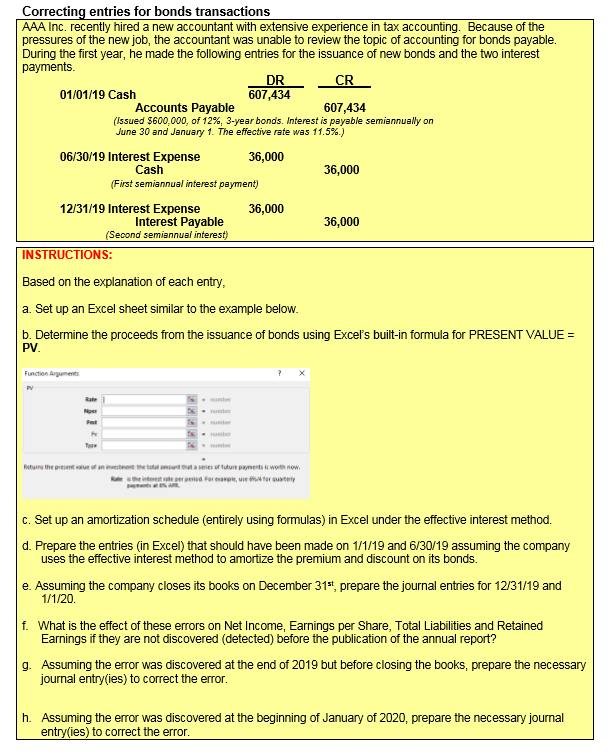

Correcting entries for bonds transactions AAA Inc. recently hired a new accountant with extensive experience in tax accounting. Because of the pressures of the new job, the accountant was unable to review the topic of accounting for bonds payable. During the first year, he made the following entries for the issuance of new bonds and the two interest payments. DR 607,434 CR 01/01/19 Cash Accounts Payable 607,434 (Issued $600,000, of 12%, 3-year bonds. Interest is payable semiannually on June 30 and January 1. The effective rate was 11.5%.) 06/30/19 Interest Expense Cash 36,000 36,000 (First semiannual interest payment) 12/31/19 Interest Expense Interest Payable 36,000 36,000 (Second semiannual interest) INSTRUCTIONS: Based on the explanation of each entry, a. Set up an Excel sheet similar to the example below. b. Determine the proceeds from the issuance of bonds using Exceľs built-in formula for PRESENT VALUE = PV. Function Arguments PV Rate IN unber Nper -unber unber Returns the present aue of an iestnent the tutal anountut a seies of tuturt paments is worth now. Re siterest te ser period For earpe, use ter quatety c. Set up an amortization schedule (entirely using formulas) in Excel under the effective interest method. d. Prepare the entries (in Excel) that should have been made on 1/1/19 and 6/30/19 assuming the company uses the effective interest method to amortize the premium and discount on its bonds. e. Assuming the company closes its books on December 31*", prepare the journal entries for 12/31/19 and 1/1/20. f. What is the effect of these errors on Net Income, Earnings per Share, Total Liabilities and Retained Earnings if they are not discovered (detected) before the publication of the annual report? g. Assuming the error was discovered at the end of 2019 but before closing the books, prepare the necessary journal entry(ies) to correct the error. h. Assuming the error was discovered at the beginning of January of 2020, prepare the necessary journal entry(ies) to correct the error.

Correcting entries for bonds transactions AAA Inc. recently hired a new accountant with extensive experience in tax accounting. Because of the pressures of the new job, the accountant was unable to review the topic of accounting for bonds payable. During the first year, he made the following entries for the issuance of new bonds and the two interest payments. DR 607,434 CR 01/01/19 Cash Accounts Payable 607,434 (Issued $600,000, of 12%, 3-year bonds. Interest is payable semiannually on June 30 and January 1. The effective rate was 11.5%.) 06/30/19 Interest Expense Cash 36,000 36,000 (First semiannual interest payment) 12/31/19 Interest Expense Interest Payable 36,000 36,000 (Second semiannual interest) INSTRUCTIONS: Based on the explanation of each entry, a. Set up an Excel sheet similar to the example below. b. Determine the proceeds from the issuance of bonds using Exceľs built-in formula for PRESENT VALUE = PV. Function Arguments PV Rate IN unber Nper -unber unber Returns the present aue of an iestnent the tutal anountut a seies of tuturt paments is worth now. Re siterest te ser period For earpe, use ter quatety c. Set up an amortization schedule (entirely using formulas) in Excel under the effective interest method. d. Prepare the entries (in Excel) that should have been made on 1/1/19 and 6/30/19 assuming the company uses the effective interest method to amortize the premium and discount on its bonds. e. Assuming the company closes its books on December 31*", prepare the journal entries for 12/31/19 and 1/1/20. f. What is the effect of these errors on Net Income, Earnings per Share, Total Liabilities and Retained Earnings if they are not discovered (detected) before the publication of the annual report? g. Assuming the error was discovered at the end of 2019 but before closing the books, prepare the necessary journal entry(ies) to correct the error. h. Assuming the error was discovered at the beginning of January of 2020, prepare the necessary journal entry(ies) to correct the error.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter18: Acquiring Capital For Growth And Development

Section18.2: Long-term Debt Financing

Problem 1OYO

Related questions

Question

f. What is the effect of these errors on Net Income, Earnings per Share, Total Liabilities and

Transcribed Image Text:Correcting entries for bonds transactions

AAA Inc. recently hired a new accountant with extensive experience in tax accounting. Because of the

pressures of the new job, the accountant was unable to review the topic of accounting for bonds payable.

During the first year, he made the following entries for the issuance of new bonds and the two interest

payments.

DR

607,434

CR

01/01/19 Cash

Accounts Payable

607,434

(Issued $600,000, of 12%, 3-year bonds. Interest is payable semiannually on

June 30 and January 1. The effective rate was 11.5%.)

06/30/19 Interest Expense

Cash

36,000

36,000

(First semiannual interest payment)

12/31/19 Interest Expense

Interest Payable

36,000

36,000

(Second semiannual interest)

INSTRUCTIONS:

Based on the explanation of each entry,

a. Set up an Excel sheet similar to the example below.

b. Determine the proceeds from the issuance of bonds using Exceľs built-in formula for PRESENT VALUE =

PV.

Function Arguments

PV

Rate

IN unber

Nper

-unber

unber

Returns the present aue of an iestnent the tutal anountut a seies of tuturt paments is worth now.

Re siterest te ser period For earpe, use ter quatety

c. Set up an amortization schedule (entirely using formulas) in Excel under the effective interest method.

d. Prepare the entries (in Excel) that should have been made on 1/1/19 and 6/30/19 assuming the company

uses the effective interest method to amortize the premium and discount on its bonds.

e. Assuming the company closes its books on December 31*", prepare the journal entries for 12/31/19 and

1/1/20.

f. What is the effect of these errors on Net Income, Earnings per Share, Total Liabilities and Retained

Earnings if they are not discovered (detected) before the publication of the annual report?

g. Assuming the error was discovered at the end of 2019 but before closing the books, prepare the necessary

journal entry(ies) to correct the error.

h. Assuming the error was discovered at the beginning of January of 2020, prepare the necessary journal

entry(ies) to correct the error.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning