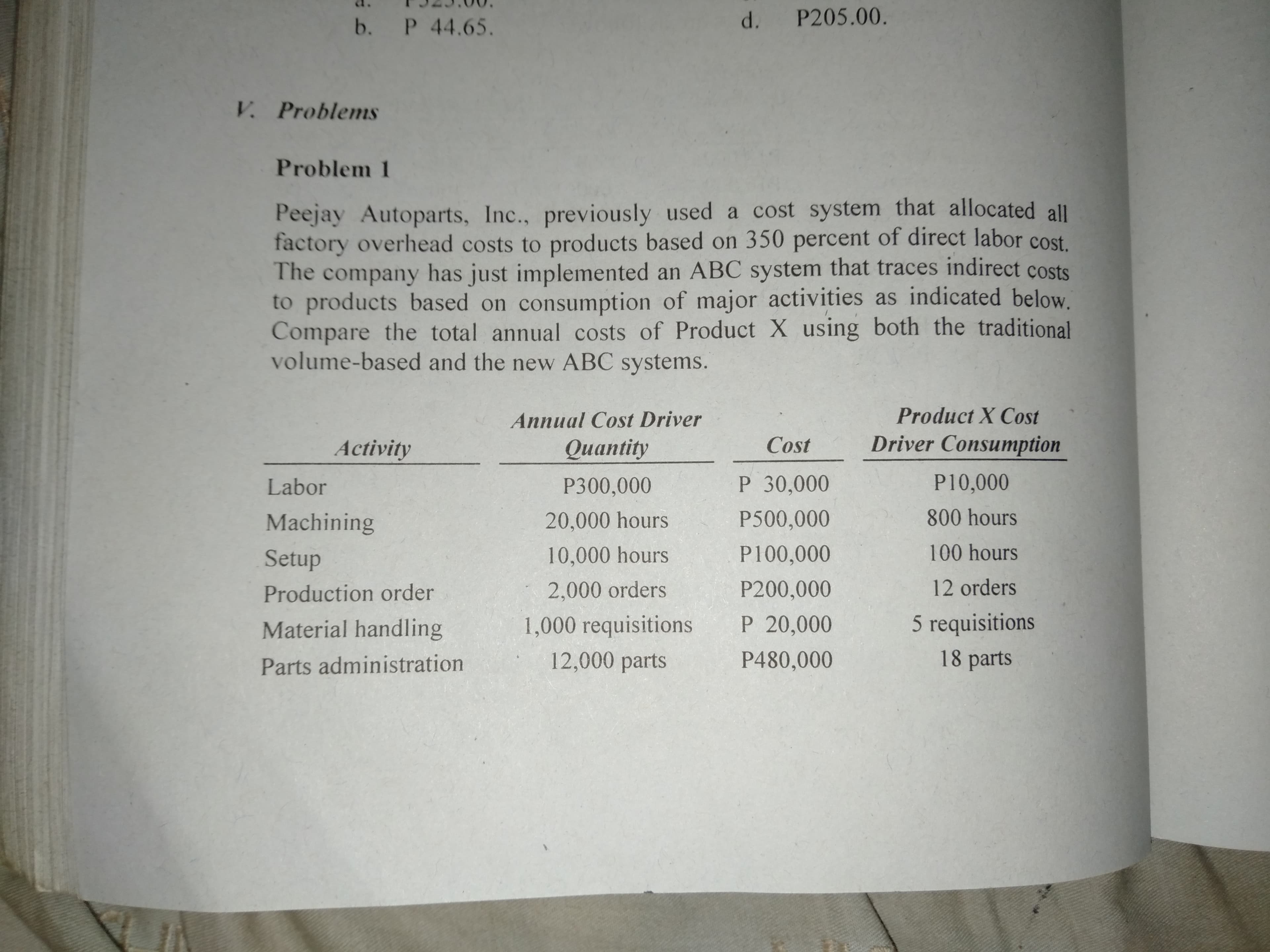

d. P205.00. b. P 44.65. V. Problems Problem 1 Peejay Autoparts, Inc., previously used a cost system that allocated all factory overhead costs to products based on 350 percent of direct labor cost. The company has just implemented an ABC system that traces indirect costs to products based on consumption of major activities as indicated below. Compare the total annual costs of Product X using both the traditional volume-based and the new ABC systems. Product X Cost Annual Cost Driver Driver Consumption Cost Qиantity Activity P10,000 P 30,000 P300,000 Labor 800 hours P500,000 Machining 20,000 hours 100 hours P100,000 10,000 hours Setup P200,000 12 orders 2,000 orders Production order P 20,000 5 requisitions 1,000 requisitions Material handling 18 parts P480,000 12,000 parts Parts administration

d. P205.00. b. P 44.65. V. Problems Problem 1 Peejay Autoparts, Inc., previously used a cost system that allocated all factory overhead costs to products based on 350 percent of direct labor cost. The company has just implemented an ABC system that traces indirect costs to products based on consumption of major activities as indicated below. Compare the total annual costs of Product X using both the traditional volume-based and the new ABC systems. Product X Cost Annual Cost Driver Driver Consumption Cost Qиantity Activity P10,000 P 30,000 P300,000 Labor 800 hours P500,000 Machining 20,000 hours 100 hours P100,000 10,000 hours Setup P200,000 12 orders 2,000 orders Production order P 20,000 5 requisitions 1,000 requisitions Material handling 18 parts P480,000 12,000 parts Parts administration

Chapter5: Process Costing

Section: Chapter Questions

Problem 1PB: The following product costs are available for Stellis Company on the production of erasers: direct...

Related questions

Question

100%

Transcribed Image Text:d. P205.00.

b. P 44.65.

V. Problems

Problem 1

Peejay Autoparts, Inc., previously used a cost system that allocated all

factory overhead costs to products based on 350 percent of direct labor cost.

The company has just implemented an ABC system that traces indirect costs

to products based on consumption of major activities as indicated below.

Compare the total annual costs of Product X using both the traditional

volume-based and the new ABC systems.

Product X Cost

Annual Cost Driver

Driver Consumption

Cost

Qиantity

Activity

P10,000

P 30,000

P300,000

Labor

800 hours

P500,000

Machining

20,000 hours

100 hours

P100,000

10,000 hours

Setup

P200,000

12 orders

2,000 orders

Production order

P 20,000

5 requisitions

1,000 requisitions

Material handling

18 parts

P480,000

12,000 parts

Parts administration

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning