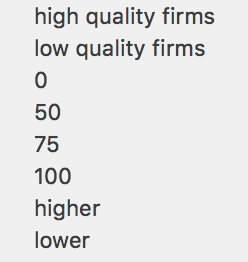

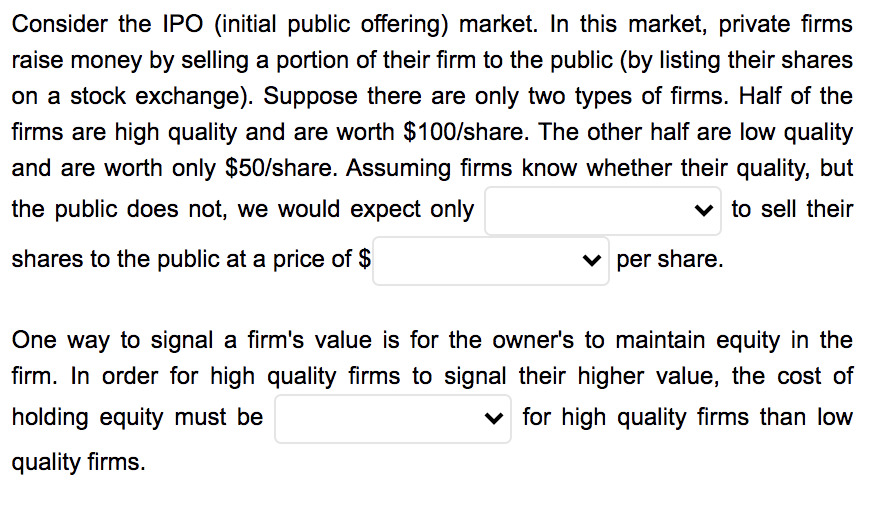

Consider the IPO (initial public offering) market. In this market, private firms raise money by selling a portion of their firm to the public (by listing their shares on a stock exchange). Suppose there are only two types of firms. Half of the firms are high quality and are worth $100/share. The other half are low quality and are worth only $50/share. Assuming firms know whether their quality, but the public does not, we would expect only v to sell their shares to the public at a price of $ v per share. One way to signal a firm's value is for the owner's to maintain equity in the firm. In order for high quality firms to signal their higher value, the cost of holding equity must be v for high quality firms than low quality firms.

Consider the IPO (initial public offering) market. In this market, private firms raise money by selling a portion of their firm to the public (by listing their shares on a stock exchange). Suppose there are only two types of firms. Half of the firms are high quality and are worth $100/share. The other half are low quality and are worth only $50/share. Assuming firms know whether their quality, but the public does not, we would expect only v to sell their shares to the public at a price of $ v per share. One way to signal a firm's value is for the owner's to maintain equity in the firm. In order for high quality firms to signal their higher value, the cost of holding equity must be v for high quality firms than low quality firms.

Chapter1: Multinational Financial Management: An Overview

Section: Chapter Questions

Problem 10QA

Related questions

Question

Transcribed Image Text:high quality firms

low quality firms

50

75

100

higher

lower

Transcribed Image Text:Consider the IPO (initial public offering) market. In this market, private firms

raise money by selling a portion of their firm to the public (by listing their shares

on a stock exchange). Suppose there are only two types of firms. Half of the

firms are high quality and are worth $100/share. The other half are low quality

and are worth only $50/share. Assuming firms know whether their quality, but

the public does not, we would expect only

v to sell their

shares to the public at a price of $

v per share.

One way to signal a firm's value is for the owner's to maintain equity in the

firm. In order for high quality firms to signal their higher value, the cost of

holding equity must be

v for high quality firms than low

quality firms.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you