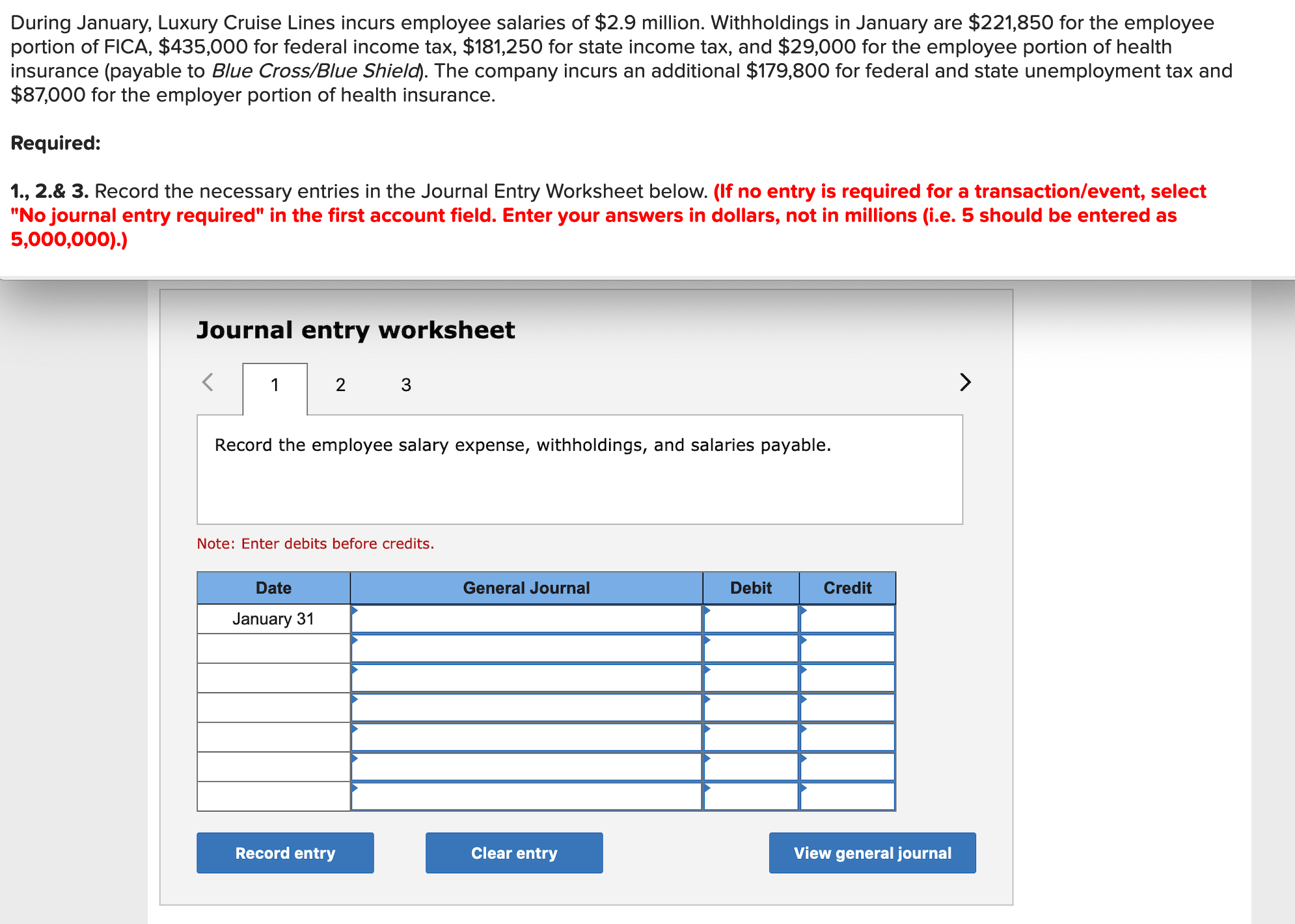

During January, Luxury Cruise Lines incurs employee salaries of $2.9 million. Withholdings in January are $221,850 for the employee portion of FICA, $435,000 for federal income tax, $181,250 for state income tax, and $29,000 for the employee portion of health insurance (payable to Blue Cross/Blue Shield). The company incurs an additional $179,800 for federal and state unemployment tax and $87,000 for the employer portion of health insurance. Required: 1., 2.& 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) Journal entry worksheet 1 2 3 >

During January, Luxury Cruise Lines incurs employee salaries of $2.9 million. Withholdings in January are $221,850 for the employee portion of FICA, $435,000 for federal income tax, $181,250 for state income tax, and $29,000 for the employee portion of health insurance (payable to Blue Cross/Blue Shield). The company incurs an additional $179,800 for federal and state unemployment tax and $87,000 for the employer portion of health insurance. Required: 1., 2.& 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) Journal entry worksheet 1 2 3 >

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 2PA

Related questions

Question

Transcribed Image Text:During January, Luxury Cruise Lines incurs employee salaries of $2.9 million. Withholdings in January are $221,850 for the employee

portion of FICA, $435,000 for federal income tax, $181,250 for state income tax, and $29,000 for the employee portion of health

insurance (payable to Blue Cross/Blue Shield). The company incurs an additional $179,800 for federal and state unemployment tax and

$87,000 for the employer portion of health insurance.

Required:

1., 2.& 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a transaction/event, select

"No journal entry required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as

5,000,000).)

Journal entry worksheet

2 3

Record the employee salary expense, withholdings, and salaries payable.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

January 31

Record entry

Clear entry

View general journal

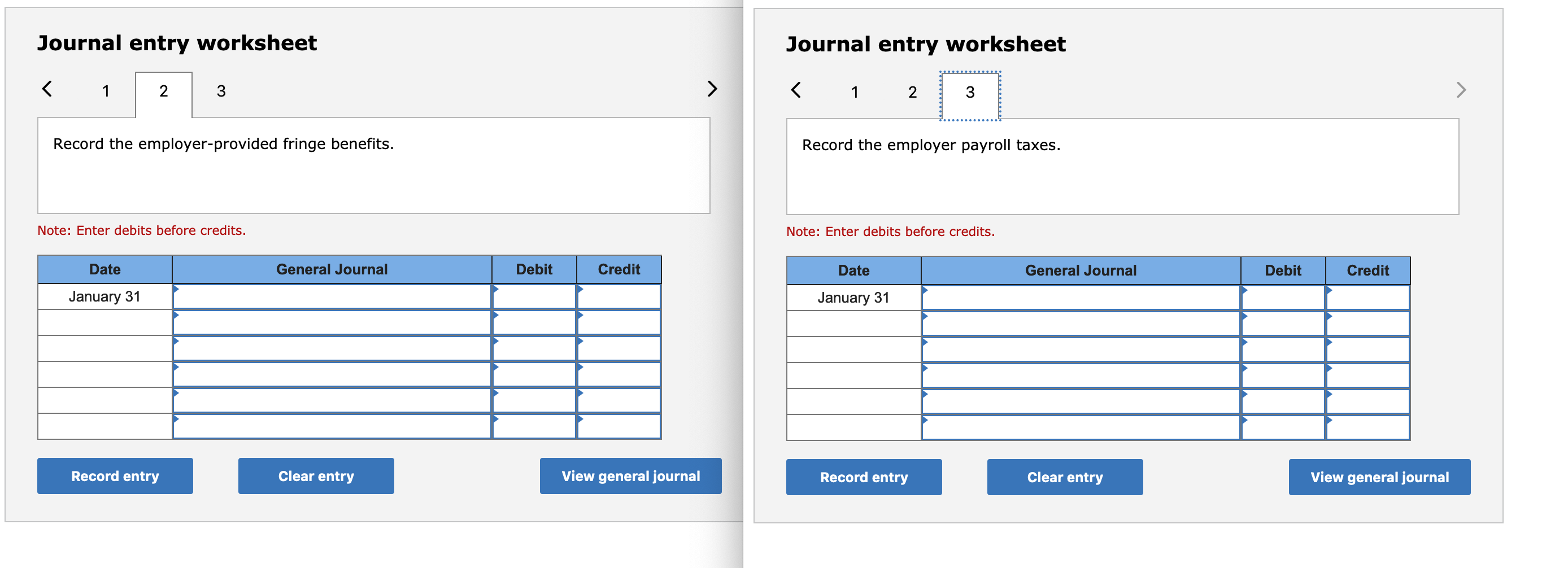

Transcribed Image Text:Journal entry worksheet

Journal entry worksheet

3

3

Record the employer-provided fringe benefits.

Record the employer payroll taxes.

Note: Enter debits before credits.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Date

General Journal

Debit

Credit

January 31

January 31

Record entry

Clear entry

View general journal

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College