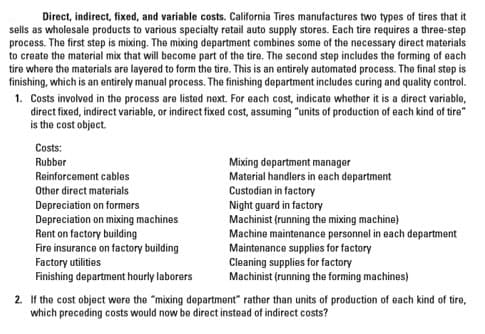

Direct, indirect, fixed, and variable costs. California Tires manufactures two types of tires that it sells as wholesale products to various specialty retail auto supply stores. Each tire requires a three-step process. The first step is mixing. The mixing department combines some of the necessary direct materials to create the material mix that will become part of the tire. The second step includes the forming of each tire where the materials are layered to form the tire. This is an entirely automated process. The final step is finishing, which is an entirely manual process. The finishing department includes curing and quality control. 1. Costs involved in the process are listed next. For each cost, indicate whether it is a direct variable, direct fixed, indirect variable, or indirect fixed cost, assuming "units of production of each kind of tire" is the cost object. Costs: Rubber Mixing department manager Material handlers in each department Custodian in factory Night guard in factory Machinist (running the mixing machine) Machine maintenance personnel in each department Reinforcement cables Other direct materials Depreciation on formers Depreciation on mixing machines Rent on factory building Fire insurance on factory building Factory utilities Finishing department hourly laborers Maintenance supplies for factory Cleaning supplies for factory Machinist (running the forming machines) 2. If the cost object were the "mixing department" rather than units of production of each kind of tire, which preceding costs would now be direct instead of indirect costs?

Direct, indirect, fixed, and variable costs. California Tires manufactures two types of tires that it sells as wholesale products to various specialty retail auto supply stores. Each tire requires a three-step process. The first step is mixing. The mixing department combines some of the necessary direct materials to create the material mix that will become part of the tire. The second step includes the forming of each tire where the materials are layered to form the tire. This is an entirely automated process. The final step is finishing, which is an entirely manual process. The finishing department includes curing and quality control. 1. Costs involved in the process are listed next. For each cost, indicate whether it is a direct variable, direct fixed, indirect variable, or indirect fixed cost, assuming "units of production of each kind of tire" is the cost object. Costs: Rubber Mixing department manager Material handlers in each department Custodian in factory Night guard in factory Machinist (running the mixing machine) Machine maintenance personnel in each department Reinforcement cables Other direct materials Depreciation on formers Depreciation on mixing machines Rent on factory building Fire insurance on factory building Factory utilities Finishing department hourly laborers Maintenance supplies for factory Cleaning supplies for factory Machinist (running the forming machines) 2. If the cost object were the "mixing department" rather than units of production of each kind of tire, which preceding costs would now be direct instead of indirect costs?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter6: Process Costing

Section: Chapter Questions

Problem 38P: Healthway uses a process-costing system to compute the unit costs of the minerals that it produces....

Related questions

Question

Transcribed Image Text:Direct, indirect, fixed, and variable costs. California Tires manufactures two types of tires that it

sells as wholesale products to various specialty retail auto supply stores. Each tire requires a three-step

process. The first step is mixing. The mixing department combines some of the necessary direct materials

to create the material mix that will become part of the tire. The second step includes the forming of each

tire where the materials are layered to form the tire. This is an entirely automated process. The final step is

finishing, which is an entirely manual process. The finishing department includes curing and quality control.

1. Costs involved in the process are listed next. For each cost, indicate whether it is a direct variable,

direct fixed, indirect variable, or indirect fixed cost, assuming "units of production of each kind of tire"

is the cost object.

Costs:

Rubber

Mixing department manager

Material handlers in each department

Custodian in factory

Night guard in factory

Machinist (running the mixing machine)

Machine maintenance personnel in each department

Reinforcement cables

Other direct materials

Depreciation on formers

Depreciation on mixing machines

Rent on factory building

Fire insurance on factory building

Factory utilities

Finishing department hourly laborers

Maintenance supplies for factory

Cleaning supplies for factory

Machinist (running the forming machines)

2. If the cost object were the "mixing department" rather than units of production of each kind of tire,

which preceding costs would now be direct instead of indirect costs?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College