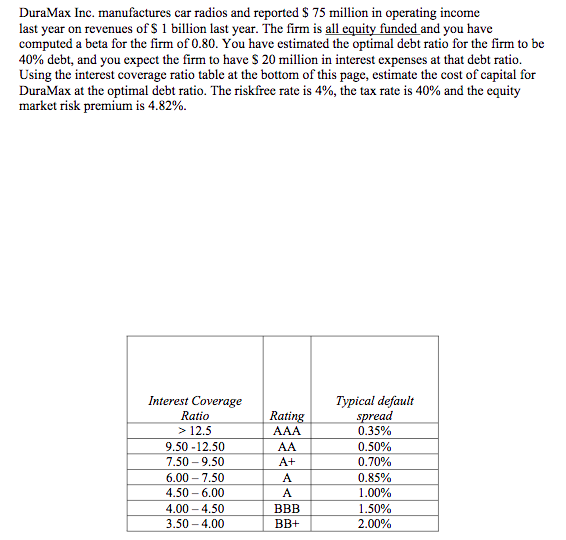

DuraMax Inc. manufactures car radios and reported $ 75 million in operating income last year on revenues of $ 1 billion last year. The firm is all equity funded and you have computed a beta for the firm of 0.80. You have estimated the optimal debt ratio for the firm to be 40% debt, and you expect the firm to have S 20 million in interest expenses at that debt ratio. Using the interest coverage ratio table at the bottom of this page, estimate the cost of capital for DuraMax at the optimal debt ratio. The riskfree rate is 4%, the tax rate is 40% and the equity market risk premium is 4.82%. Interest Coverage Typical default spread 0.35% Ratio Rating AAA > 12.5 9.50 -12.50 AA 0.50% 7.50 - 9.50 6.00 – 7.50 4.50 - 6.00 A+ 0.70% 0.85% 1.00% BBB 1.50% 2.00% 4.00 – 4.50 3.50 – 4.00 BB+

DuraMax Inc. manufactures car radios and reported $ 75 million in operating income last year on revenues of $ 1 billion last year. The firm is all equity funded and you have computed a beta for the firm of 0.80. You have estimated the optimal debt ratio for the firm to be 40% debt, and you expect the firm to have S 20 million in interest expenses at that debt ratio. Using the interest coverage ratio table at the bottom of this page, estimate the cost of capital for DuraMax at the optimal debt ratio. The riskfree rate is 4%, the tax rate is 40% and the equity market risk premium is 4.82%. Interest Coverage Typical default spread 0.35% Ratio Rating AAA > 12.5 9.50 -12.50 AA 0.50% 7.50 - 9.50 6.00 – 7.50 4.50 - 6.00 A+ 0.70% 0.85% 1.00% BBB 1.50% 2.00% 4.00 – 4.50 3.50 – 4.00 BB+

Chapter14: Capital Structure Management In Practice

Section: Chapter Questions

Problem 15P

Related questions

Question

Transcribed Image Text:DuraMax Inc. manufactures car radios and reported $ 75 million in operating income

last year on revenues of $ 1 billion last year. The firm is all equity funded and you have

computed a beta for the firm of 0.80. You have estimated the optimal debt ratio for the firm to be

40% debt, and you expect the firm to have S 20 million in interest expenses at that debt ratio.

Using the interest coverage ratio table at the bottom of this page, estimate the cost of capital for

DuraMax at the optimal debt ratio. The riskfree rate is 4%, the tax rate is 40% and the equity

market risk premium is 4.82%.

Interest Coverage

Typical default

spread

0.35%

Ratio

Rating

AAA

> 12.5

9.50 -12.50

AA

0.50%

7.50 - 9.50

6.00 – 7.50

4.50 - 6.00

A+

0.70%

0.85%

1.00%

BBB

1.50%

2.00%

4.00 – 4.50

3.50 – 4.00

BB+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning