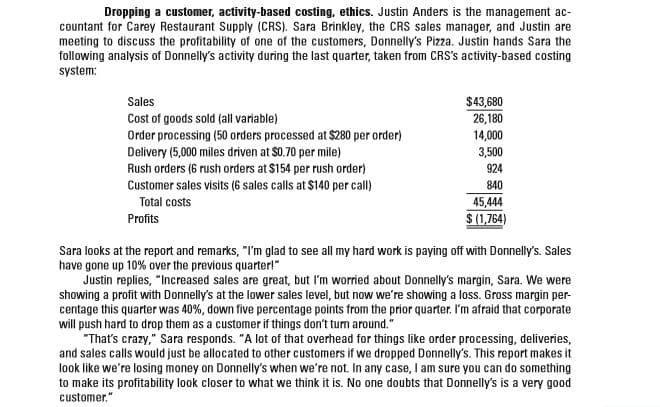

Dropping a customer, activity-based costing, ethics. Justin Anders is the management ac- countant for Carey Restaurant Supply (CRS). Sara Brinkley, the CRS sales manager, and Justin are meeting to discuss the profitability of one of the customers, Donnelly's Pizza. Justin hands Sara the following analysis of Donnelly's activity during the last quarter, taken from CRS's activity-based costing system: Sales $43,680 Cost of goods sold (all variable) 26,180 14,000 Order processing (50 orders processed at $280 per order) Delivery (5,000 miles driven at $0.70 per mile) 3,500 Rush orders (6 rush orders at $154 per rush order) Customer sales visits (6 sales calls at $140 per call) 924 840 Total costs 45,444 Profits $ (1,764) Sara looks at the report and remarks, "I'm glad to see all my hard work is paying off with Donnelly's. Sales have gone up 10% over the previous quarter!" Justin replies, "Increased sales are great, but I'm worried about Donnelly's margin, Sara. We were showing a profit with Donnelly's at the lower sales level, but now we're showing a loss. Gross margin per- centage this quarter was 40%, down five percentage points from the prior quarter. I'm afraid that corporate will push hard to drop them as a customer if things don't turn around." "That's crazy," Sara responds. "A lot of that overhead for things like order processing, deliveries, and sales calls would just be allocated to other customers if we dropped Donnelly's. This report makes it look like we're losing money on Donnelly's when we're not. In any case, I am sure you can do something to make its profitability look closer to what we think it is. No one doubts that Donnelly's is a very good customer."

Dropping a customer, activity-based costing, ethics. Justin Anders is the management ac- countant for Carey Restaurant Supply (CRS). Sara Brinkley, the CRS sales manager, and Justin are meeting to discuss the profitability of one of the customers, Donnelly's Pizza. Justin hands Sara the following analysis of Donnelly's activity during the last quarter, taken from CRS's activity-based costing system: Sales $43,680 Cost of goods sold (all variable) 26,180 14,000 Order processing (50 orders processed at $280 per order) Delivery (5,000 miles driven at $0.70 per mile) 3,500 Rush orders (6 rush orders at $154 per rush order) Customer sales visits (6 sales calls at $140 per call) 924 840 Total costs 45,444 Profits $ (1,764) Sara looks at the report and remarks, "I'm glad to see all my hard work is paying off with Donnelly's. Sales have gone up 10% over the previous quarter!" Justin replies, "Increased sales are great, but I'm worried about Donnelly's margin, Sara. We were showing a profit with Donnelly's at the lower sales level, but now we're showing a loss. Gross margin per- centage this quarter was 40%, down five percentage points from the prior quarter. I'm afraid that corporate will push hard to drop them as a customer if things don't turn around." "That's crazy," Sara responds. "A lot of that overhead for things like order processing, deliveries, and sales calls would just be allocated to other customers if we dropped Donnelly's. This report makes it look like we're losing money on Donnelly's when we're not. In any case, I am sure you can do something to make its profitability look closer to what we think it is. No one doubts that Donnelly's is a very good customer."

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 4BE: Activity-based costing: selling and administrative expenses Jungle Junior Company manufactures and...

Related questions

Question

Assume that Sara is partly correct in her assessment of the report. Upon further investigation, it is determined that 10% of the order

Transcribed Image Text:Dropping a customer, activity-based costing, ethics. Justin Anders is the management ac-

countant for Carey Restaurant Supply (CRS). Sara Brinkley, the CRS sales manager, and Justin are

meeting to discuss the profitability of one of the customers, Donnelly's Pizza. Justin hands Sara the

following analysis of Donnelly's activity during the last quarter, taken from CRS's activity-based costing

system:

Sales

$43,680

Cost of goods sold (all variable)

26,180

14,000

Order processing (50 orders processed at $280 per order)

Delivery (5,000 miles driven at $0.70 per mile)

3,500

Rush orders (6 rush orders at $154 per rush order)

Customer sales visits (6 sales calls at $140 per call)

924

840

Total costs

45,444

Profits

$ (1,764)

Sara looks at the report and remarks, "I'm glad to see all my hard work is paying off with Donnelly's. Sales

have gone up 10% over the previous quarter!"

Justin replies, "Increased sales are great, but I'm worried about Donnelly's margin, Sara. We were

showing a profit with Donnelly's at the lower sales level, but now we're showing a loss. Gross margin per-

centage this quarter was 40%, down five percentage points from the prior quarter. I'm afraid that corporate

will push hard to drop them as a customer if things don't turn around."

"That's crazy," Sara responds. "A lot of that overhead for things like order processing, deliveries,

and sales calls would just be allocated to other customers if we dropped Donnelly's. This report makes it

look like we're losing money on Donnelly's when we're not. In any case, I am sure you can do something

to make its profitability look closer to what we think it is. No one doubts that Donnelly's is a very good

customer."

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning