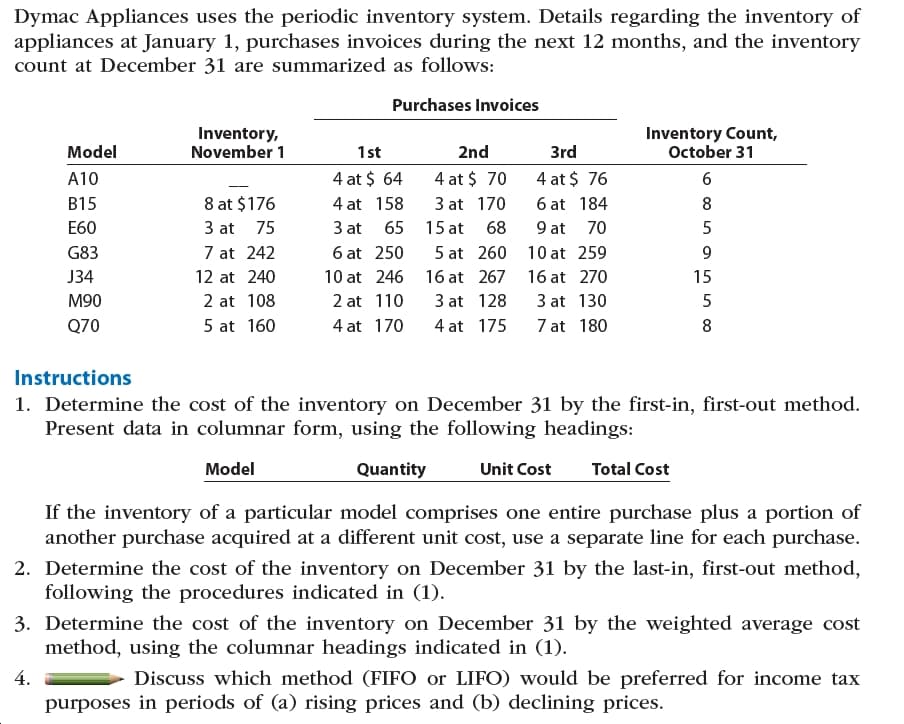

Dymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the next 12 months, and the inventory count at December 31 are summarized as follows: Purchases Invoices Inventory Count, October 31 Inventory, November 1 Model 2nd 1st Зrd 4 at $ 64 4 at $ 70 4 at $ 76 A10 8 at $176 B15 4 at 158 3 at 170 6 at 184 15 at 9 at 3 at 3 at E60 75 65 68 70 5 7 at 242 5 at 260 G83 6 at 250 10 at 259 J34 12 at 240 10 at 246 16 at 267 16 at 270 15 2 at 110 2 at 108 M90 3 at 128 3 at 130 7 at 180 5 at 160 4 at 170 Q70 4 at 175 Instructions 1. Determine the cost of the inventory on December 31 by the first-in, first-out method. Present data in columnar form, using the following headings: Model Quantity Unit Cost Total Cost If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1). 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1). 4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.

Dymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the next 12 months, and the inventory count at December 31 are summarized as follows: Purchases Invoices Inventory Count, October 31 Inventory, November 1 Model 2nd 1st Зrd 4 at $ 64 4 at $ 70 4 at $ 76 A10 8 at $176 B15 4 at 158 3 at 170 6 at 184 15 at 9 at 3 at 3 at E60 75 65 68 70 5 7 at 242 5 at 260 G83 6 at 250 10 at 259 J34 12 at 240 10 at 246 16 at 267 16 at 270 15 2 at 110 2 at 108 M90 3 at 128 3 at 130 7 at 180 5 at 160 4 at 170 Q70 4 at 175 Instructions 1. Determine the cost of the inventory on December 31 by the first-in, first-out method. Present data in columnar form, using the following headings: Model Quantity Unit Cost Total Cost If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1). 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1). 4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 5PA: Dymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances...

Related questions

Question

Transcribed Image Text:Dymac Appliances uses the periodic inventory system. Details regarding the inventory of

appliances at January 1, purchases invoices during the next 12 months, and the inventory

count at December 31 are summarized as follows:

Purchases Invoices

Inventory Count,

October 31

Inventory,

November 1

Model

2nd

1st

Зrd

4 at $ 64

4 at $ 70

4 at $ 76

A10

8 at $176

B15

4 at 158

3 at 170

6 at 184

15 at

9 at

3 at

3 at

E60

75

65

68

70

5

7 at 242

5 at 260

G83

6 at 250

10 at 259

J34

12 at 240

10 at 246

16 at 267

16 at 270

15

2 at 110

2 at 108

M90

3 at 128

3 at 130

7 at 180

5 at 160

4 at 170

Q70

4 at 175

Instructions

1. Determine the cost of the inventory on December 31 by the first-in, first-out method.

Present data in columnar form, using the following headings:

Model

Quantity

Unit Cost

Total Cost

If the inventory of a particular model comprises one entire purchase plus a portion of

another purchase acquired at a different unit cost, use a separate line for each purchase.

2. Determine the cost of the inventory on December 31 by the last-in, first-out method,

following the procedures indicated in (1).

3. Determine the cost of the inventory on December 31 by the weighted average cost

method, using the columnar headings indicated in (1).

4.

Discuss which method (FIFO or LIFO) would be preferred for income tax

purposes in periods of (a) rising prices and (b) declining prices.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub