Darrell (46) is unmarried. His mother, Marlene (81), lives in a nursing home. Darrell pays the entire cost of the nursing home and more than 50% of Marlene's total support. Darrell's wages were $77,000; Marlene's income consisted of $1,800 taxable interest and $9,600 social security benefits. Question 16 of 50. What is Darrelr's correct and most favorable 2019 filing status? O single. O Married filing jointly. O Married filing separately. O Head of household. O Qualifying widow(er). OMark for follow up Question 17 of 50. Does Darrell meet the qualifications for claiming the Child Tax Credit/Additional Child Tax Credit or the Other Dependent Credit? Choose the best answer. O Darrell is eligible to claim the Child Tax Credit/Additional Child Tax Credit. O Darrell is eligible to claim the Other Dependent Credit. O Darrell is not eligible to claim the Child Tax Credit/Additional Child Tax Credit or the Other Dependent Credit. OMark for follow up Question 18 of 50. Is Darrell eligible to claim and receive the Earned Income Tax Credit? O Yes. O No. OMark for follo

Darrell (46) is unmarried. His mother, Marlene (81), lives in a nursing home. Darrell pays the entire cost of the nursing home and more than 50% of Marlene's total support. Darrell's wages were $77,000; Marlene's income consisted of $1,800 taxable interest and $9,600 social security benefits. Question 16 of 50. What is Darrelr's correct and most favorable 2019 filing status? O single. O Married filing jointly. O Married filing separately. O Head of household. O Qualifying widow(er). OMark for follow up Question 17 of 50. Does Darrell meet the qualifications for claiming the Child Tax Credit/Additional Child Tax Credit or the Other Dependent Credit? Choose the best answer. O Darrell is eligible to claim the Child Tax Credit/Additional Child Tax Credit. O Darrell is eligible to claim the Other Dependent Credit. O Darrell is not eligible to claim the Child Tax Credit/Additional Child Tax Credit or the Other Dependent Credit. OMark for follow up Question 18 of 50. Is Darrell eligible to claim and receive the Earned Income Tax Credit? O Yes. O No. OMark for follo

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 34P

Related questions

Question

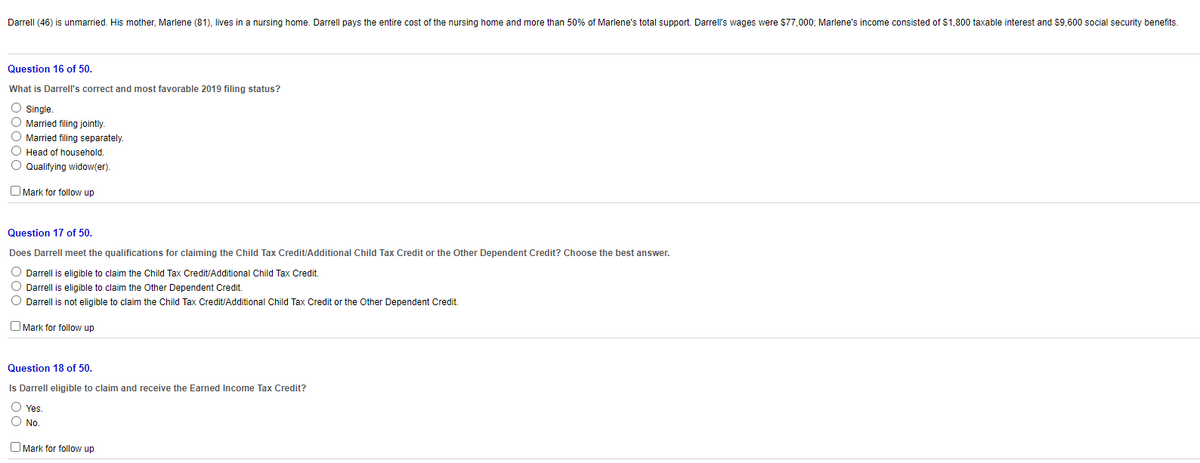

Transcribed Image Text:Darrell (46) is unmarried. His mother, Marlene (81), lives in a nursing home. Darrell pays the entire cost of the nursing home and more than 50% of Marlene's total support. Darrell's wages were $77,000; Marlene's income consisted of $1,800 taxable interest and $9,600 social security benefits.

Question 16 of 50.

What is Darrell's correct and most favorable 2019 filing status?

O Single.

O Married filing jointly.

O Married filing separately.

O Head of household.

O Qualifying widow(er).

O Mark for follow up

Question 17 of 50.

Does Darrell meet the qualifications for claiming the Child Tax Credit/Additional Child Tax Credit or the Other Dependent Credit? Choose the best answer.

O Darrell is eligible to claim the Child Tax Credit/Additional Child Tax Credit.

O Darrell is eligible to claim the Other Dependent Credit.

O Darrell is not eligible to claim the Child Tax Credit/Additional Child Tax Credit or the Other Dependent Credit.

O Mark for follow up

Question 18 of 50.

Is Darrell eligible to claim and receive the Earned Income Tax Credit?

O Yes

O No.

O Mark for follow up

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT