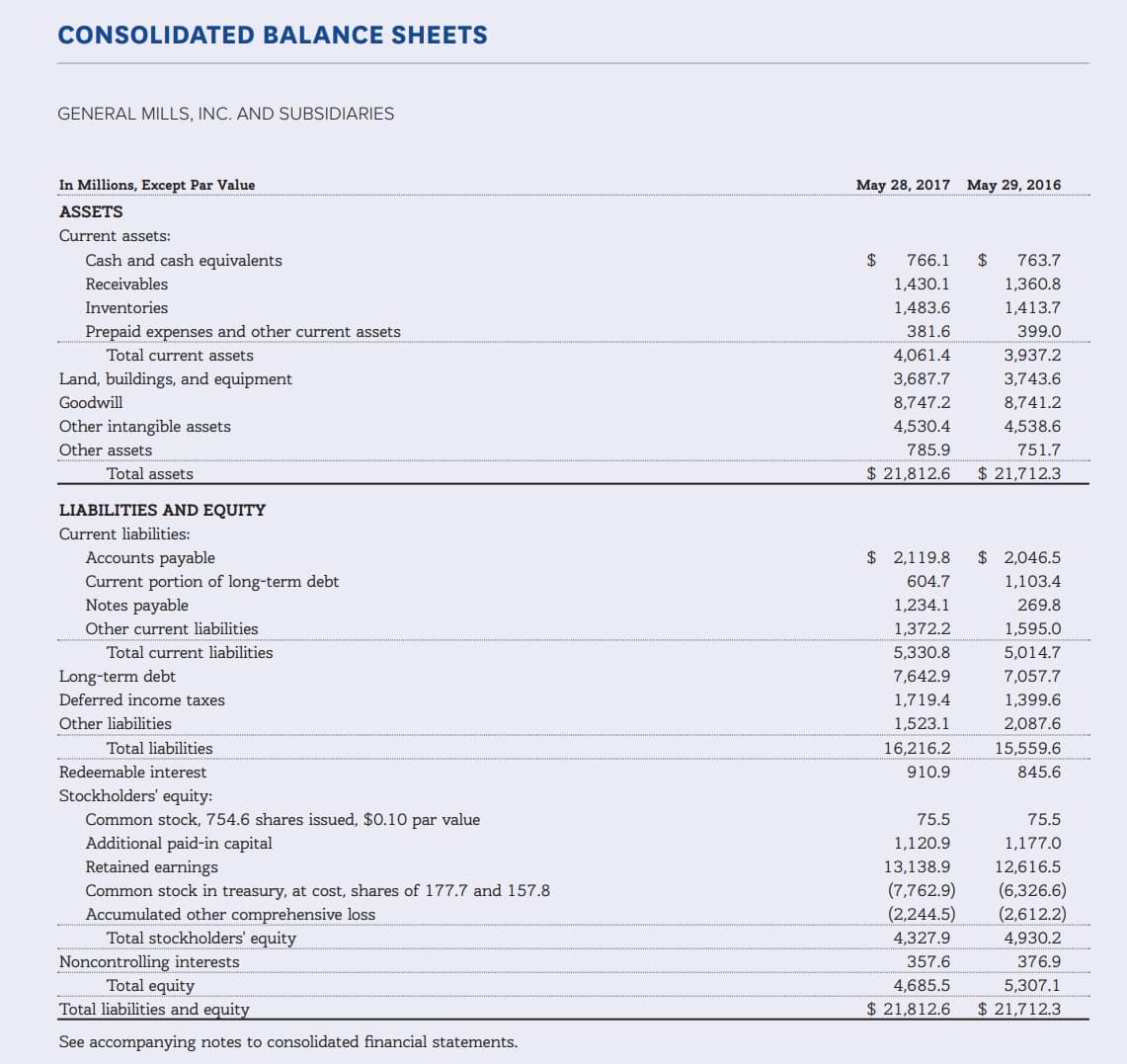

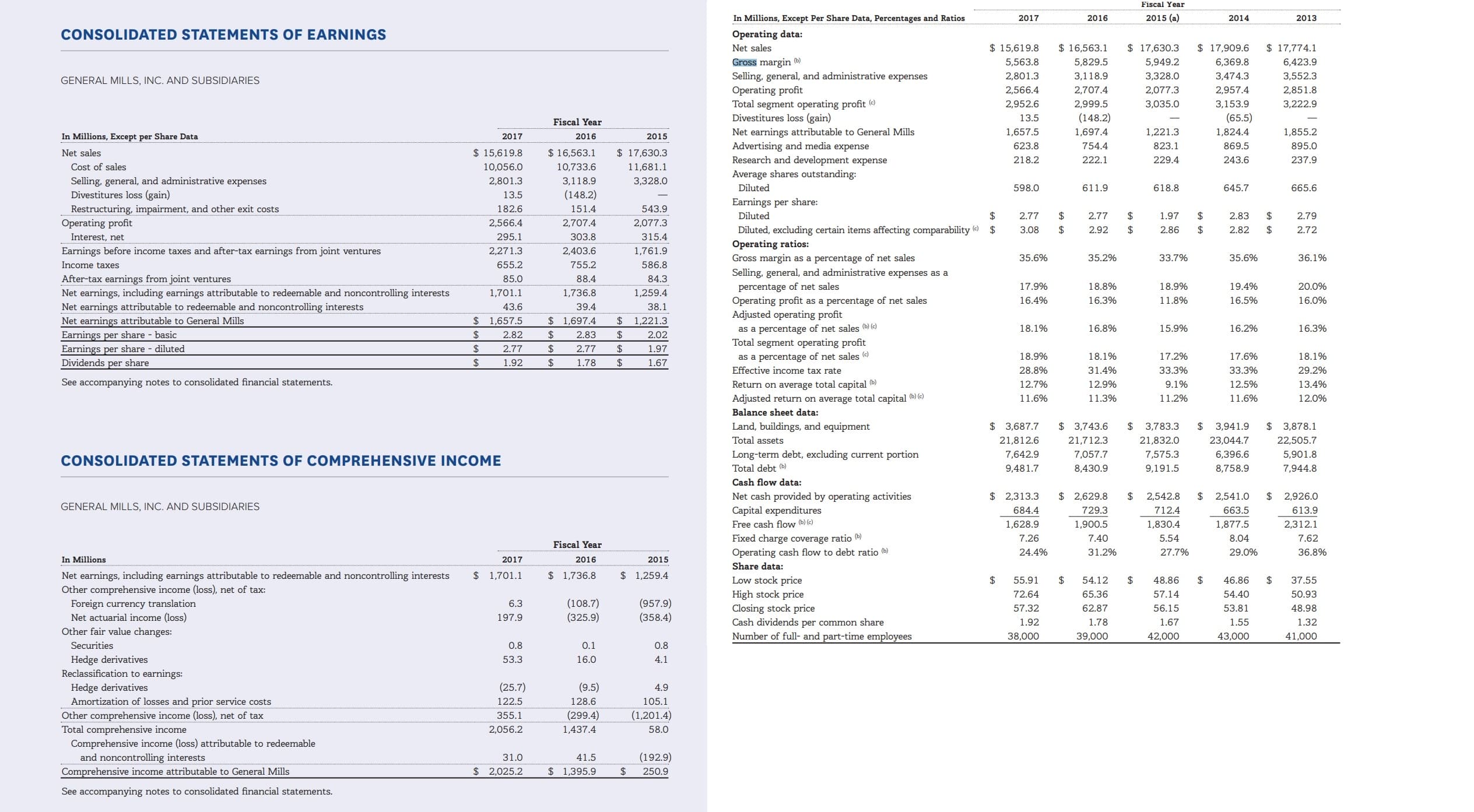

CONSOLIDATED BALANCE SHEETS GENERAL MILLS, INC. AND SUBSIDIARIES In Millions, Except Par Value May 29, 2016 May 28, 2017 ASSETS Current assets: Cash and cash equivalents $ 763.7 1,360.8 $ 766.1 Receivables 1,430.1 Inventories 1,483.6 1,413.7 Prepaid expenses and other current assets 381.6 399.0 Total current assets 4,061.4 3,937.2 Land, buildings, and equipment 3,687.7 3,743.6 8,741.2 Goodwill 8,747.2 Other intangible assets 4,530.4 4,538.6 Other assets 785.9 751.7 Total assets $ 21,812.6 $ 21,712.3 LIABILITIES AND EQUITY Current liabilities: Accounts payable $ 2,119.8 2,046.5 Current portion of long-term debt Notes payable 604.7 1,103.4 1,234.1 269.8 Other current liabilities 1,372.2 1,595.0 5,014.7 Total current liabilities 5,330.8 Long-term debt 7,642.9 7,057.7 Deferred income taxes 1,719.4 1,399.6 Other liabilities 1,523.1 2,087.6 Total liabilities 16,216.2 15,559.6 Redeemable interest 910.9 845.6 Stockholders' equity: Common stock, 754.6 shares issued, $0.10 par value Additional paid-in capital Retained earnings 75.5 75.5 1,120.9 1,177.0 13,138.9 12,616.5 (7,762.9) (2,244.5) (6,326.6) (2,612.2) Common stock in treasury, at cost, shares of 177.7 and 157.8 Accumulated other comprehensive loss Total stockholders' equity 4,327.9 4,930.2 Noncontrolling interests Total equity Total liabilities and equity 357.6 376.9 5,307.1 4,685.5 $ 21,712.3 $21,812.6 See accompanying notes to consolidated financial statements. Fiscal Year 2015 (a) In Millions, Except Per Share Data, Percentages and Ratios 2017 2016 2014 2013 CONSOLIDATED STATEMENTS OF EARNINGS Operating data: $ 17,630.3 $ 17,774.1 $15,619.8 $ 16,563.1 17,909.6 Net sales Gross margin b) Selling, general, and administrative expenses Operating profit Total segment operating profit (e Divestitures loss (gain) Net earnings attributable to General Mills Advertising and media expense Research and development expense 5,563.8 5,829.5 5,949.2 6,369.8 6,423.9 3,328.0 2,801.3 3,118.9 3,474.3 3,552.3 GENERAL MILLS, INC. AND SUBSIDIARIES 2,566.4 2,707.4 2,077.3 2,957.4 2,851.8 2,952.6 2,999.5 3,035.0 3,153.9 3,222.9 (148.2) (65.5) 13.5 Fiscal Year 1,657.5 1,697.4 1,221.3 1,824.4 1,855.2 In Millions, Except per Share Data 2017 2016 2015 754.4 623.8 823.1 869.5 895.0 $ 17,630.3 Net sales $ 15,619.8 $ 16,563.1 243.6 218.2 222.1 229.4 237.9 Cost of sales 10,056.0 10,733.6 11,681.1 Average shares outstanding: Selling, general, and administrative expenses Divestitures loss (gain) Restructuring, impairment, and other exit costs Operating profit 3,118.9 3,328.0 2,801.3 Diluted 598.0 611.9 618.8 645.7 665.6 (148.2) 13.5 Earnings per share: 182.6 151.4 543.9 $ $ Diluted 2.77 2.77 1.97 2.83 2.79 2,566.4 2,707.4 2,077.3 Diluted, excluding certain items affecting comparability $ Operating ratios: Gross margin as a percentage of net sales $ 3.08 2.92 $ 2.86 $ 2.82 2.72 $ Interest, net 295.1 303.8 315.4 Earnings before income taxes and after-tax earnings from joint ventures 2,271.3 2,403.6 1,761.9 35.6% 33.7% 35.2% 35.6% 36.1% 655.2 586.8 Income taxes 755.2 Selling, general, and administrative expenses as a After-tax earnings from joint ventures Net earnings, including earnings attributable to redeemable and noncontrolling interests Net earnings attributable to redeemable and noncontrolling interests 85.0 88.4 84.3 percentage of net sales Operating profit as a percentage of net sales Adjusted operating profit 19.4% 17.9% 18.8% 18.9% 20.0% 1,701.1 1,736.8 1,259.4 16.3% 11.8% 16.4% 16.5% 16.0% 43.6 39.4 38.1 $ 1,697.4 $ 1,657.5 Net earnings attribut able to General Mills 1,221.3 as a percentage of net sales (b) (c) Total segment operating profit 18.1% 16.8% 15.9% 16.2% 16.3% Earnings per share basic Earnings per share diluted Dividends per share $ 2.82 2.83 2.02 $ 2.77 2.77 1.97 $ as a percentage of net sales Effective income tax rate 18.9% 18.1% 17.2% 17.6% 18.1% $ 1.92 1.78 1.67 $ $ 28.8% 31.4% 33.3% 33.3% 29.2% See accompanying notes to consolidated financial statements. Return on average total capital 12.7% 12.9% 9.1% 12.5% 13.4% Adjusted return on average total capital b)e) 11.6% 11.3% 11.2% 11.6% 12.0% Balance sheet data: $ 3,687.7 Land, buildings, and equipment Total assets $3,743.6 $ 3,941.9 3,878.1 3,783.3 21,812.6 23,044.7 21,712.3 21,832.0 22,505.7 6,396.6 Long-term debt, excluding current portion 7,642.9 7,057.7 7,575.3 5,901.8 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Total debt (b) 9,481.7 8,430.9 9,191.5 8,758.9 7,944.8 Cash flow data: $ 2,313.3 $ 2,542.8 712.4 $ 2,926.0 613.9 $ 2,629.8 $ 2,541.0 Net cash provided by operating activities Capital expenditures Free cash flow (b) (e) GENERAL MILLS, INC. AND SUBSIDIARIES 729.3 684.4 663.5 1,628.9 1,900.5 1,830.4 1,877.5 2,312.1 Fixed charge coverage ratio () Operating cash flow to debt ratio (b) 7.26 7.40 5.54 8.04 7.62 Fiscal Year 24.4% 31.2% 27.7% 29.0% 36.8% 2016 In Millions 2017 2015 Share data: $ 1,701.1 $ 1,259.4 1,736.8 Net earnings, including earnings attributable to redeemable and noncontrolling interests Other comprehensive income (loss), net of tax: Foreign currency translation Net actuarial income (loss) Low stock price $ $ 55.91 54.12 48.86 46.86 37.55 High stock price Closing stock price 72.64 65.36 57.14 54.40 50.93 (957.9) (358.4) (108.7) (325.9) 6.3 57.32 62.87 56.15 53.81 48.98 197.9 Cash dividends per common share 1.92 1.78 1.67 1.55 1.32 Other fair value changes: Number of full- and part-time employees 38,000 39,000 42,000 43,000 41,000 Securities 0.8 0.1 0.8 Hedge derivatives Reclassification to earnings: Hedge derivatives 53.3 16.0 4.1 (25.7) (9.5) 4.9 Amortization of losses and prior service costs Other comprehensive income (loss), net of tax Total comprehensive income Comprehensive income (loss) attributable to redeemable 122.5 128.6 105.1 (299.4) (1,201.4) 355.1 2,056.2 1,437.4 58.0 (192.9) and noncontrolling interests Comprehensive income attributable to General Mills 31.0 41.5 $ 2,025.2 1,395.9 250.9 See accompanying notes to consolidated financial statements.

CONSOLIDATED BALANCE SHEETS GENERAL MILLS, INC. AND SUBSIDIARIES In Millions, Except Par Value May 29, 2016 May 28, 2017 ASSETS Current assets: Cash and cash equivalents $ 763.7 1,360.8 $ 766.1 Receivables 1,430.1 Inventories 1,483.6 1,413.7 Prepaid expenses and other current assets 381.6 399.0 Total current assets 4,061.4 3,937.2 Land, buildings, and equipment 3,687.7 3,743.6 8,741.2 Goodwill 8,747.2 Other intangible assets 4,530.4 4,538.6 Other assets 785.9 751.7 Total assets $ 21,812.6 $ 21,712.3 LIABILITIES AND EQUITY Current liabilities: Accounts payable $ 2,119.8 2,046.5 Current portion of long-term debt Notes payable 604.7 1,103.4 1,234.1 269.8 Other current liabilities 1,372.2 1,595.0 5,014.7 Total current liabilities 5,330.8 Long-term debt 7,642.9 7,057.7 Deferred income taxes 1,719.4 1,399.6 Other liabilities 1,523.1 2,087.6 Total liabilities 16,216.2 15,559.6 Redeemable interest 910.9 845.6 Stockholders' equity: Common stock, 754.6 shares issued, $0.10 par value Additional paid-in capital Retained earnings 75.5 75.5 1,120.9 1,177.0 13,138.9 12,616.5 (7,762.9) (2,244.5) (6,326.6) (2,612.2) Common stock in treasury, at cost, shares of 177.7 and 157.8 Accumulated other comprehensive loss Total stockholders' equity 4,327.9 4,930.2 Noncontrolling interests Total equity Total liabilities and equity 357.6 376.9 5,307.1 4,685.5 $ 21,712.3 $21,812.6 See accompanying notes to consolidated financial statements. Fiscal Year 2015 (a) In Millions, Except Per Share Data, Percentages and Ratios 2017 2016 2014 2013 CONSOLIDATED STATEMENTS OF EARNINGS Operating data: $ 17,630.3 $ 17,774.1 $15,619.8 $ 16,563.1 17,909.6 Net sales Gross margin b) Selling, general, and administrative expenses Operating profit Total segment operating profit (e Divestitures loss (gain) Net earnings attributable to General Mills Advertising and media expense Research and development expense 5,563.8 5,829.5 5,949.2 6,369.8 6,423.9 3,328.0 2,801.3 3,118.9 3,474.3 3,552.3 GENERAL MILLS, INC. AND SUBSIDIARIES 2,566.4 2,707.4 2,077.3 2,957.4 2,851.8 2,952.6 2,999.5 3,035.0 3,153.9 3,222.9 (148.2) (65.5) 13.5 Fiscal Year 1,657.5 1,697.4 1,221.3 1,824.4 1,855.2 In Millions, Except per Share Data 2017 2016 2015 754.4 623.8 823.1 869.5 895.0 $ 17,630.3 Net sales $ 15,619.8 $ 16,563.1 243.6 218.2 222.1 229.4 237.9 Cost of sales 10,056.0 10,733.6 11,681.1 Average shares outstanding: Selling, general, and administrative expenses Divestitures loss (gain) Restructuring, impairment, and other exit costs Operating profit 3,118.9 3,328.0 2,801.3 Diluted 598.0 611.9 618.8 645.7 665.6 (148.2) 13.5 Earnings per share: 182.6 151.4 543.9 $ $ Diluted 2.77 2.77 1.97 2.83 2.79 2,566.4 2,707.4 2,077.3 Diluted, excluding certain items affecting comparability $ Operating ratios: Gross margin as a percentage of net sales $ 3.08 2.92 $ 2.86 $ 2.82 2.72 $ Interest, net 295.1 303.8 315.4 Earnings before income taxes and after-tax earnings from joint ventures 2,271.3 2,403.6 1,761.9 35.6% 33.7% 35.2% 35.6% 36.1% 655.2 586.8 Income taxes 755.2 Selling, general, and administrative expenses as a After-tax earnings from joint ventures Net earnings, including earnings attributable to redeemable and noncontrolling interests Net earnings attributable to redeemable and noncontrolling interests 85.0 88.4 84.3 percentage of net sales Operating profit as a percentage of net sales Adjusted operating profit 19.4% 17.9% 18.8% 18.9% 20.0% 1,701.1 1,736.8 1,259.4 16.3% 11.8% 16.4% 16.5% 16.0% 43.6 39.4 38.1 $ 1,697.4 $ 1,657.5 Net earnings attribut able to General Mills 1,221.3 as a percentage of net sales (b) (c) Total segment operating profit 18.1% 16.8% 15.9% 16.2% 16.3% Earnings per share basic Earnings per share diluted Dividends per share $ 2.82 2.83 2.02 $ 2.77 2.77 1.97 $ as a percentage of net sales Effective income tax rate 18.9% 18.1% 17.2% 17.6% 18.1% $ 1.92 1.78 1.67 $ $ 28.8% 31.4% 33.3% 33.3% 29.2% See accompanying notes to consolidated financial statements. Return on average total capital 12.7% 12.9% 9.1% 12.5% 13.4% Adjusted return on average total capital b)e) 11.6% 11.3% 11.2% 11.6% 12.0% Balance sheet data: $ 3,687.7 Land, buildings, and equipment Total assets $3,743.6 $ 3,941.9 3,878.1 3,783.3 21,812.6 23,044.7 21,712.3 21,832.0 22,505.7 6,396.6 Long-term debt, excluding current portion 7,642.9 7,057.7 7,575.3 5,901.8 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Total debt (b) 9,481.7 8,430.9 9,191.5 8,758.9 7,944.8 Cash flow data: $ 2,313.3 $ 2,542.8 712.4 $ 2,926.0 613.9 $ 2,629.8 $ 2,541.0 Net cash provided by operating activities Capital expenditures Free cash flow (b) (e) GENERAL MILLS, INC. AND SUBSIDIARIES 729.3 684.4 663.5 1,628.9 1,900.5 1,830.4 1,877.5 2,312.1 Fixed charge coverage ratio () Operating cash flow to debt ratio (b) 7.26 7.40 5.54 8.04 7.62 Fiscal Year 24.4% 31.2% 27.7% 29.0% 36.8% 2016 In Millions 2017 2015 Share data: $ 1,701.1 $ 1,259.4 1,736.8 Net earnings, including earnings attributable to redeemable and noncontrolling interests Other comprehensive income (loss), net of tax: Foreign currency translation Net actuarial income (loss) Low stock price $ $ 55.91 54.12 48.86 46.86 37.55 High stock price Closing stock price 72.64 65.36 57.14 54.40 50.93 (957.9) (358.4) (108.7) (325.9) 6.3 57.32 62.87 56.15 53.81 48.98 197.9 Cash dividends per common share 1.92 1.78 1.67 1.55 1.32 Other fair value changes: Number of full- and part-time employees 38,000 39,000 42,000 43,000 41,000 Securities 0.8 0.1 0.8 Hedge derivatives Reclassification to earnings: Hedge derivatives 53.3 16.0 4.1 (25.7) (9.5) 4.9 Amortization of losses and prior service costs Other comprehensive income (loss), net of tax Total comprehensive income Comprehensive income (loss) attributable to redeemable 122.5 128.6 105.1 (299.4) (1,201.4) 355.1 2,056.2 1,437.4 58.0 (192.9) and noncontrolling interests Comprehensive income attributable to General Mills 31.0 41.5 $ 2,025.2 1,395.9 250.9 See accompanying notes to consolidated financial statements.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.10E

Related questions

Question

I need assistance calculating ratios with the attached income statement and balance sheet:

| Fiscal 2017 | Fiscal 2016 | |

| Gross margin, as reported | 35.6% | 35.2% |

| Mark-to-market effects | (0.1) | (0.4) |

| Restructuring costs | 0.3 | 0.5 |

| Project-related costs | 0.3 | 0.3 |

| Adjusted gross margin | 36.1% | 35.6% |

Calculate the following financial ratios for 2016 and 2017

4. Reutrn on assets (2015, total assets = $21,932.0 million)

5. Return on common

6.

Transcribed Image Text:CONSOLIDATED BALANCE SHEETS

GENERAL MILLS, INC. AND SUBSIDIARIES

In Millions, Except Par Value

May 29, 2016

May 28, 2017

ASSETS

Current assets:

Cash and cash equivalents

$

763.7

1,360.8

$

766.1

Receivables

1,430.1

Inventories

1,483.6

1,413.7

Prepaid expenses and other current assets

381.6

399.0

Total current assets

4,061.4

3,937.2

Land, buildings, and equipment

3,687.7

3,743.6

8,741.2

Goodwill

8,747.2

Other intangible assets

4,530.4

4,538.6

Other assets

785.9

751.7

Total assets

$ 21,812.6

$ 21,712.3

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$ 2,119.8

2,046.5

Current portion of long-term debt

Notes payable

604.7

1,103.4

1,234.1

269.8

Other current liabilities

1,372.2

1,595.0

5,014.7

Total current liabilities

5,330.8

Long-term debt

7,642.9

7,057.7

Deferred income taxes

1,719.4

1,399.6

Other liabilities

1,523.1

2,087.6

Total liabilities

16,216.2

15,559.6

Redeemable interest

910.9

845.6

Stockholders' equity:

Common stock, 754.6 shares issued, $0.10 par value

Additional paid-in capital

Retained earnings

75.5

75.5

1,120.9

1,177.0

13,138.9

12,616.5

(7,762.9)

(2,244.5)

(6,326.6)

(2,612.2)

Common stock in treasury, at cost, shares of 177.7 and 157.8

Accumulated other comprehensive loss

Total stockholders' equity

4,327.9

4,930.2

Noncontrolling interests

Total equity

Total liabilities and equity

357.6

376.9

5,307.1

4,685.5

$ 21,712.3

$21,812.6

See accompanying notes to consolidated financial statements.

Transcribed Image Text:Fiscal Year

2015 (a)

In Millions, Except Per Share Data, Percentages and Ratios

2017

2016

2014

2013

CONSOLIDATED STATEMENTS OF EARNINGS

Operating data:

$ 17,630.3

$ 17,774.1

$15,619.8

$ 16,563.1

17,909.6

Net sales

Gross margin b)

Selling, general, and administrative expenses

Operating profit

Total segment operating profit (e

Divestitures loss (gain)

Net earnings attributable to General Mills

Advertising and media expense

Research and development expense

5,563.8

5,829.5

5,949.2

6,369.8

6,423.9

3,328.0

2,801.3

3,118.9

3,474.3

3,552.3

GENERAL MILLS, INC. AND SUBSIDIARIES

2,566.4

2,707.4

2,077.3

2,957.4

2,851.8

2,952.6

2,999.5

3,035.0

3,153.9

3,222.9

(148.2)

(65.5)

13.5

Fiscal Year

1,657.5

1,697.4

1,221.3

1,824.4

1,855.2

In Millions, Except per Share Data

2017

2016

2015

754.4

623.8

823.1

869.5

895.0

$ 17,630.3

Net sales

$ 15,619.8

$ 16,563.1

243.6

218.2

222.1

229.4

237.9

Cost of sales

10,056.0

10,733.6

11,681.1

Average shares outstanding:

Selling, general, and administrative expenses

Divestitures loss (gain)

Restructuring, impairment, and other exit costs

Operating profit

3,118.9

3,328.0

2,801.3

Diluted

598.0

611.9

618.8

645.7

665.6

(148.2)

13.5

Earnings per share:

182.6

151.4

543.9

$

$

Diluted

2.77

2.77

1.97

2.83

2.79

2,566.4

2,707.4

2,077.3

Diluted, excluding certain items affecting comparability $

Operating ratios:

Gross margin as a percentage of net sales

$

3.08

2.92

$

2.86

$

2.82

2.72

$

Interest, net

295.1

303.8

315.4

Earnings before income taxes and after-tax earnings from joint ventures

2,271.3

2,403.6

1,761.9

35.6%

33.7%

35.2%

35.6%

36.1%

655.2

586.8

Income taxes

755.2

Selling, general, and administrative expenses as a

After-tax earnings from joint ventures

Net earnings, including earnings attributable to redeemable and noncontrolling interests

Net earnings attributable to redeemable and noncontrolling interests

85.0

88.4

84.3

percentage of net sales

Operating profit as a percentage of net sales

Adjusted operating profit

19.4%

17.9%

18.8%

18.9%

20.0%

1,701.1

1,736.8

1,259.4

16.3%

11.8%

16.4%

16.5%

16.0%

43.6

39.4

38.1

$ 1,697.4

$ 1,657.5

Net earnings attribut able to General Mills

1,221.3

as a percentage of net sales (b) (c)

Total segment operating profit

18.1%

16.8%

15.9%

16.2%

16.3%

Earnings per share basic

Earnings per share diluted

Dividends per share

$

2.82

2.83

2.02

$

2.77

2.77

1.97

$

as a percentage of net sales

Effective income tax rate

18.9%

18.1%

17.2%

17.6%

18.1%

$

1.92

1.78

1.67

$

$

28.8%

31.4%

33.3%

33.3%

29.2%

See accompanying notes to consolidated financial statements.

Return on average total capital

12.7%

12.9%

9.1%

12.5%

13.4%

Adjusted return on average total capital b)e)

11.6%

11.3%

11.2%

11.6%

12.0%

Balance sheet data:

$ 3,687.7

Land, buildings, and equipment

Total assets

$3,743.6

$

3,941.9

3,878.1

3,783.3

21,812.6

23,044.7

21,712.3

21,832.0

22,505.7

6,396.6

Long-term debt, excluding current portion

7,642.9

7,057.7

7,575.3

5,901.8

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Total debt (b)

9,481.7

8,430.9

9,191.5

8,758.9

7,944.8

Cash flow data:

$ 2,313.3

$

2,542.8

712.4

$

2,926.0

613.9

$ 2,629.8

$ 2,541.0

Net cash provided by operating activities

Capital expenditures

Free cash flow (b) (e)

GENERAL MILLS, INC. AND SUBSIDIARIES

729.3

684.4

663.5

1,628.9

1,900.5

1,830.4

1,877.5

2,312.1

Fixed charge coverage ratio ()

Operating cash flow to debt ratio (b)

7.26

7.40

5.54

8.04

7.62

Fiscal Year

24.4%

31.2%

27.7%

29.0%

36.8%

2016

In Millions

2017

2015

Share data:

$ 1,701.1

$ 1,259.4

1,736.8

Net earnings, including earnings attributable to redeemable and noncontrolling interests

Other comprehensive income (loss), net of tax:

Foreign currency translation

Net actuarial income (loss)

Low stock price

$

$

55.91

54.12

48.86

46.86

37.55

High stock price

Closing stock price

72.64

65.36

57.14

54.40

50.93

(957.9)

(358.4)

(108.7)

(325.9)

6.3

57.32

62.87

56.15

53.81

48.98

197.9

Cash dividends per common share

1.92

1.78

1.67

1.55

1.32

Other fair value changes:

Number of full- and part-time employees

38,000

39,000

42,000

43,000

41,000

Securities

0.8

0.1

0.8

Hedge derivatives

Reclassification to earnings:

Hedge derivatives

53.3

16.0

4.1

(25.7)

(9.5)

4.9

Amortization of losses and prior service costs

Other comprehensive income (loss), net of tax

Total comprehensive income

Comprehensive income (loss) attributable to redeemable

122.5

128.6

105.1

(299.4)

(1,201.4)

355.1

2,056.2

1,437.4

58.0

(192.9)

and noncontrolling interests

Comprehensive income attributable to General Mills

31.0

41.5

$ 2,025.2

1,395.9

250.9

See accompanying notes to consolidated financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning