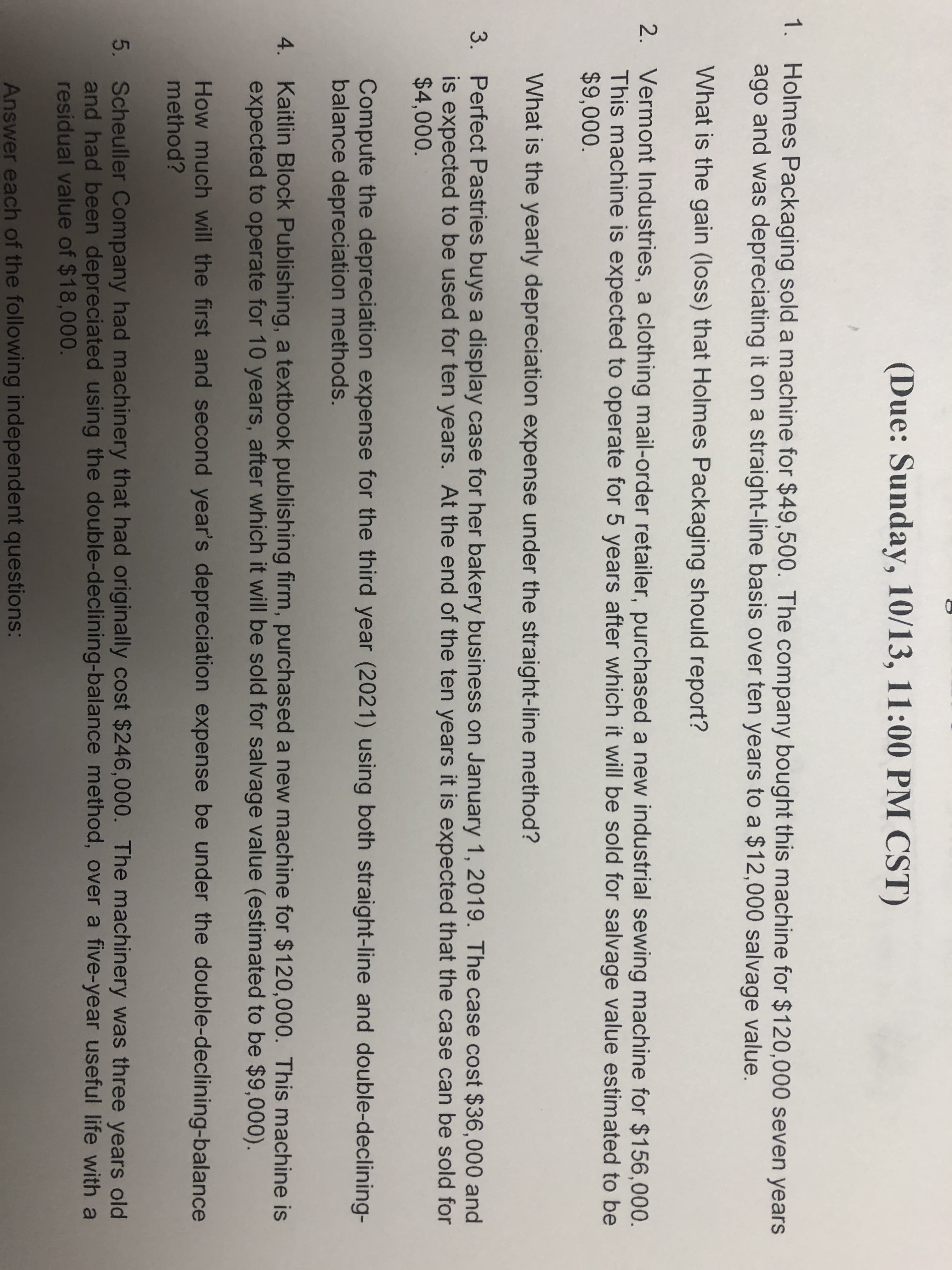

(Due: Sunday, 10/13, 11:00 PM CST) Holmes Packaging sold a machine for $49,500. The company bought this machine for $120,000 seven years ago and was depreciating it on a straight-line basis over ten years to a $12,000 salvage value. 1. What is the gain (loss) that Holmes Packaging should report? 2. Vermont Industries, a clothing mail-order retailer, purchased a new industrial sewing machine for $156,000. This machine is expected to operate for 5 years after which it will be sold for salvage value estimated to be $9,000 What is the yearly depreciation expense under the straight-line method? Perfect Pastries buys a display case for her bakery business on January 1, 2019. The case cost $36,000 and is expected to be used for ten years. At the end of the ten years it is expected that the case can be sold for $4,000 3. Compute the depreciation expense for the third year (2021) using both straight-line and double-declining- balance depreciation methods. Kaitlin Block Publishing, a textbook publishing firm, purchased a new machine for $120,000. This machine is expected to operate for 10 years, after which it will be sold for salvage value (estimated to be $9,000). 4. How much will the first and second year's depreciation expense be under the double-declining-balance method? 5. Scheuller Company had machinery that had originally cost $246,000. The machinery was three years old and had been depreciated using the double-declining-balance method, over a five-year useful life with a residual value of $18,000. Answer each of the following independent questions:

(Due: Sunday, 10/13, 11:00 PM CST) Holmes Packaging sold a machine for $49,500. The company bought this machine for $120,000 seven years ago and was depreciating it on a straight-line basis over ten years to a $12,000 salvage value. 1. What is the gain (loss) that Holmes Packaging should report? 2. Vermont Industries, a clothing mail-order retailer, purchased a new industrial sewing machine for $156,000. This machine is expected to operate for 5 years after which it will be sold for salvage value estimated to be $9,000 What is the yearly depreciation expense under the straight-line method? Perfect Pastries buys a display case for her bakery business on January 1, 2019. The case cost $36,000 and is expected to be used for ten years. At the end of the ten years it is expected that the case can be sold for $4,000 3. Compute the depreciation expense for the third year (2021) using both straight-line and double-declining- balance depreciation methods. Kaitlin Block Publishing, a textbook publishing firm, purchased a new machine for $120,000. This machine is expected to operate for 10 years, after which it will be sold for salvage value (estimated to be $9,000). 4. How much will the first and second year's depreciation expense be under the double-declining-balance method? 5. Scheuller Company had machinery that had originally cost $246,000. The machinery was three years old and had been depreciated using the double-declining-balance method, over a five-year useful life with a residual value of $18,000. Answer each of the following independent questions:

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PB: Montezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $8,000 and...

Related questions

Question

On question 3, would the answer be 3200 for straight line and 4608 for double declining or should I multiply that by 7 since it’s asking for third year

Transcribed Image Text:(Due: Sunday, 10/13, 11:00 PM CST)

Holmes Packaging sold a machine for $49,500. The company bought this machine for $120,000 seven years

ago and was depreciating it on a straight-line basis over ten years to a $12,000 salvage value.

1.

What is the gain (loss) that Holmes Packaging should report?

2. Vermont Industries, a clothing mail-order retailer, purchased a new industrial sewing machine for $156,000.

This machine is expected to operate for 5 years after which it will be sold for salvage value estimated to be

$9,000

What is the yearly depreciation expense under the straight-line method?

Perfect Pastries buys a display case for her bakery business on January 1, 2019. The case cost $36,000 and

is expected to be used for ten years. At the end of the ten years it is expected that the case can be sold for

$4,000

3.

Compute the depreciation expense for the third year (2021) using both straight-line and double-declining-

balance depreciation methods.

Kaitlin Block Publishing, a textbook publishing firm, purchased a new machine for $120,000. This machine is

expected to operate for 10 years, after which it will be sold for salvage value (estimated to be $9,000).

4.

How much will the first and second year's depreciation expense be under the double-declining-balance

method?

5. Scheuller Company had machinery that had originally cost $246,000. The machinery was three years old

and had been depreciated using the double-declining-balance method, over a five-year useful life with a

residual value of $18,000.

Answer each of the following independent questions:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,