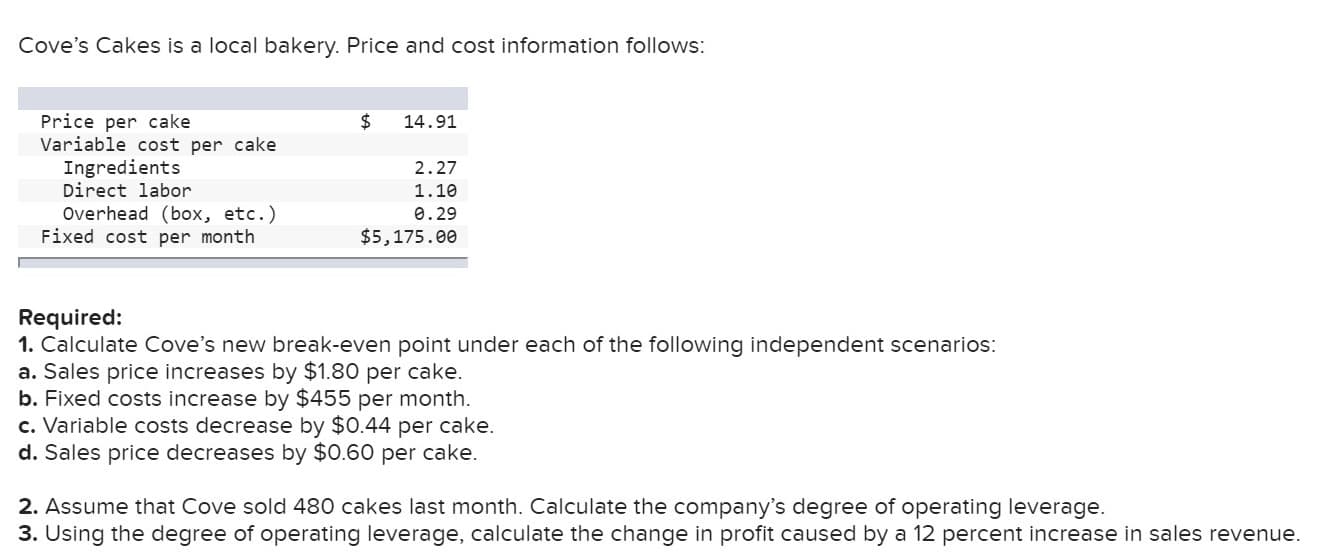

Cove's Cakes is a local bakery. Price and cost information follows: Price per cake Variable cost per cake Ingredients Direct labor 14.91 2.27 1.10 Overhead (box, etc.) Fixed cost per month 0.29 $5,175.00 Required: 1. Calculate Cove's new break-even point under each of the following independent scenarios: a. Sales price increases by $1.80 per cake. b. Fixed costs increase by $455 per month c. Variable costs decrease by $0.44 per cake. d. Sales price decreases by $0.60 per cake. 2. Assume that Cove sold 480 cakes last month. Calculate the company's degree of operating leverage. 3. Using the degree of operating leverage, calculate the change in profit caused by a 12 percent increase in sales revenue.

Cove's Cakes is a local bakery. Price and cost information follows: Price per cake Variable cost per cake Ingredients Direct labor 14.91 2.27 1.10 Overhead (box, etc.) Fixed cost per month 0.29 $5,175.00 Required: 1. Calculate Cove's new break-even point under each of the following independent scenarios: a. Sales price increases by $1.80 per cake. b. Fixed costs increase by $455 per month c. Variable costs decrease by $0.44 per cake. d. Sales price decreases by $0.60 per cake. 2. Assume that Cove sold 480 cakes last month. Calculate the company's degree of operating leverage. 3. Using the degree of operating leverage, calculate the change in profit caused by a 12 percent increase in sales revenue.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 2CE

Related questions

Question

Transcribed Image Text:Cove's Cakes is a local bakery. Price and cost information follows:

Price per cake

Variable cost per cake

Ingredients

Direct labor

14.91

2.27

1.10

Overhead (box, etc.)

Fixed cost per month

0.29

$5,175.00

Required:

1. Calculate Cove's new break-even point under each of the following independent scenarios:

a. Sales price increases by $1.80 per cake.

b. Fixed costs increase by $455 per month

c. Variable costs decrease by $0.44 per cake.

d. Sales price decreases by $0.60 per cake.

2. Assume that Cove sold 480 cakes last month. Calculate the company's degree of operating leverage.

3. Using the degree of operating leverage, calculate the change in profit caused by a 12 percent increase in sales revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 5 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub