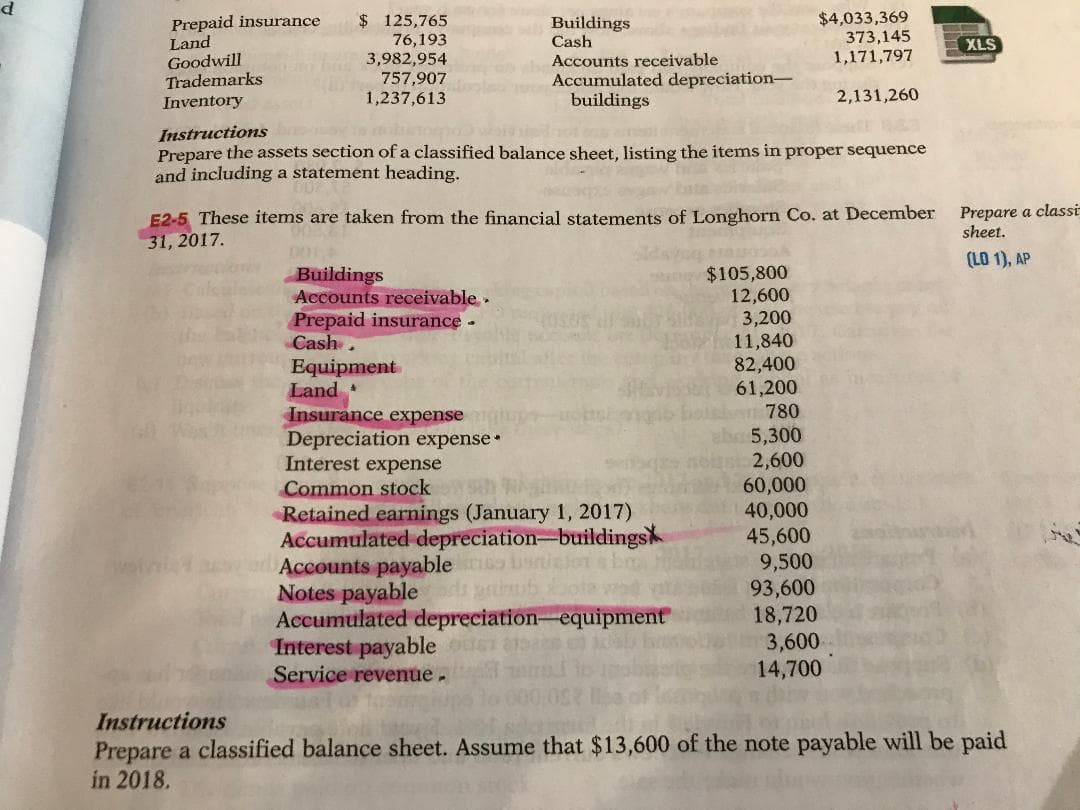

$4,033,369 373,145 1,171,797 Prepaid insurance Land Goodwill Trademarks Inventory $ 125,765 76,193 3,982,954 757,907 1,237,613 Buildings Cash XLS Accounts receivable Accumulated depreciation- buildings 2,131,260 Instructions Prepare the assets section of a classified balance sheet, listing the items in proper sequence and including a statement heading. Prepare a classi sheet. E2-5 These items are taken from the financial statements of Longhorn Co. at December 31, 2017. (LO 1), AP Buildings Accounts receivable. Prepaid insurance - Cash. Equipment Land Insurance expense Depreciation expense• Interest expense Common stock Retained earnings (January 1, 2017) Accumulated depreciation-buildings Accounts payable Notes payable d Accumulated depreciation-equipment Interest payable Service revenue- $105,800 12,600 3,200 11,840 82,400 61,200 780 5,300 2,600 60,000 40,000 45,600 9,500 93,600 18,720 3,600 14,700 woiv Instructions Prepare a classified balance sheet. Assume that $13,600 of the note payable will be paid in 2018.

$4,033,369 373,145 1,171,797 Prepaid insurance Land Goodwill Trademarks Inventory $ 125,765 76,193 3,982,954 757,907 1,237,613 Buildings Cash XLS Accounts receivable Accumulated depreciation- buildings 2,131,260 Instructions Prepare the assets section of a classified balance sheet, listing the items in proper sequence and including a statement heading. Prepare a classi sheet. E2-5 These items are taken from the financial statements of Longhorn Co. at December 31, 2017. (LO 1), AP Buildings Accounts receivable. Prepaid insurance - Cash. Equipment Land Insurance expense Depreciation expense• Interest expense Common stock Retained earnings (January 1, 2017) Accumulated depreciation-buildings Accounts payable Notes payable d Accumulated depreciation-equipment Interest payable Service revenue- $105,800 12,600 3,200 11,840 82,400 61,200 780 5,300 2,600 60,000 40,000 45,600 9,500 93,600 18,720 3,600 14,700 woiv Instructions Prepare a classified balance sheet. Assume that $13,600 of the note payable will be paid in 2018.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

Accounting question: If you are doing a balance sheet with notes payable of 96,600. Assuming 13,600 of the note payable will be paid the following year. Where are how do you enter it.

Long Term Liability?

Transcribed Image Text:$4,033,369

373,145

1,171,797

Prepaid insurance

Land

Goodwill

Trademarks

Inventory

$ 125,765

76,193

3,982,954

757,907

1,237,613

Buildings

Cash

XLS

Accounts receivable

Accumulated depreciation-

buildings

2,131,260

Instructions

Prepare the assets section of a classified balance sheet, listing the items in proper sequence

and including a statement heading.

Prepare a classi

sheet.

E2-5 These items are taken from the financial statements of Longhorn Co. at December

31, 2017.

(LO 1), AP

Buildings

Accounts receivable.

Prepaid insurance -

Cash.

Equipment

Land

Insurance expense

Depreciation expense•

Interest expense

Common stock

Retained earnings (January 1, 2017)

Accumulated depreciation-buildings

Accounts payable

Notes payable d

Accumulated depreciation-equipment

Interest payable

Service revenue-

$105,800

12,600

3,200

11,840

82,400

61,200

780

5,300

2,600

60,000

40,000

45,600

9,500

93,600

18,720

3,600

14,700

woiv

Instructions

Prepare a classified balance sheet. Assume that $13,600 of the note payable will be paid

in 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning