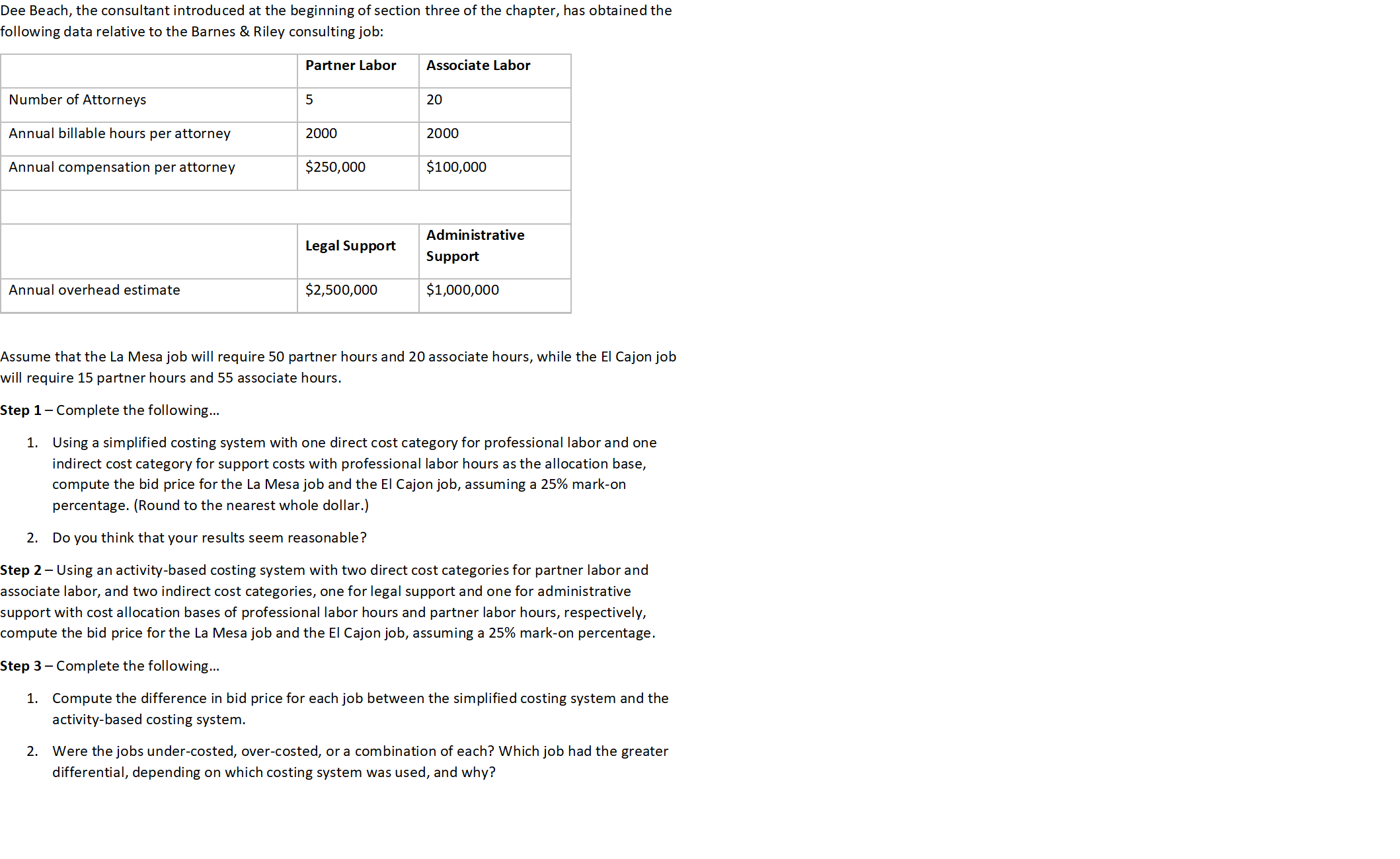

Dee Beach, the consultant introduced at the beginning of section three of the chapter, has obtained the following data relative to the Barnes & Riley consulting job: Partner Labor 5 2000 $250,000 Associate Labor 20 2000 $100,000 Number of Attorneys Annual billable hours per attorney Annual compensation per attorney Administrative Support $1,000,000 Legal Support $2,500,000 Annual overhead estimate Assume that the La Mesa job will require 50 partner hours and 20 associate hours, while the El Cajon job will require 15 partner hours and 55 associate hours Step 1- Complete the following... Using a simplified costing system with one direct cost category for professional labor and one indirect cost category for support costs with professional labor hours as the allocation base, compute the bid price for the La Mesa job and the El Cajon job, assuming a 25% mark-on percentage. (Round to the nearest whole dollar.) 1. 2. Do you think that your results seem reasonable? Step 2 - Using an activity-based costing system with two direct cost categories for partner labor and associate labor, and two indirect cost categories, one for legal support and one for administrative support with cost allocation bases of professional labor hours and partner labor hours, respectively, compute the bid price for the La Mesa job and the El Cajon job, assuming a 25% mark-on percentage. Step 3- Complete the following... Compute the difference in bid price for each job between the simplified costing system and the activity-based costing system 1. 2. Were the jobs under-costed, over-costed, or a combination of each? Which job had the greater differential, depending on which costing system was used, and why?

Dee Beach, the consultant introduced at the beginning of section three of the chapter, has obtained the following data relative to the Barnes & Riley consulting job: Partner Labor 5 2000 $250,000 Associate Labor 20 2000 $100,000 Number of Attorneys Annual billable hours per attorney Annual compensation per attorney Administrative Support $1,000,000 Legal Support $2,500,000 Annual overhead estimate Assume that the La Mesa job will require 50 partner hours and 20 associate hours, while the El Cajon job will require 15 partner hours and 55 associate hours Step 1- Complete the following... Using a simplified costing system with one direct cost category for professional labor and one indirect cost category for support costs with professional labor hours as the allocation base, compute the bid price for the La Mesa job and the El Cajon job, assuming a 25% mark-on percentage. (Round to the nearest whole dollar.) 1. 2. Do you think that your results seem reasonable? Step 2 - Using an activity-based costing system with two direct cost categories for partner labor and associate labor, and two indirect cost categories, one for legal support and one for administrative support with cost allocation bases of professional labor hours and partner labor hours, respectively, compute the bid price for the La Mesa job and the El Cajon job, assuming a 25% mark-on percentage. Step 3- Complete the following... Compute the difference in bid price for each job between the simplified costing system and the activity-based costing system 1. 2. Were the jobs under-costed, over-costed, or a combination of each? Which job had the greater differential, depending on which costing system was used, and why?

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 27CE

Related questions

Question

100%

Transcribed Image Text:Dee Beach, the consultant introduced at the beginning of section three of the chapter, has obtained the

following data relative to the Barnes & Riley consulting job:

Partner Labor

5

2000

$250,000

Associate Labor

20

2000

$100,000

Number of Attorneys

Annual billable hours per attorney

Annual compensation per attorney

Administrative

Support

$1,000,000

Legal Support

$2,500,000

Annual overhead estimate

Assume that the La Mesa job will require 50 partner hours and 20 associate hours, while the El Cajon job

will require 15 partner hours and 55 associate hours

Step 1- Complete the following...

Using a simplified costing system with one direct cost category for professional labor and one

indirect cost category for support costs with professional labor hours as the allocation base,

compute the bid price for the La Mesa job and the El Cajon job, assuming a 25% mark-on

percentage. (Round to the nearest whole dollar.)

1.

2. Do you think that your results seem reasonable?

Step 2 - Using an activity-based costing system with two direct cost categories for partner labor and

associate labor, and two indirect cost categories, one for legal support and one for administrative

support with cost allocation bases of professional labor hours and partner labor hours, respectively,

compute the bid price for the La Mesa job and the El Cajon job, assuming a 25% mark-on percentage.

Step 3- Complete the following...

Compute the difference in bid price for each job between the simplified costing system and the

activity-based costing system

1.

2.

Were the jobs under-costed, over-costed, or a combination of each? Which job had the greater

differential, depending on which costing system was used, and why?

Expert Solution

Trending now

This is a popular solution!

Step by step

Solved in 9 steps with 7 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning