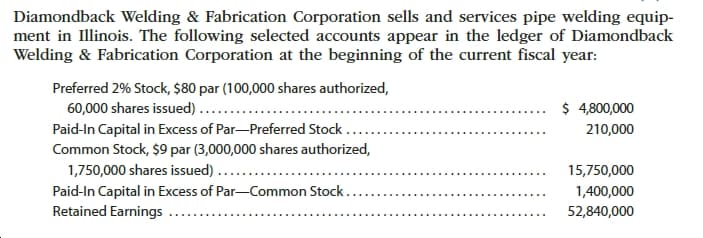

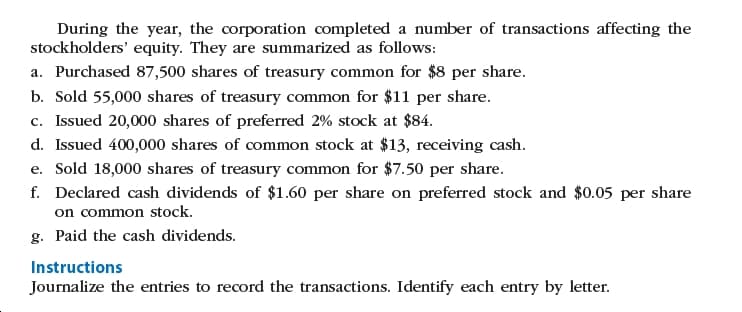

Diamondback Welding & Fabrication Corporation sells and services pipe welding equip- ment in Illinois. The following selected accounts appear in the ledger of Diamondback Welding & Fabrication Corporation at the beginning of the current fiscal year: Preferred 2% Stock, $80 par (100,000 shares authorized, 60,000 shares issued) .... Paid-In Capital in Excess of Par-Preferred Stock. $ 4,800,000 210,000 Common Stock, $9 par (3,000,000 shares authorized, 1,750,000 shares issued) ... 15,750,000 .... Paid-In Capital in Excess of Par-Common Stock. Retained Earnings 1,400,000 52,840,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Purchased 87,500 shares of treasury common for $8 per share. b. Sold 55,000 shares of treasury common for $11 per share. c. Issued 20,000 shares of preferred 2% stock at $84. d. Issued 400,000 shares of common stock at $13, receiving cash. e. Sold 18,000 shares of treasury common for $7.50 per share. f. Declared cash dividends of $1.60 per share on preferred stock and $0.05 per share on common stock. g. Paid the cash dividends. Instructions Journalize the entries to record the transactions. Identify each entry by letter.

Diamondback Welding & Fabrication Corporation sells and services pipe welding equip- ment in Illinois. The following selected accounts appear in the ledger of Diamondback Welding & Fabrication Corporation at the beginning of the current fiscal year: Preferred 2% Stock, $80 par (100,000 shares authorized, 60,000 shares issued) .... Paid-In Capital in Excess of Par-Preferred Stock. $ 4,800,000 210,000 Common Stock, $9 par (3,000,000 shares authorized, 1,750,000 shares issued) ... 15,750,000 .... Paid-In Capital in Excess of Par-Common Stock. Retained Earnings 1,400,000 52,840,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Purchased 87,500 shares of treasury common for $8 per share. b. Sold 55,000 shares of treasury common for $11 per share. c. Issued 20,000 shares of preferred 2% stock at $84. d. Issued 400,000 shares of common stock at $13, receiving cash. e. Sold 18,000 shares of treasury common for $7.50 per share. f. Declared cash dividends of $1.60 per share on preferred stock and $0.05 per share on common stock. g. Paid the cash dividends. Instructions Journalize the entries to record the transactions. Identify each entry by letter.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 2MC: Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions...

Related questions

Question

Transcribed Image Text:Diamondback Welding & Fabrication Corporation sells and services pipe welding equip-

ment in Illinois. The following selected accounts appear in the ledger of Diamondback

Welding & Fabrication Corporation at the beginning of the current fiscal year:

Preferred 2% Stock, $80 par (100,000 shares authorized,

60,000 shares issued) ....

Paid-In Capital in Excess of Par-Preferred Stock.

$ 4,800,000

210,000

Common Stock, $9 par (3,000,000 shares authorized,

1,750,000 shares issued) ...

15,750,000

....

Paid-In Capital in Excess of Par-Common Stock.

Retained Earnings

1,400,000

52,840,000

Transcribed Image Text:During the year, the corporation completed a number of transactions affecting the

stockholders' equity. They are summarized as follows:

a. Purchased 87,500 shares of treasury common for $8 per share.

b. Sold 55,000 shares of treasury common for $11 per share.

c. Issued 20,000 shares of preferred 2% stock at $84.

d. Issued 400,000 shares of common stock at $13, receiving cash.

e. Sold 18,000 shares of treasury common for $7.50 per share.

f. Declared cash dividends of $1.60 per share on preferred stock and $0.05 per share

on common stock.

g. Paid the cash dividends.

Instructions

Journalize the entries to record the transactions. Identify each entry by letter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,