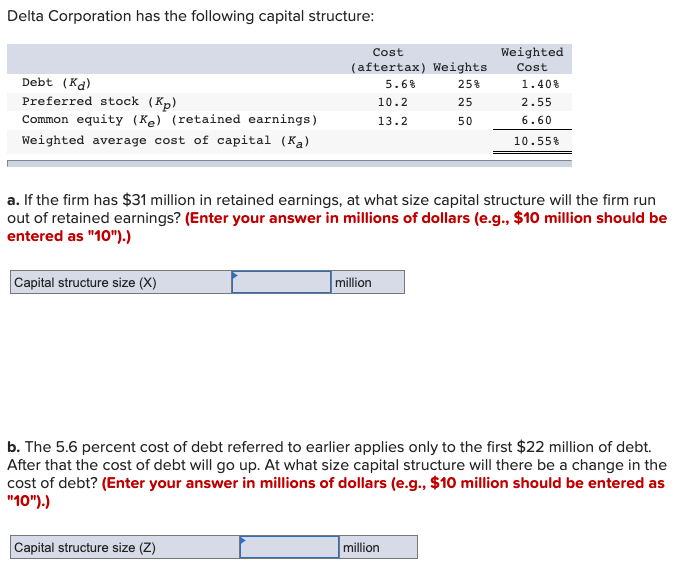

Delta Corporation has the following capital structure: Cost Weighted (aftertax) Weights Cost Debt (Ka) Preferred stock (Kp) Common equity (Ke) (retained earnings) 5.6% 25% 1.40% 10.2 25 2.55 13.2 50 6.60 Weighted average cost of capital (Ka) 10.55% a. If the firm has $31 million in retained earnings, at what size capital structure will the firm run out of retained earnings? (Enter your answer in millions of dollars (e.g., $10 million should be entered as "10").) Capital structure size (X) million

Delta Corporation has the following capital structure: Cost Weighted (aftertax) Weights Cost Debt (Ka) Preferred stock (Kp) Common equity (Ke) (retained earnings) 5.6% 25% 1.40% 10.2 25 2.55 13.2 50 6.60 Weighted average cost of capital (Ka) 10.55% a. If the firm has $31 million in retained earnings, at what size capital structure will the firm run out of retained earnings? (Enter your answer in millions of dollars (e.g., $10 million should be entered as "10").) Capital structure size (X) million

Chapter13: Capital Structure Concepts

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:Delta Corporation has the following capital structure:

Cost

Weighted

(aftertax) Weights

Cost

Debt (Ka)

Preferred stock (Kp)

Common equity (Ke) (retained earnings)

5.6%

25%

1.40%

10.2

25

2.55

13.2

50

6.60

Weighted average cost of capital (Ka)

10.55%

a. If the firm has $31 million in retained earnings, at what size capital structure will the firm run

out of retained earnings? (Enter your answer in millions of dollars (e.g., $10 million should be

entered as "10").)

Capital structure size (X)

million

b. The 5.6 percent cost of debt referred to earlier applies only to the first $22 million of debt.

After that the cost of debt will go up. At what size capital structure will there be a change in the

cost of debt? (Enter your answer in millions of dollars (e.g., $10 million should be entered as

"10").)

Capital structure size (Z)

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning