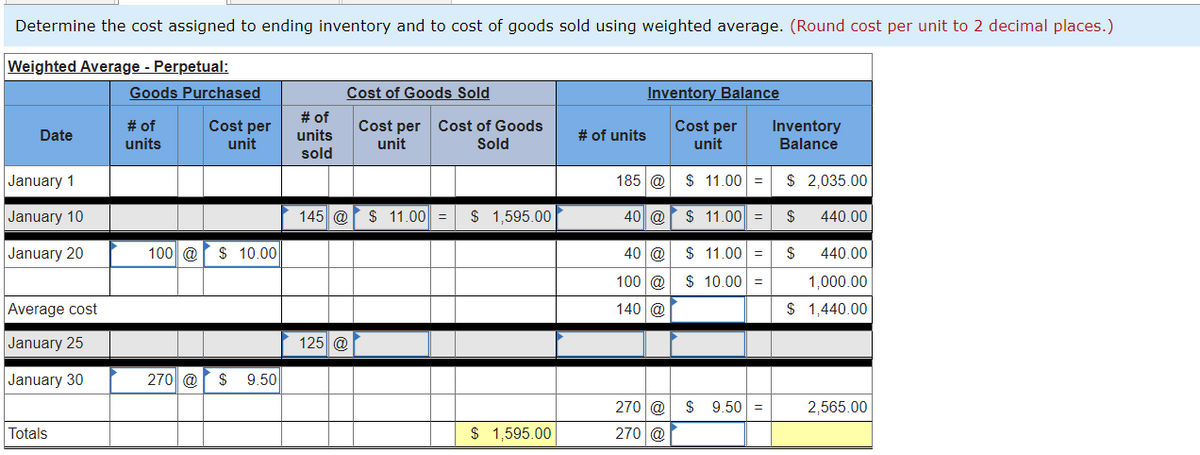

Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.) Weighted Average - Perpetual: Goods Purchased Cost of Goods Sold Inventory Balance # of units Cost per unit # of units Cost per unit Cost of Goods Sold Cost per unit Inventory Balance Date # of units sold January 1 185 @ $ 11.00 = $ 2,035.00 January 10 145 @ $ 11.00 = $ 1,595.00 40 @ $ 11.00 = $ 440.00 January 20 100 @ $ 10.00 40 @ $ 11.00 = 440.00 100 @ $ 10.00 = 1,000.00 Average cost 140 @ $ 1,440.00 January 25 125 @ January 30 270 @ $ 9.50 270 @ $ 9.50 = 2,565.00 Totals $ 1,595.00 270 @

Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.) Weighted Average - Perpetual: Goods Purchased Cost of Goods Sold Inventory Balance # of units Cost per unit # of units Cost per unit Cost of Goods Sold Cost per unit Inventory Balance Date # of units sold January 1 185 @ $ 11.00 = $ 2,035.00 January 10 145 @ $ 11.00 = $ 1,595.00 40 @ $ 11.00 = $ 440.00 January 20 100 @ $ 10.00 40 @ $ 11.00 = 440.00 100 @ $ 10.00 = 1,000.00 Average cost 140 @ $ 1,440.00 January 25 125 @ January 30 270 @ $ 9.50 270 @ $ 9.50 = 2,565.00 Totals $ 1,595.00 270 @

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8P: Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning...

Related questions

Topic Video

Question

Transcribed Image Text:Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.)

Weighted Average - Perpetual:

Goods Purchased

Cost of Goods Sold

Inventory Balance

# of

units

sold

# of

Cost per Cost of Goods

unit

Cost per

Cost per

Inventory

Balance

Date

# of units

units

unit

Sold

unit

January 1

185 @

$ 11.00 =

$ 2,035.00

January 10

145 @

$ 11.00 =

$ 1,595.00

40 @

$ 11.00 =

$

440.00

January 20

100 @

$ 10.00

40 @

$ 11.00 =

$

440.00

100 @

$ 10.00 =

1,000.00

Average cost

140 @

$ 1,440.00

January 25

125 @

January 30

270 @

$

9.50

270 @

$

9.50

2,565.00

Totals

$ 1,595.00

270 @

![Required information

Use the following information for the Exercises below.

[The following information applies to the questions displayed below.]

Laker Company reported the following January purchases and sales data for its only product.

Activities

Units Acquired at Cost

185 units @ $11.00 = $2,035

Date

Units sold at Retail

Jan. 1 Beginning inventory

Jan. 10 Sales

145 units @ $20.00

Jan. 20 Purchase

100 units @ $10.00 =

1,000

Jan. 25 Sales

125 units @ $20.00

Jan. 30 Purchase

270 units @ $ 9.50 =

2,565

Totals

555 units

$5,600

270 units

The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 285 units, where

270 are from the January 30 purchase, 5 are from the January 20 purchase, and 10 are from beginning inventory.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F6a02b260-ff6c-4d5e-84bc-57397ca3f648%2F61781942-744f-4146-a229-4a19166badbb%2Fdm9jppr_processed.png&w=3840&q=75)

Transcribed Image Text:Required information

Use the following information for the Exercises below.

[The following information applies to the questions displayed below.]

Laker Company reported the following January purchases and sales data for its only product.

Activities

Units Acquired at Cost

185 units @ $11.00 = $2,035

Date

Units sold at Retail

Jan. 1 Beginning inventory

Jan. 10 Sales

145 units @ $20.00

Jan. 20 Purchase

100 units @ $10.00 =

1,000

Jan. 25 Sales

125 units @ $20.00

Jan. 30 Purchase

270 units @ $ 9.50 =

2,565

Totals

555 units

$5,600

270 units

The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 285 units, where

270 are from the January 30 purchase, 5 are from the January 20 purchase, and 10 are from beginning inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning