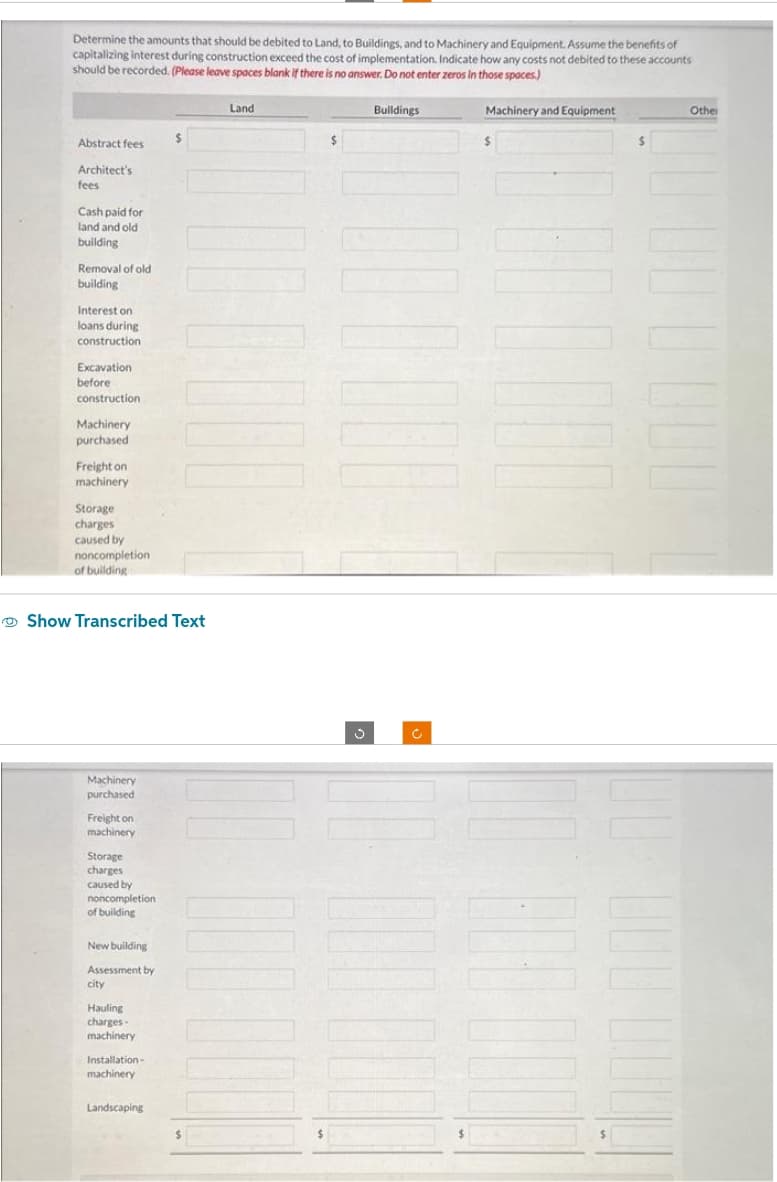

Determine the amounts that should be debited to Land, to Buildings, and to Machinery and Equipment. Assume the benefits of capitalizing interest during construction exceed the cost of implementation. Indicate how any costs not debited to these accounts should be recorded. (Please leave spaces blank if there is no answer. Do not enter zeros in those spaces) Abstract fees Architect's fees Cash paid for Land Buildings Machinery and Equipment $ Other

Determine the amounts that should be debited to Land, to Buildings, and to Machinery and Equipment. Assume the benefits of capitalizing interest during construction exceed the cost of implementation. Indicate how any costs not debited to these accounts should be recorded. (Please leave spaces blank if there is no answer. Do not enter zeros in those spaces) Abstract fees Architect's fees Cash paid for Land Buildings Machinery and Equipment $ Other

Chapter6: Business Expenses

Section: Chapter Questions

Problem 55P

Related questions

Question

Please do not give image format solve fast answering

Transcribed Image Text:Determine the amounts that should be debited to Land, to Buildings, and to Machinery and Equipment. Assume the benefits of

capitalizing interest during construction exceed the cost of implementation. Indicate how any costs not debited to these accounts

should be recorded. (Please leave spaces blank if there is no answer. Do not enter zeros in those spaces)

Abstract fees

Architect's

fees

Cash paid for

land and old

building

Removal of old

building

Interest on

loans during

construction

Excavation

before

construction

Machinery

purchased

Freight on

machinery

Storage

charges

caused by

noncompletion

of building

Machinery

purchased

Show Transcribed Text

Freight on

machinery

Storage

charges

caused by

noncompletion

of building

New building

Assessment by

city

Hauling

charges

machinery

Installation-

machinery

$

Landscaping

$

Land

I

$

3

Buildings.

Ć

$

Machinery and Equipment

$

000000

TOTE

$

Other

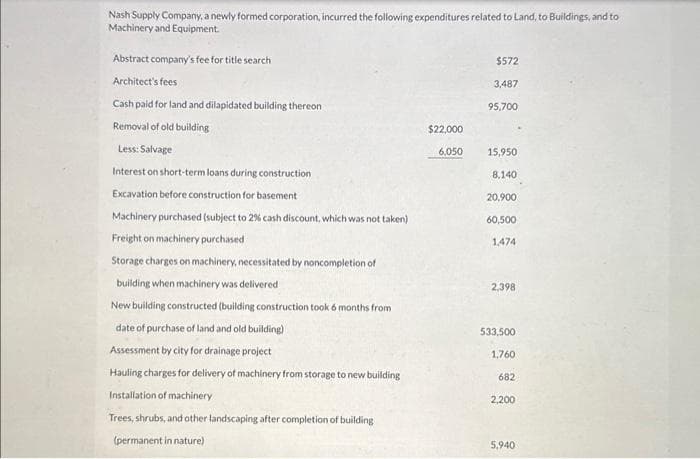

Transcribed Image Text:Nash Supply Company, a newly formed corporation, incurred the following expenditures related to Land, to Buildings, and to

Machinery and Equipment.

Abstract company's fee for title search

Architect's fees

Cash paid for land and dilapidated building thereon

Removal of old building

Less: Salvage

Interest on short-term loans during construction

Excavation before construction for basement

Machinery purchased (subject to 2% cash discount, which was not taken)

Freight on machinery purchased

Storage charges on machinery, necessitated by noncompletion of

building when machinery was delivered

New building constructed (building construction took 6 months from

date of purchase of land and old building)

Assessment by city for drainage project

Hauling charges for delivery of machinery from storage to new building

Installation of machinery

Trees, shrubs, and other landscaping after completion of building

(permanent in nature)

$22,000

6,050

$572

3,487

95,700

15,950

8,140

20,900

60,500

1,474

2,398

533,500

1,760

682

2,200

5,940

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College