Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 8PROB

Related questions

Question

Please answer just part D

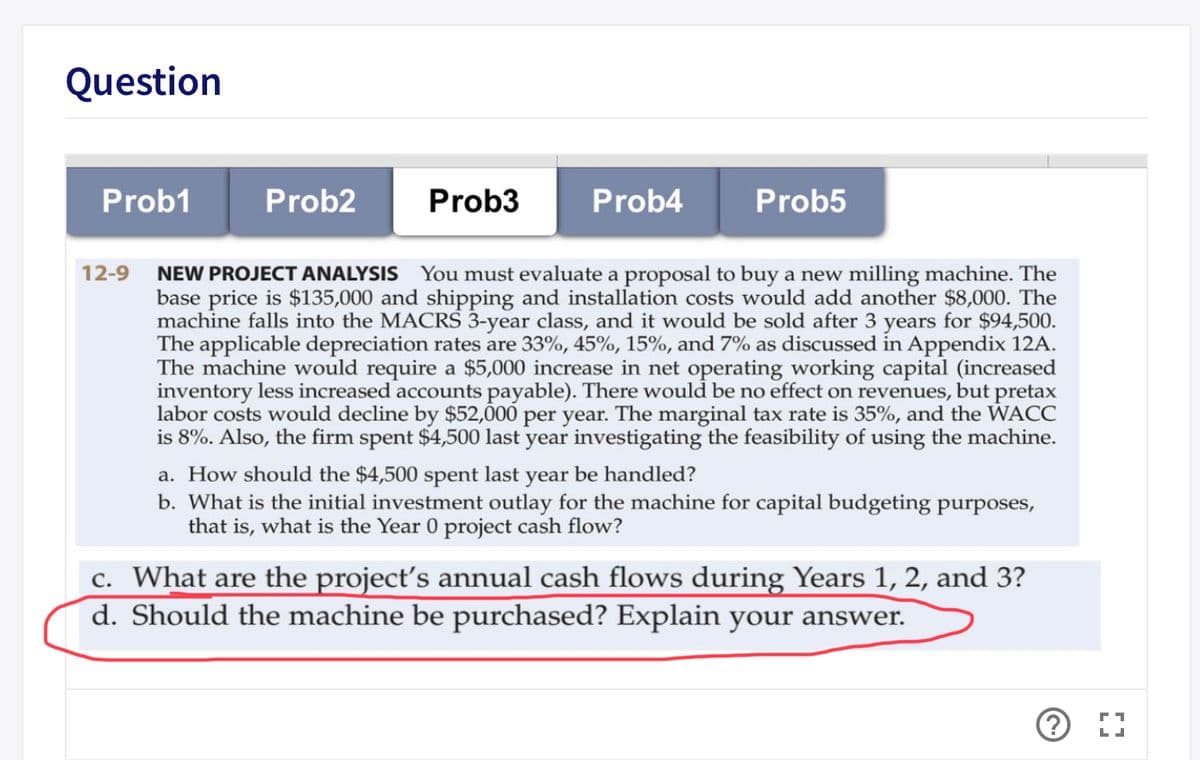

Transcribed Image Text:Question

Prob1

Prob2

Prob3

Prob4

Prob5

12-9 NEW PROJECT ANALYSIS You must evaluate a proposal to buy a new milling machine. The

base price is $135,000 and shipping and installation costs would add another $8,000. The

machine falls into the MACRS 3-year class, and it would be sold after 3 years for $94,500.

The applicable depreciation rates are 33%, 45%, 15%, and 7% as discussed in Appendix 12A.

The machine would require a $5,000 increase in net operating working capital (increased

inventory less increased accounts payable). There would be no effect on revenues, but pretax

labor costs would decline by $52,000 per year. The marginal tax rate is 35%, and the WACC

is 8%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine.

a. How should the $4,500 spent last year be handled?

b. What is the initial investment outlay for the machine for capital budgeting purposes,

that is, what is the Year 0 project cash flow?

c. What are the project's annual cash flows during Years 1, 2, and 3?

d. Should the machine be purchased? Explain your answer.

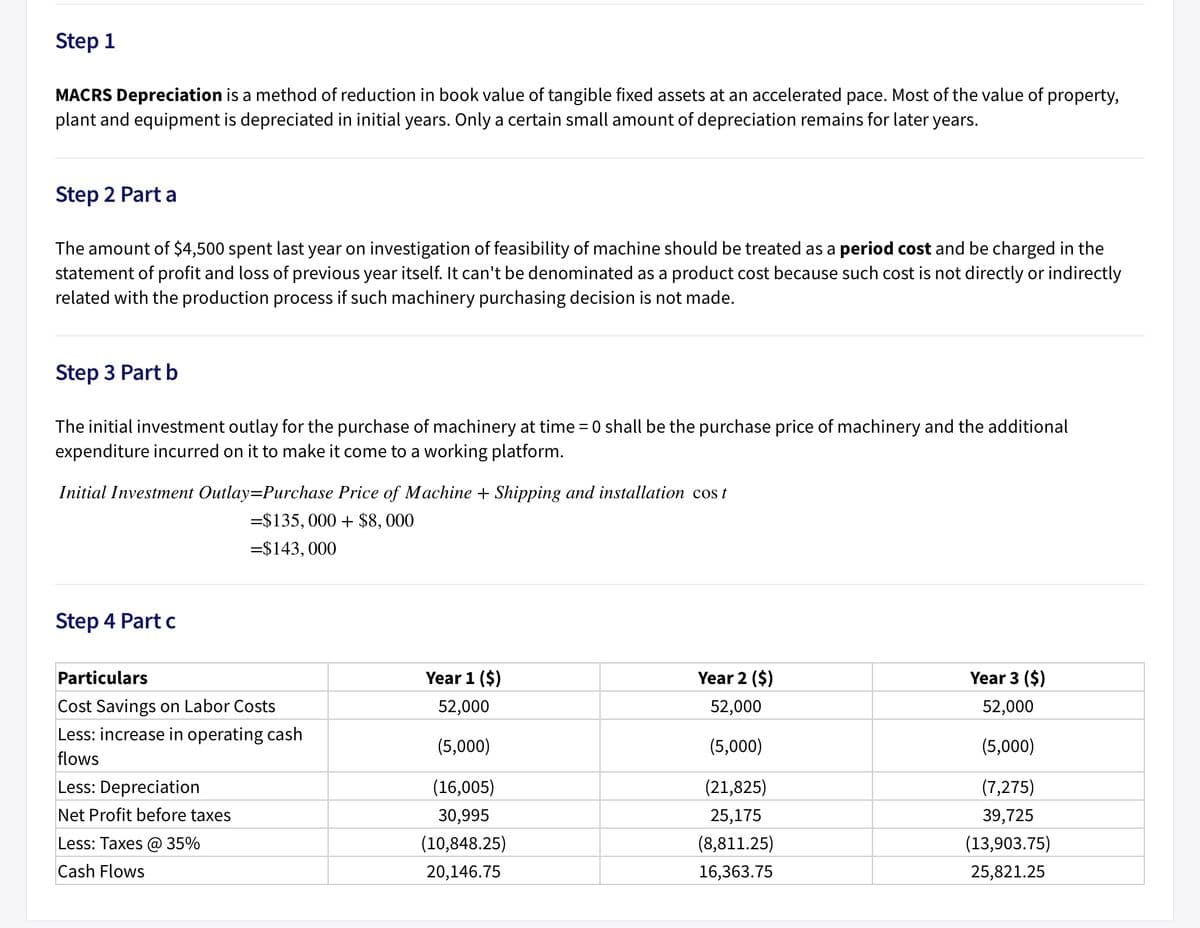

Transcribed Image Text:Step 1

MACRS Depreciation is a method of reduction in book value of tangible fixed assets at an accelerated pace. Most of the value of property,

plant and equipment is depreciated in initial years. Only a certain small amount of depreciation remains for later years.

Step 2 Part a

The amount of $4,500 spent last year on investigation of feasibility of machine should be treated as a period cost and be charged in the

statement of profit and loss of previous year itself. It can't be denominated as a product cost because such cost is not directly or indirectly

related with the production process if such machinery purchasing decision is not made.

Step 3 Part b

The initial investment outlay for the purchase of machinery at time = 0 shall be the purchase price of machinery and the additional

expenditure incurred on it to make it come to a working platform.

Initial Investment Outlay=Purchase Price of Machine + Shipping and installation cos t

=$135, 000 + $8,000

=$143, 000

Step 4 Part c

Particulars

Year 1 ($)

Year 2 ($)

Year 3 ($)

Cost Savings on Labor Costs

52,000

52,000

52,000

Less: increase in operating cash

(5,000)

(5,000)

(5,000)

flows

Less: Depreciation

(16,005)

(21,825)

(7,275)

Net Profit before taxes

30,995

25,175

39,725

Less: Taxes @ 35%

(10,848.25)

(8,811.25)

(13,903.75)

Cash Flows

20,146.75

16,363.75

25,821.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning