da MT 1 have ned $L

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 9E: Each of the following scenarios is independent. All cash flows are after-tax cash flows. Required:...

Related questions

Question

ط

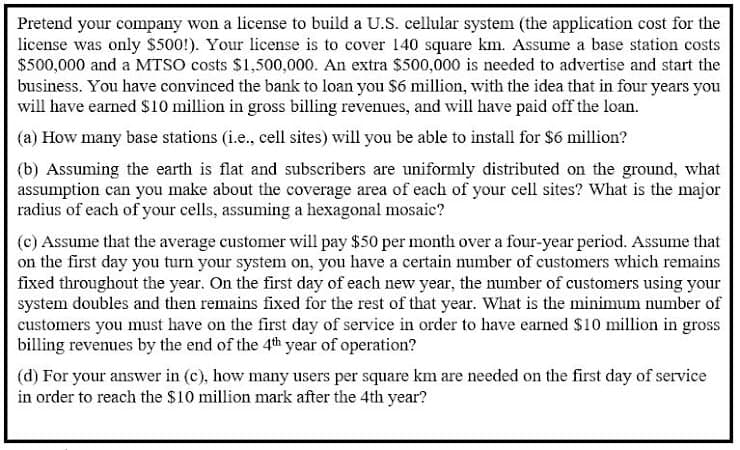

Transcribed Image Text:Pretend your company won a license to build a U.S. cellular system (the application cost for the

license was only $500!). Your license is to cover 140 square km. ASsume a base station costs

$500,000 and a MTSO costs $1,500,000. An extra $500,000 is needed to advertise and start the

business. You have convinced the bank to loan you $6 million, with the idea that in four years you

will have earned S10 million in gross billing revenues, and will have paid off the loan.

(a) How many base stations (i.e., cell sites) will you be able to install for $6 million?

(b) Assuming the earth is flat and subscribers are uniformly distributed on the ground, what

assumption can you make about the coverage area of each of your cell sites? What is the major

radius of each of your cells, assuming a hexagonal mosaic?

(c) Assume that the average customer will pay $50 per month over a four-year period. Assume that

on the first day you turn your system on, you have a certain number of customers which remains

fixed throughout the year. On the first day of each new year, the number of customers using your

system doubles and then remains fixed for the rest of that year. What is the minimum number of

customers you must have on the first day of service in order to have earned $10 million in gross

billing revenues by the end of the 4th year of operation?

(d) For your answer in (c), how many users per square km are needed on the first day of service

in order to reach the $10 million mark after the 4th year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning