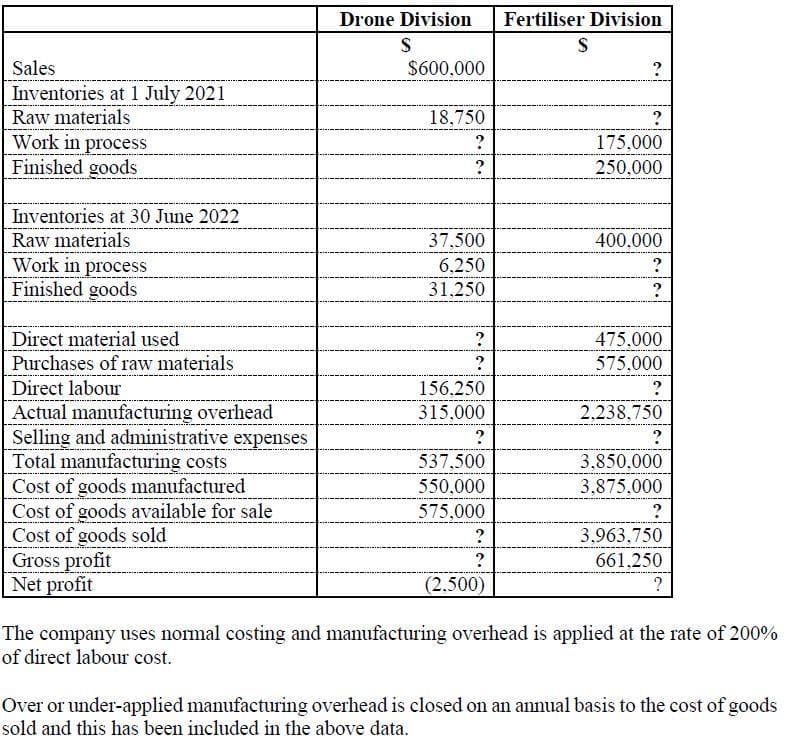

Determine the missing amounts in each of the divisions shown above.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter26: Manufacturing Accounting: The Job Order Cost System

Section: Chapter Questions

Problem 2SEA: SCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Maupin...

Related questions

Topic Video

Question

Determine the missing amounts in each of the divisions shown above.

Transcribed Image Text:Sales

Inventories at 1 July 2021

Raw materials

Work in process

Finished goods

Inventories at 30 June 2022

Raw materials

Work in process

Finished goods

Direct material used

Purchases of raw materials

Direct labour

Actual manufacturing overhead

Selling and administrative expenses

Total manufacturing costs

Cost of goods manufactured

Cost of goods available for sale

Cost of goods sold

Gross profit

Net profit

Drone Division

S

$600,000

18,750

?

?

37,500

6.250

31,250

?

?

156,250

315,000

?

537,500

550,000

575,000

?

?

(2,500)

Fertiliser Division

S

175,000

250,000

400,000

475,000

575,000

2,238,750

?

3,850,000

3,875,000

3,963,750

661,250

?

The company uses normal costing and manufacturing overhead is applied at the rate of 200%

of direct labour cost.

Over or under-applied manufacturing overhead is closed on an annual basis to the cost of goods

sold and this has been included in the above data.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,