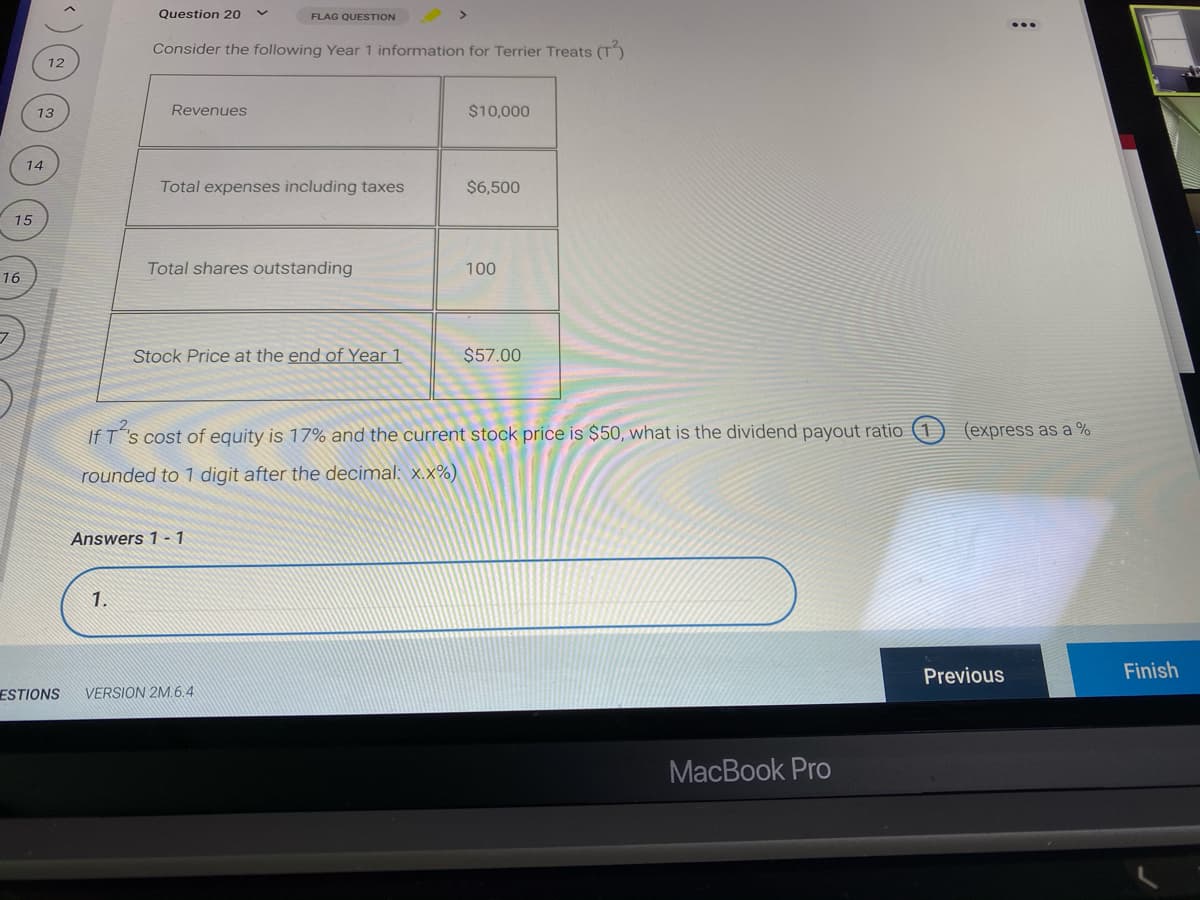

Consider the following Year 1 information for Terrier Treats (T) Revenues $10,000 Total expenses including taxes $6,500 Total shares outstanding 100 Stock Price at the end of Year 1 $57.00 If Ts cost of equity is 17% and the current stock price is $50, what is the dividend payout ratio (express as a % rounded to 1 digit after the decimal: x.x%)

Consider the following Year 1 information for Terrier Treats (T) Revenues $10,000 Total expenses including taxes $6,500 Total shares outstanding 100 Stock Price at the end of Year 1 $57.00 If Ts cost of equity is 17% and the current stock price is $50, what is the dividend payout ratio (express as a % rounded to 1 digit after the decimal: x.x%)

Chapter11: The Cost Of Capital

Section: Chapter Questions

Problem 8PROB

Related questions

Question

Practice Pack

Transcribed Image Text:Question 20

FLAG QUESTION

Consider the following Year 1 information for Terrier Treats (T)

12

13

Revenues

$10,000

14

Total expenses including taxes

$6,500

15

Total shares outstanding

100

16

Stock Price at the end of Year 1

$57.00

If T"s cost of equity is 17% and the current stock price is $50, what is the dividend payout ratio (1

(express as a %

rounded to 1 digit after the decimal: x.x%)

Answers 1 - 1

1.

Previous

Finish

ESTIONS

VERSION 2M.6.4

MacBook Pro

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning