Consider two local banks. Bank A has 89 loans outstanding, each for $1.0 million, that it expects will be repaid today. Each loan has a 6% probability of defaut, in which case the bank is not read anything. The chance of default is independent across all the loans Bank B has only one loan of $59 million outstanding, which it also expects will be repaid today. It also has a 6% probability of not being repaid Calculate the following: a. The expected overall payoff of each bank b. The standard deviation of the overall payoff of each bank The expected overall payoff of each bank The expected overall payoff of Bank A is $ million (Round to the nearest integer)

Consider two local banks. Bank A has 89 loans outstanding, each for $1.0 million, that it expects will be repaid today. Each loan has a 6% probability of defaut, in which case the bank is not read anything. The chance of default is independent across all the loans Bank B has only one loan of $59 million outstanding, which it also expects will be repaid today. It also has a 6% probability of not being repaid Calculate the following: a. The expected overall payoff of each bank b. The standard deviation of the overall payoff of each bank The expected overall payoff of each bank The expected overall payoff of Bank A is $ million (Round to the nearest integer)

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 14P

Related questions

Question

Pls help its kinda easy for u sir

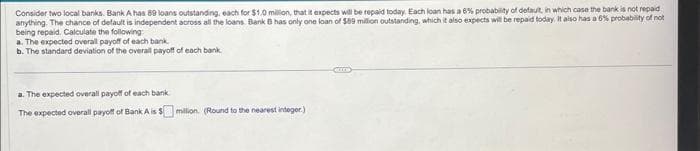

Transcribed Image Text:Consider two local banks. Bank A has 89 loans outstanding, each for $1.0 million, that it expects will be repaid today. Each loan has a 6% probability of default, in which case the bank is not repaid

anything. The chance of default is independent across all the loans. Bank B has only one loan of $89 million outstanding, which it also expects will be repaid today. It also has a 6% probability of not

being repaid. Calculate the following:

a. The expected overall payoff of each bank.

b. The standard deviation of the overall payoff of each bank.

a. The expected overall payoff of each bank

The expected overall payoff of Bank A is $

million. (Round to the nearest integer.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT