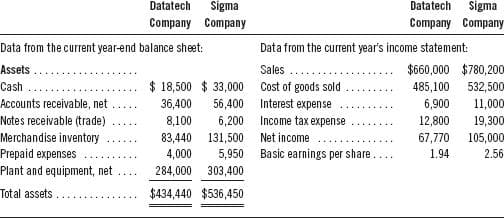

Data from the current year-end balance sheet: Assets Cash ***E *********** ******* Accounts receivable, net Notes receivable (trade) Merchandise inventory Prepaid expenses Plant and equipment, net ****** Total assets THE ***** ***** Datatech Sigma Company Company ************** $ 18,500 $33,000 36,400 56,400 8,100 6,200 83,440 131,500 4,000 5,950 284,000 303,400 $434,440 $536,450 Data from the current year's income statement: Sales Cost of goods sold Interest expense Income tax expense ******LTE **** ***E Datatech Sigma Company Company Net income ***** Basic earnings per share..... $660,000 $780,200 485,100 532,500 6,900 11,00C 12,800 19,300 67,770 105,000 1.94 2.56

Data from the current year-end balance sheet: Assets Cash ***E *********** ******* Accounts receivable, net Notes receivable (trade) Merchandise inventory Prepaid expenses Plant and equipment, net ****** Total assets THE ***** ***** Datatech Sigma Company Company ************** $ 18,500 $33,000 36,400 56,400 8,100 6,200 83,440 131,500 4,000 5,950 284,000 303,400 $434,440 $536,450 Data from the current year's income statement: Sales Cost of goods sold Interest expense Income tax expense ******LTE **** ***E Datatech Sigma Company Company Net income ***** Basic earnings per share..... $660,000 $780,200 485,100 532,500 6,900 11,00C 12,800 19,300 67,770 105,000 1.94 2.56

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter5: Inventories And Cost Of Goods Sold

Section: Chapter Questions

Problem 5.26MCE

Related questions

Question

Please do not provide answer in image formate thnak you.

1. Compute the net profit margin, total asset turnover, return on total assets, and return on common

2. Assume each company paid a cash dividend of $1.50 per share and that each company’s stock can be purchased at $25 a share. Compute each company’s price earnings ratio and dividend yield.

3. Identify which company’s stock you would recommend as the better investment and explain why.

Transcribed Image Text:Datatech Sigma

Company Company

Data from the current year-end balance sheet:

Assets.

Cash

Accounts receivable, net

Notes receivable (trade)

Merchandise inventory

Prepaid expenses

Plant and equipment, net

Total assets.

$ 18,500 $33,000

36,400

8,100

56,400

6,200

83,440 131,500

4,000

5,950

284,000 303,400

$434,440 $536,450

Datatech Sigma

Company Company

Data from the current year's income statement:

Sales

Cost of goods sold

Interest expense

Income tax expense

Net income

Basic earnings per share..

$660,000 $780,200

485,100

6,900

12,800

67,770

1.94

532,500

11,000

19,300

105,000

2.56

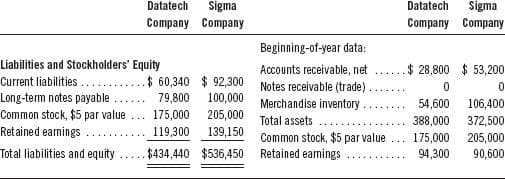

Transcribed Image Text:Liabilities and Stockholders'

Current liabilities..

Long-term notes payable.

Common stock, $5 par value

Retained earnings.

Total liabilities and equity

Datatech Sigma

Company Company

Equity

$ 60,340 $92,300

79,800 100,000

175,000 205,000

119,300 139,150

$434,440 $536,450

Beginning-of-year data:

Accounts receivable, net

Notes receivable (trade).

Merchandise inventory.

Total assets

Common stock, $5 par value

Retained earnings

.......

Datatech Sigma

Company Company

.$ 28,800 $ 53,200

0

0

54,600

106,400

388,000

372,500

175,000 205,000

94,300

90,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning