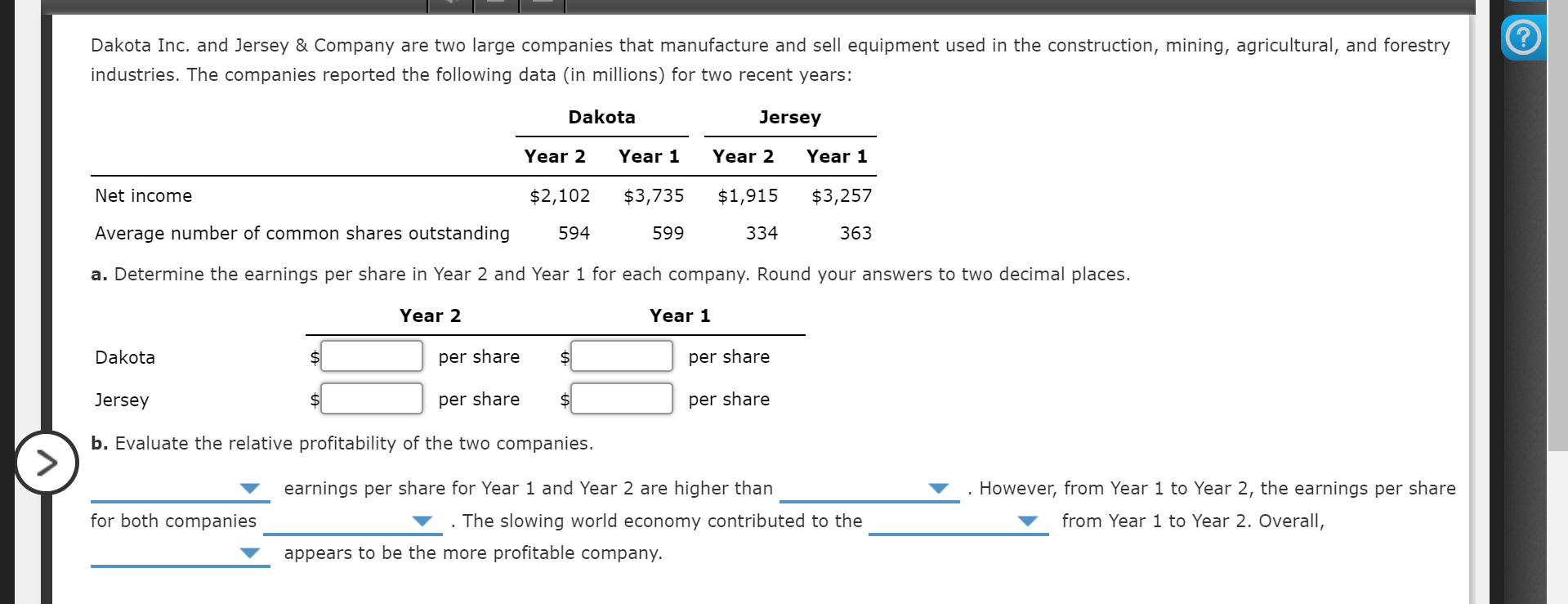

Dakota Inc. and Jersey & Company are two large companies that manufacture and sell equipment used in the construction, mining, agricultural, and forestry industries. The companies reported the following data (in millions) for two recent years: Dakota Jersey Year 2 Year 1 Year 2 Year 1 Net income $2,102 $3,735 $1,915 $3,257 Average number of common shares outstanding 594 599 334 363 a. Determine the earnings per share in Year 2 and Year 1 for each company. Round your answers to two decimal places. Year 2 Year 1 Dakota $4 per share per share Jersey per share per share b. Evaluate the relative profitability of the two companies. earnings per share for Year 1 and Year 2 are higher than . However, from Year 1 to Year 2, the earnings per share from Year 1 to Year 2. Overall, for both companies . The slowing world economy contributed to the appears to be the more profitable company.

Dakota Inc. and Jersey & Company are two large companies that manufacture and sell equipment used in the construction, mining, agricultural, and forestry industries. The companies reported the following data (in millions) for two recent years: Dakota Jersey Year 2 Year 1 Year 2 Year 1 Net income $2,102 $3,735 $1,915 $3,257 Average number of common shares outstanding 594 599 334 363 a. Determine the earnings per share in Year 2 and Year 1 for each company. Round your answers to two decimal places. Year 2 Year 1 Dakota $4 per share per share Jersey per share per share b. Evaluate the relative profitability of the two companies. earnings per share for Year 1 and Year 2 are higher than . However, from Year 1 to Year 2, the earnings per share from Year 1 to Year 2. Overall, for both companies . The slowing world economy contributed to the appears to be the more profitable company.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 63P: Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture...

Related questions

Question

100%

can you please help me im not sure what to do

Transcribed Image Text:Dakota Inc. and Jersey & Company are two large companies that manufacture and sell equipment used in the construction, mining, agricultural, and forestry

industries. The companies reported the following data (in millions) for two recent years:

Dakota

Jersey

Year 2

Year 1

Year 2

Year 1

Net income

$2,102

$3,735

$1,915

$3,257

Average number of common shares outstanding

594

599

334

363

a. Determine the earnings per share in Year 2 and Year 1 for each company. Round your answers to two decimal places.

Year 2

Year 1

Dakota

$4

per share

per share

Jersey

per share

per share

b. Evaluate the relative profitability of the two companies.

earnings per share for Year 1 and Year 2 are higher than

. However, from Year 1 to Year 2, the earnings per share

from Year 1 to Year 2. Overall,

for both companies

. The slowing world economy contributed to the

appears to be the more profitable company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College