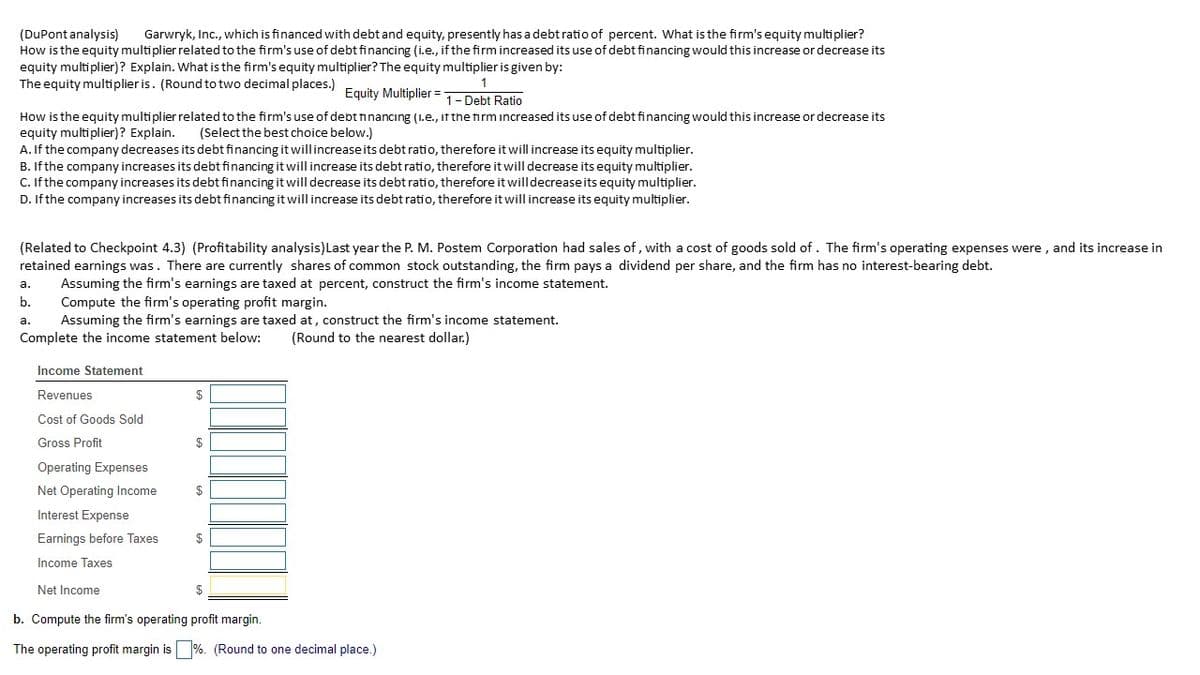

(DuPont analysis) Garwryk, Inc., which is financed with debt and equity, presently has a debt ratio of percent. What is the firm's equity multi plier? How is the equity multiplier related to the firm's use of debt financing (i.e., if the firm increased its use of debt financing would this increase or decrease its equity multi plier)? Explain. What is the firm's equity multiplier? The equity multiplier is given by: The equity multiplier is. (Round to two decimal places.) 1 Equity Multiplier =7 1- Debt Ratio How is the equity multiplier related to the firm's use of debt nnancıng (1.e., It the nrm increased its use of debt financing would this increase or decrease its equity multi plier)? Explain. (Select the best choice below.) A. If the company decreases its debt financing it willincreaseits debt ratio, therefore it will increase its equity multiplier. B. If the company increases its debt financing it will increase its debt ratio, therefore it will decrease its equity multiplier. C. If the company increases its debt financing it will decrease its debt ratio, therefore it willdecreaseits equity multiplier. D. If the company increases its debt financing it will increase its debt ratio, therefore it will increase its equity multiplier.

(DuPont analysis) Garwryk, Inc., which is financed with debt and equity, presently has a debt ratio of percent. What is the firm's equity multi plier? How is the equity multiplier related to the firm's use of debt financing (i.e., if the firm increased its use of debt financing would this increase or decrease its equity multi plier)? Explain. What is the firm's equity multiplier? The equity multiplier is given by: The equity multiplier is. (Round to two decimal places.) 1 Equity Multiplier =7 1- Debt Ratio How is the equity multiplier related to the firm's use of debt nnancıng (1.e., It the nrm increased its use of debt financing would this increase or decrease its equity multi plier)? Explain. (Select the best choice below.) A. If the company decreases its debt financing it willincreaseits debt ratio, therefore it will increase its equity multiplier. B. If the company increases its debt financing it will increase its debt ratio, therefore it will decrease its equity multiplier. C. If the company increases its debt financing it will decrease its debt ratio, therefore it willdecreaseits equity multiplier. D. If the company increases its debt financing it will increase its debt ratio, therefore it will increase its equity multiplier.

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 1P

Related questions

Question

SNHU acc 202

Transcribed Image Text:(DuPontanalysis)

How is the equity multiplier related to the firm's use of debt financing (i.e., if the firm increased its use of debt financing would this increase or decrease its

equity multi plier)? Explain. What is the firm's equity multiplier? The equity multiplier is given by:

The equity multiplier is. (Round to two decimal places.)

Garwryk, Inc., which is financed with debt and equity, presently has a debt ratio of percent. What is the firm's equity multiplier?

Equity Multiplier =

1- Debt Ratio

How is the equity multiplier related to the firm's use of debt financıng (1.e., it the firm increased its use of debt financing would this increase or decrease its

equity multiplier)? Explain.

A. If the company decreases its debt financing it willincreaseits debt ratio, therefore it will increase its equity multiplier.

(Select the best choice below.)

B. If the company increases its debt financing it will increase its debt ratio, therefore it will decrease its equity multiplier.

C. If the company increases its debt financing it will decrease its debt ratio, therefore it willdecrease its equity multiplier.

D. If the company increases its debt financing it will increase its debt ratio, therefore it will increase its equity multiplier.

(Related to Checkpoint 4.3) (Profitability analysis)Last year the P. M. Postem Corporation had sales of, with a cost of goods sold of . The firm's operating expenses were , and its increase in

retained earnings was. There are currently shares of common stock outstanding, the firm pays a dividend per share, and the firm has no interest-bearing debt.

Assuming the firm's earnings are taxed at percent, construct the firm's income statement.

Compute the firm's operating profit margin.

Assuming the firm's earnings are taxed at, construct the firm's income statement.

a.

b.

a.

Complete the income statement below:

(Round to the nearest dollar.)

Income Statement

Revenues

$

Cost of Goods Sold

Gross Profit

$

Operating Expenses

Net Operating Income

Interest Expense

Earnings before Taxes

$

Income Taxes

Net Income

$

b. Compute the firm's operating profit margin.

The operating profit margin is %. (Round to one decimal place.)

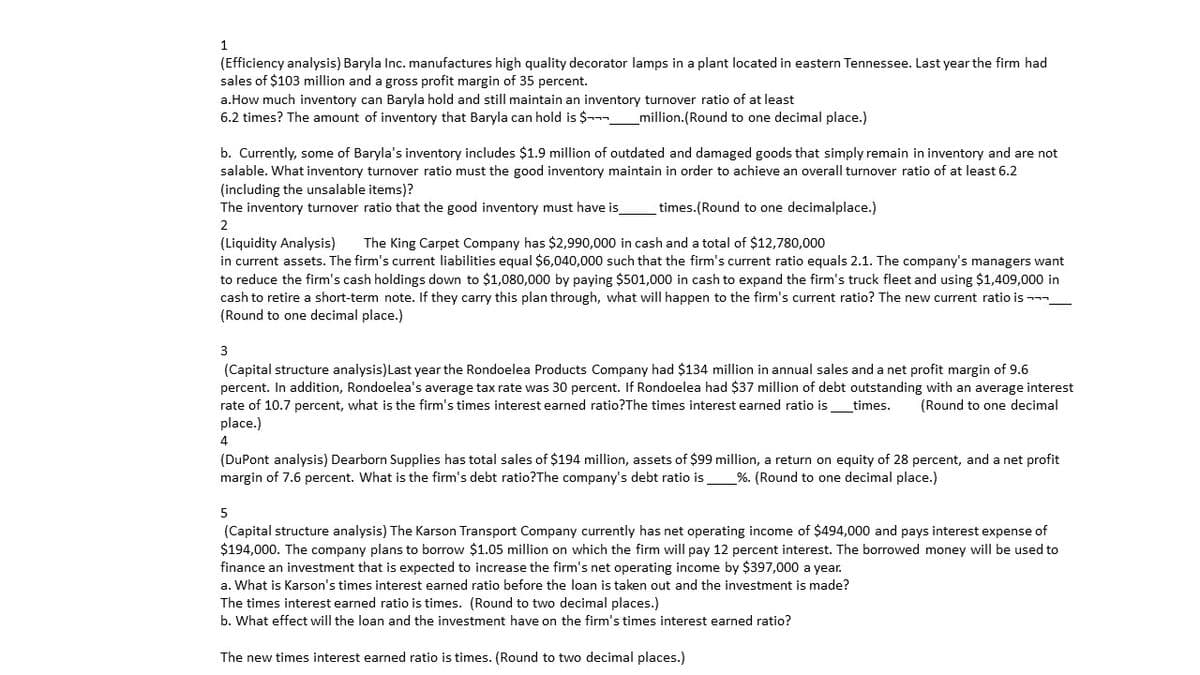

Transcribed Image Text:(Efficiency analysis) Baryla Inc. manufactures high quality decorator lamps in a plant located in eastern Tennessee. Last year the firm had

sales of $103 million and a gross profit margin of 35 percent.

a.How much inventory can Baryla hold and still maintain an inventory turnover ratio of at least

6.2 times? The amount of inventory that Baryla can hold is $---

_million.(Round to one decimal place.)

b. Currently, some of Baryla's inventory includes $1.9 million of outdated and damaged goods that simply remain in inventory and are not

salable. What inventory turnover ratio must the good inventory maintain in order to achieve an overall turnover ratio of at least 6.2

(including the unsalable items)?

The inventory turnover ratio that the good inventory must have is

times.(Round to one decimalplace.)

2

The King Carpet Company has $2,990,000 in cash and a total of $12,780,000

(Liquidity Analysis)

in current assets. The firm's current liabilities equal $6,040,000 such that the firm's current ratio equals 2.1. The company's managers want

to reduce the firm's cash holdings down to $1,080,000 by paying $501,000 in cash to expand the firm's truck fleet and using $1,409,000 in

cash to retire a short-term note. If they carry this plan through, what will happen to the firm's current ratio? The new current ratio is ---

(Round to one decimal place.)

3

(Capital structure analysis)Last year the Rondoelea Products Company had $134 million in annual sales and a net profit margin of 9.6

percent. In addition, Rondoelea's average tax rate was 30 percent. If Rondoelea had $37 million of debt outstanding with an average interest

rate of 10.7 percent, what is the firm's times interest earned ratio?The times interest earned ratio is

times.

(Round to one decimal

place.)

4

(DuPont analysis) Dearborn Supplies has total sales of $194 million, assets of $99 million, a return on equity of 28 percent, and a net profit

margin of 7.6 percent. What is the firm's debt ratio?The company's debt ratio is

%. (Round to one decimal place.)

(Capital structure analysis) The Karson Transport Company currently has net operating income of $494,000 and pays interest expense of

$194,000. The company plans to borrow $1.05 million on which the firm will pay 12 percent interest. The borrowed money will be used to

finance an investment that is expected to increase the firm's net operating income by $397,000 a year.

a. What is Karson's times interest earned ratio before the loan is taken out and the investment is made?

The times interest earned ratio is times. (Round to two decimal places.)

b. What effect will the loan and the investment have on the firm's times interest earned ratio?

The new times interest earned ratio is times. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning