$4 30,000 From the balance sheet: 150,000 Cash ... 200,000 Accounts receivable . 500,000 Inventory Plant assets (net of accumulated depreciation) Current liabilities.... ... .. 150,000 300,000 Total stockholders' equity. 1,000,000 Total assets From the income statement: $1,500,000 Net sales 1,080,000 Cost of goods sold ... 315,000 Operating expenses .. 84,000 Interest expense... 6,000 Income tax expense 15,000 Net income .... From the statement of cash flows: Net cash provided by operating activities (including interest paid of $79,000) .. $ 40,000 Net cash used in investing activities (46,000) Financing activities: Amounts borrowed $ 50,000 ... .... Repayment of amounts borrowed... Dividends paid.. Net cash provided by financing activities ... Net increase in cash during the year (14,000) (20,000) 16,000 2. 10,000 ... ....

$4 30,000 From the balance sheet: 150,000 Cash ... 200,000 Accounts receivable . 500,000 Inventory Plant assets (net of accumulated depreciation) Current liabilities.... ... .. 150,000 300,000 Total stockholders' equity. 1,000,000 Total assets From the income statement: $1,500,000 Net sales 1,080,000 Cost of goods sold ... 315,000 Operating expenses .. 84,000 Interest expense... 6,000 Income tax expense 15,000 Net income .... From the statement of cash flows: Net cash provided by operating activities (including interest paid of $79,000) .. $ 40,000 Net cash used in investing activities (46,000) Financing activities: Amounts borrowed $ 50,000 ... .... Repayment of amounts borrowed... Dividends paid.. Net cash provided by financing activities ... Net increase in cash during the year (14,000) (20,000) 16,000 2. 10,000 ... ....

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 56P: The following selected information is taken from the financial statements of Arnn Company for its...

Related questions

Question

14.6A

Transcribed Image Text:Repayment ôf

16,000

Dividends paid

Net cash provided by financing activities

$4

10,000

Net increase in cash during the year

a. Explain how the interest expense shown in the income statement could be $84,000, when a

interest payment appearing in the statement of cash flows is only $79,000.

Instructions

b. Compute the following (round to one decimal place):

1. Current ratio

2. Quick ratio

3. Working capital

4. Debt ratio

с.

Comment on these measurements and evaluate Dickson, Inc.'s short-term debt-paying ability.

d. Compute the following ratios (assume that the year-end amounts of total assets and total stock-

holders' equity also represent the average amounts throughout the year).

1. Return on assets

2. Return on equity

Comment on the company's performance under these measurements. Explain why the return

on assets and return on equity are so different.

е.

f. Discuss (1) the apparent safety of long-term creditors' claims and (2) the prospects for Dick

son, Inc., continuing its dividend payments at the present level.

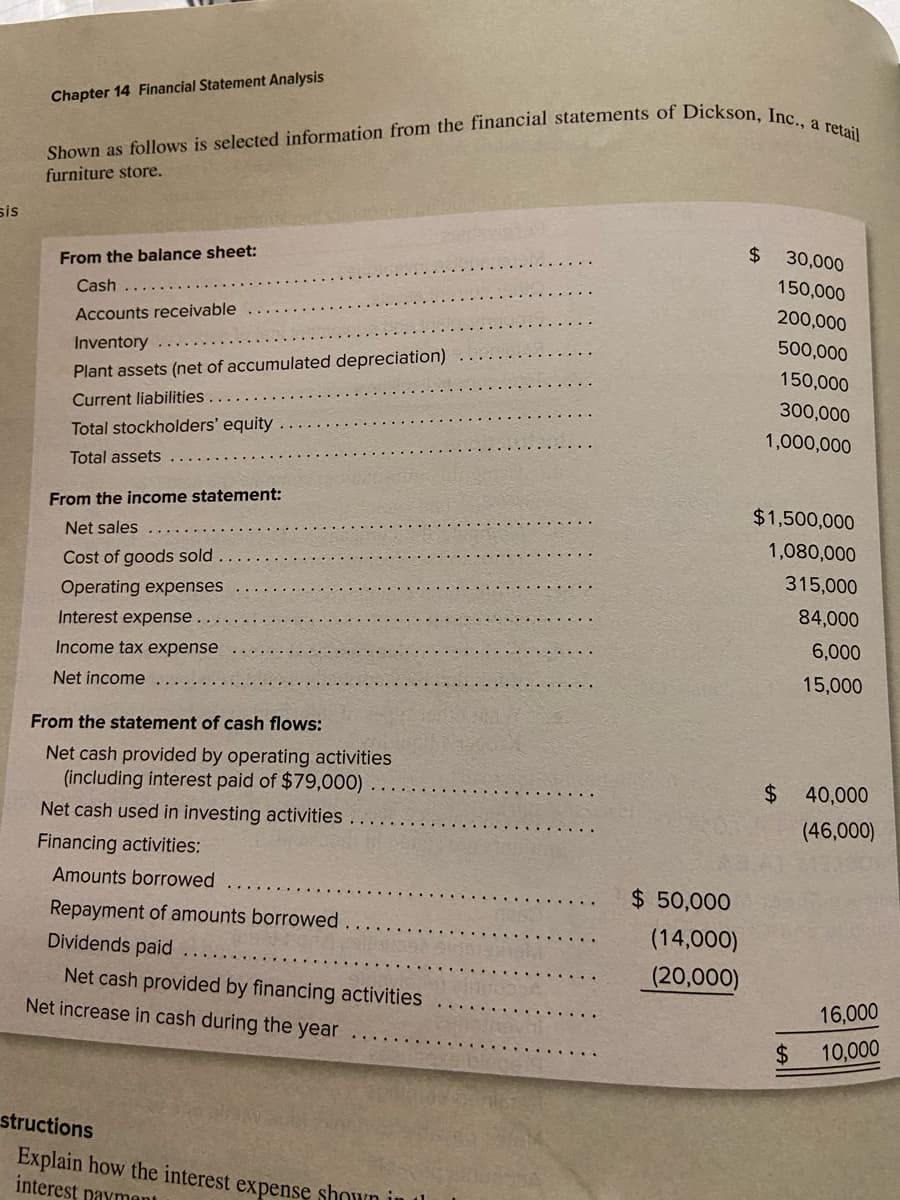

Transcribed Image Text:Shown as follows is selected information from the financial statements of Dickson, Inc., a retail

Chapter 14 Financial Statement Analysis

furniture store.

sis

24

30,000

From the balance sheet:

150,000

Cash

200,000

Accounts receivable

500,000

Inventory

150,000

Plant assets (net of accumulated depreciation)

Current liabilities

300,000

Total stockholders' equity

1,000,000

Total assets

From the income statement:

$1,500,000

Net sales

1,080,000

Cost of goods sold

315,000

Operating expenses

84,000

Interest expense

6,000

Income tax expense

15,000

Net income

From the statement of cash flows:

Net cash provided by operating activities

(including interest paid of $79,000)

$4

40,000

Net cash used in investing activities.

(46,000)

Financing activities:

Amounts borrowed

$ 50,000

Repayment of amounts borrowed

(14,000)

Dividends paid

(20,000)

Net cash provided by financing activities

Net increase in cash during the year

16,000

2$

10,000

structions

Explain how the interest expensę shown in tl

interest navmant

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning