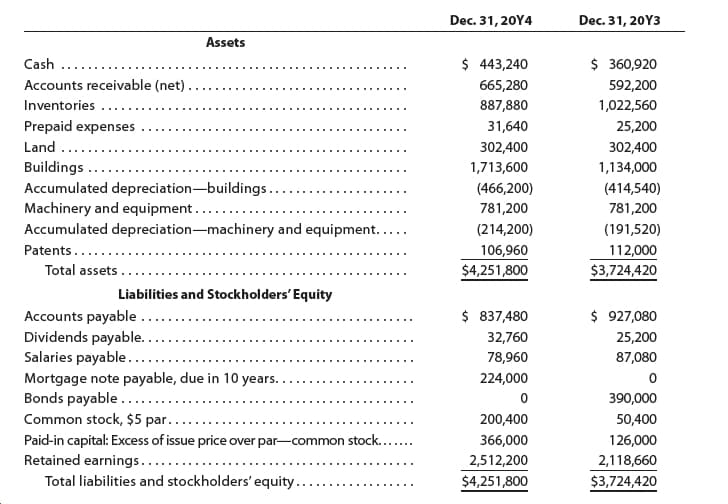

Dec. 31, 20Y4 Dec. 31, 20Y3 Assets $ 360,920 $ 443,240 Cash ...... Accounts receivable (net). 665,280 592,200 Inventories 887,880 1,022,560 Prepaid expenses 31,640 25,200 Land..... 302,400 302,400 Buildings Accumulated depreciation-buildings Machinery and equipment.. Accumulated depreciation-machinery and equipment..... 1,134,000 1,713,600 (466,200) (414,540) 781,200 781,200 ...... (214,200) (191,520) Patents.... 106,960 112,000 Total assets $4,251,800 $3,724,420 Liabilities and Stockholders' Equity Accounts payable... Dividends payable.. Salaries payable.. Mortgage note payable, due in 10 years.. Bonds payable .. Common stock, $5 par.. $ 837,480 $ 927,080 25,200 32,760 78,960 87,080 224,000 390,000 200,400 50,400 Paid-in capital: Excess of issue price over par-common stock..... Retained earnings.... Total liabilities and stockholders' equity.. 366,000 126,000 2,512,200 2,118,660 $4,251,800 $3,724,420

The comparative balance sheet of Harris Industries Inc. at December 31, 20Y4 and 20Y3, is as follows:

Please see the attachment for details:

An examination of the income statement and the accounting records revealed the following additional information applicable to 20Y4:

a. Net income, $524,580.

b.

c. Patent amortization reported on the income statement, $5,040.

d. A building was constructed for $579,600.

e. A mortgage note for $224,000 was issued for cash.

f. 30,000 shares of common stock were issued at $13 in exchange for the bonds payable.

g. Cash dividends declared, $131,040.

Instructions

Prepare a statement of

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images