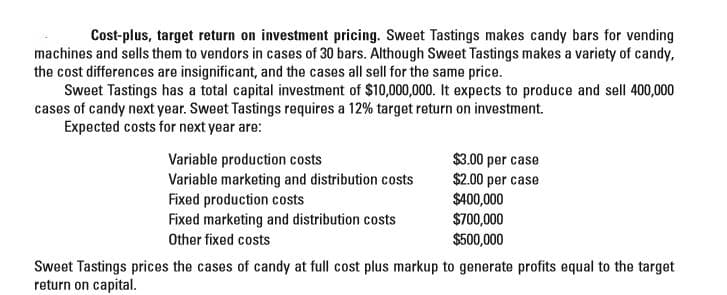

Cost-plus, target return on investment pricing. Sweet Tastings makes candy bars for vending machines and sells them to vendors in cases of 30 bars. Although Sweet Tastings makes a variety of candy, the cost differences are insignificant, and the cases all sell for the same price. Sweet Tastings has a total capital investment of $10,000,000. It expects to produce and sell 400,000 cases of candy next year. Sweet Tastings requires a 12% target return on investment. Expected costs for next year are: Variable production costs Variable marketing and distribution costs Fixed production costs Fixed marketing and distribution costs $3.00 per case $2.00 per case $400,000 $700,000 $500,000 Other fixed costs Sweet Tastings prices the cases of candy at full cost plus markup to generate profits equal to the target return on capital.

Cost-plus, target return on investment pricing. Sweet Tastings makes candy bars for vending machines and sells them to vendors in cases of 30 bars. Although Sweet Tastings makes a variety of candy, the cost differences are insignificant, and the cases all sell for the same price. Sweet Tastings has a total capital investment of $10,000,000. It expects to produce and sell 400,000 cases of candy next year. Sweet Tastings requires a 12% target return on investment. Expected costs for next year are: Variable production costs Variable marketing and distribution costs Fixed production costs Fixed marketing and distribution costs $3.00 per case $2.00 per case $400,000 $700,000 $500,000 Other fixed costs Sweet Tastings prices the cases of candy at full cost plus markup to generate profits equal to the target return on capital.

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 2PB: Mortech makes digital cameras for drones. Their basic digital camera uses $80 in variable costs and...

Related questions

Question

Sweet Tastings is considering increasing its selling price to $13 per case. Assuming production and sales decrease by 10%, calculate Sweet Tastings’ return on investment. Is increasing the selling price a good idea?

Transcribed Image Text:Cost-plus, target return on investment pricing. Sweet Tastings makes candy bars for vending

machines and sells them to vendors in cases of 30 bars. Although Sweet Tastings makes a variety of candy,

the cost differences are insignificant, and the cases all sell for the same price.

Sweet Tastings has a total capital investment of $10,000,000. It expects to produce and sell 400,000

cases of candy next year. Sweet Tastings requires a 12% target return on investment.

Expected costs for next year are:

Variable production costs

Variable marketing and distribution costs

Fixed production costs

Fixed marketing and distribution costs

$3.00 per case

$2.00 per case

$400,000

$700,000

$500,000

Other fixed costs

Sweet Tastings prices the cases of candy at full cost plus markup to generate profits equal to the target

return on capital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning