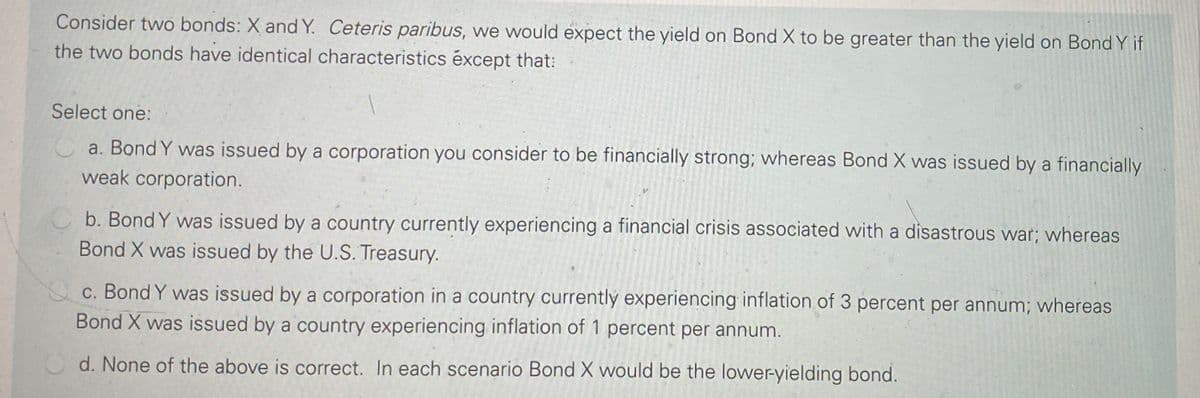

Consider two bonds: X and Y. Ceteris paribus, we would expect the yield on Bond X to be greater than the yield on Bond Y if the two bonds have identical characteristics éxcept that: Select one: a. Bond Y was issued by a corporation you consider to be financially strong; whereas Bond X was issued by a financially weak corporation. b. Bond Y was issued by a country currently experiencing a financial crisis associated with a disastrous war; whereas Bond X was issued by the U.S. Treasury. c. Bond Y was issued by a corporation in a country currently experiencing inflation of 3 percent per annum; whereas Bond X was issued by a country experiencing inflation of 1 percent per annum. d. None of the above is correct. In each scenario Bond X would be the lower-yielding bond.

Consider two bonds: X and Y. Ceteris paribus, we would expect the yield on Bond X to be greater than the yield on Bond Y if the two bonds have identical characteristics éxcept that: Select one: a. Bond Y was issued by a corporation you consider to be financially strong; whereas Bond X was issued by a financially weak corporation. b. Bond Y was issued by a country currently experiencing a financial crisis associated with a disastrous war; whereas Bond X was issued by the U.S. Treasury. c. Bond Y was issued by a corporation in a country currently experiencing inflation of 3 percent per annum; whereas Bond X was issued by a country experiencing inflation of 1 percent per annum. d. None of the above is correct. In each scenario Bond X would be the lower-yielding bond.

Chapter18: Long-term Debt Financing

Section: Chapter Questions

Problem 1QA

Related questions

Concept explainers

Question

100%

Transcribed Image Text:Consider two bonds: X and Y. Ceteris paribus, we would expect the yield on Bond X to be greater than the yield on Bond Y if

the two bonds have identical characteristics éxcept that:

Select one:

a. Bond Y was issued by a corporation you consider to be financially strong; whereas Bond X was issued by a financially

weak corporation.

b. Bond Y was issued by a country currently experiencing a financial crisis associated with a disastrous war; whereas

Bond X was issued by the U.S. Treasury.

c. Bond Y was issued by a corporation in a country currentlý experiencing inflation of 3 percent per annum; whereas

Bond X was issued by a country experiencing inflation of 1 percent per annum.

d. None of the above is correct. In each scenario Bond X would be the lower-yielding bond.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you