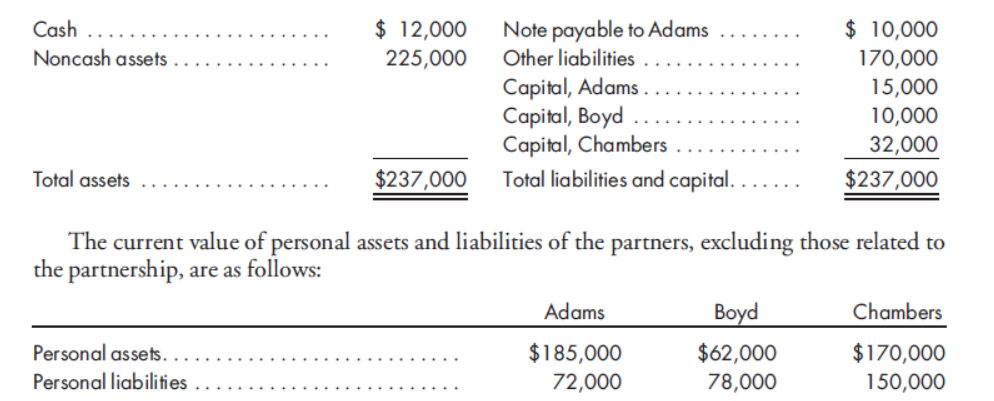

$ 12,000 Note payable to Adams Other liabilities $ 10,000 170,000 15,000 10,000 Cash Noncash assets 225,000 Capital, Adams Capital, Boyd Capital, Chambers Total liabilities and capital. 32,000 Total assets $237,000 $237,000 The current value of personal assets and liabilities of the partners, excluding those related to the partnership, are as follows: Adams Boyd Chambers Personal assets. $185,000 72,000 $62,000 78,000 $170,000 Personal liabilities 150,000

Twelve years ago, Adams, Boyd, and Chambers formed a

Boyd is extremely concerned that after liquidation of the partnership they would still continue to be personally insolvent. This would be devastating to Boyd, and they have come to you with their concerns.

Prepare a response to each of Boyd’s independent questions noting that

1. If assets with a book value of $180,000 were sold for $200,000 and the partners agreed to maintain a minimum cash balance of $5,000, would any of the available cash be distributed to Boyd?

2. If all of the noncash assets were sold for net proceeds of $280,000 and all cash was distributed, would any of the available cash be distributed to Boyd?

3. Assume that all of the noncash assets were sold for net proceeds of $150,000 and all cash was distributed. If Adams contributed the necessary assets to the partnership to liquidate unsatisfied outside creditors, how much would Boyd be liable to Adams for?

4. How much would all of the noncash assets have to be sold for so that after distributing all available cash Boyd could liquidate their personal liabilities?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps