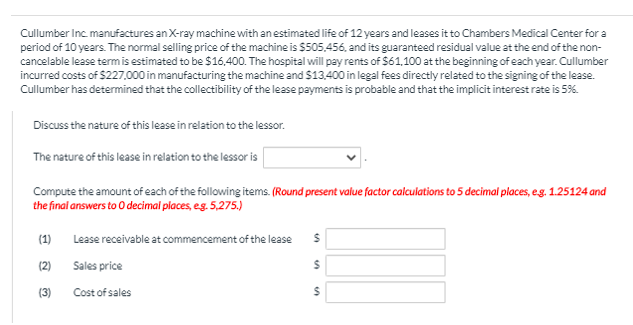

Cullumber Inc. manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $505,456, and its guaranteed residual value at the end of the non- cancelable lease termis estimated to be $16.400. The hospital will pay rents of S61.100 at the beginning of each year. Cullumber incurred costs of $227.000 in manufacturing the machine and $13.400 in legal fees directly related to the signing of the lease. Cullumber has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Discuss the nature of this lease in relation to the lessor. The nature of this lease in relation to the lessor is Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to 0 decimal places, eg. 5,275.) (1) Lease receivable at commencement of the lease s (2) Sales price (3) Cost of sales %24 %24

Cullumber Inc. manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $505,456, and its guaranteed residual value at the end of the non- cancelable lease termis estimated to be $16.400. The hospital will pay rents of S61.100 at the beginning of each year. Cullumber incurred costs of $227.000 in manufacturing the machine and $13.400 in legal fees directly related to the signing of the lease. Cullumber has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Discuss the nature of this lease in relation to the lessor. The nature of this lease in relation to the lessor is Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to 0 decimal places, eg. 5,275.) (1) Lease receivable at commencement of the lease s (2) Sales price (3) Cost of sales %24 %24

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:Cullumber Inc manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a

period of 10 years. The normal selling price of the machine is $505,456. and its guaranteed residual value at the end of the non-

cancelable lease termis estimated to be $16,400. The hospital will pay rents of $61,100 at the beginning of each year. Cullumber

incurred costs of $227,000 in manufacturing the machine and $13400 in legal fees directly related to the signing of the lease.

Cullumber has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%.

Discuss the nature of this lease in relation to the lessor.

The nature of this lease in relation to the lessor is

Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and

the final answers to 0 decimai places, eg. 5,275.)

(1)

Lease receivable at commencement of the lease

(2)

Sales price

(3)

Cost of sales

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning