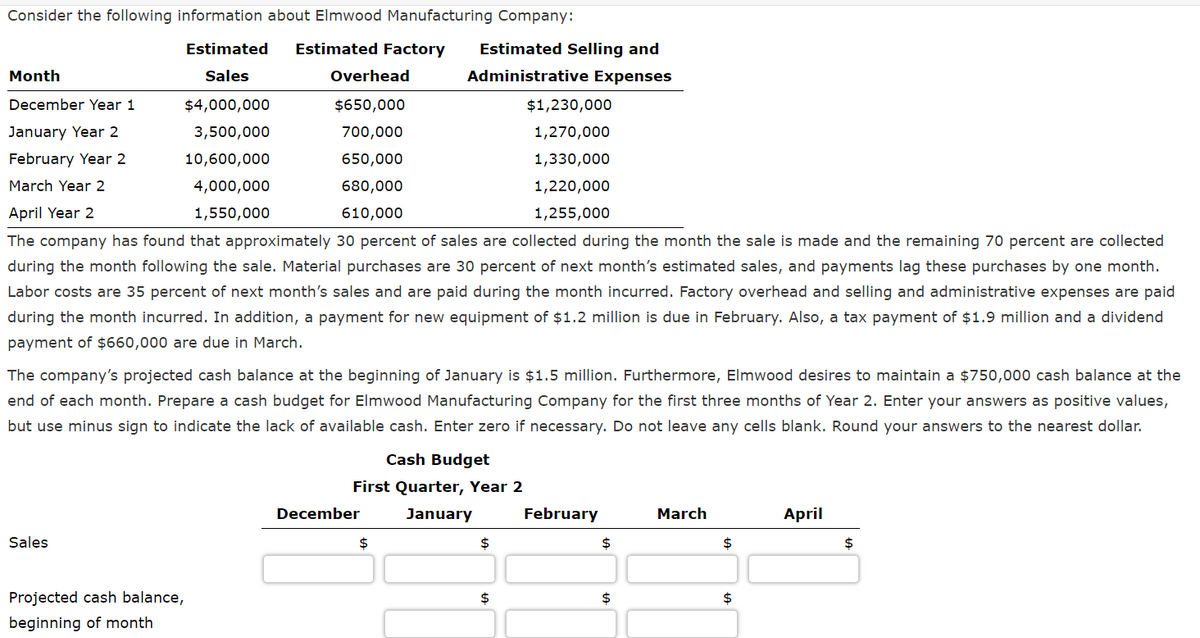

Transcribed Image Text:Consider the following information about Elmwood Manufacturing Company:

Estimated

Estimated Factory

Estimated Selling and

Month

Sales

Overhead

Administrative Expenses

December Year 1

$4,000,000

$650,000

$1,230,000

January Year 2

3,500,000

700,000

1,270,000

February Year 2

10,600,000

650,000

1,330,000

March Year 2

4,000,000

680,000

1,220,000

April Year 2

1,550,000

610,000

1,255,000

The company has found that approximately 30 percent of sales are collected during the month the sale is made and the remaining 70 percent are collected

during the month following the sale. Material purchases are 30 percent of next month's estimated sales, and payments lag these purchases by one month.

Labor costs are 35 percent of next month's sales and are paid during the month incurred. Factory overhead and selling and administrative expenses are paid

during the month incurred. In addition, a payment for new equipment of $1.2 million is due in February. Also, a tax payment of $1.9 million and a dividend

payment of $660,000 are due in March.

The company's projected cash balance at the beginning of January is $1.5 million. Furthermore, Elmwood desires to maintain a $750,000 cash balance at the

end of each month. Prepare a cash budget for Elmwood Manufacturing Company for the first three months of Year 2. Enter your answers as positive values,

but use minus sign to indicate the lack of available cash. Enter zero if necessary. Do not leave any cells blank. Round your answers to the nearest dollar.

Cash Budget

First Quarter, Year 2

December

January

February

March

April

Sales

$

2$

$

$

2$

Projected cash balance,

2$

24

$

beginning of month

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College