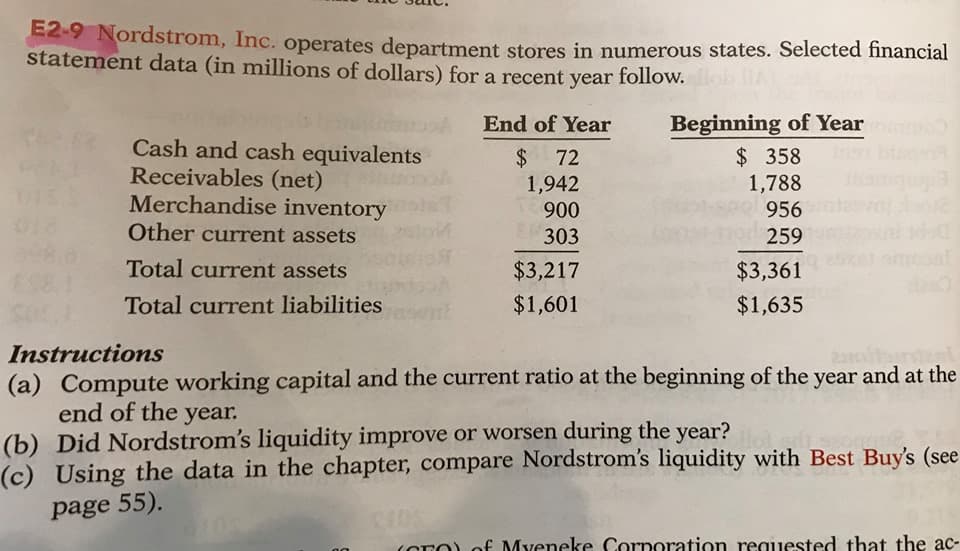

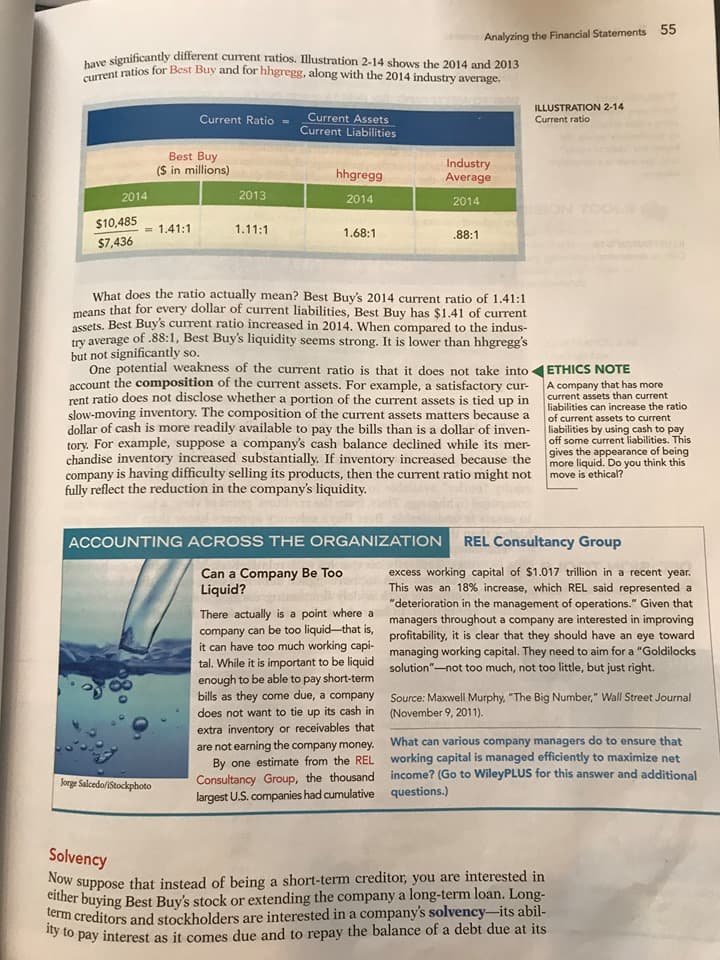

E2-9 Nordstrom, Inc. operates department stores in numerous states. Selected financial statement data (in millions of dollars) for a recent year follow. Beginning of Year End of Year Cash and cash equivalents Receivables (net) Merchandise inventory Other current assets $ 72 1,942 $358 1,788 956 900 303 259 Total current assets $3,217 $3,361 $1,601 $1,635 Total current liabilities Instructions (a) Compute working capital and the current ratio at the beginning of the year and at the end of the year. (b) Did Nordstrom's liquidity improve or worsen during the year? (c) Using the data in the chapter, compare Nordstrom's liquidity with Best Buy's (see page 55). SOTO) of Myeneke Corporation requested that the ac- 55 Analyzing the Financial Statements a significantly different current ratios. Illustration 2-14 shows the 2014 and 2013 current ratios for Best Buy and for hhgregg, along with the 2014 industry average. ILLUSTRATION 2-14 Current Ratio- Current Assets Current Liabilities Current ratio Best Buy (S in millions) Industry Average hhgregg 2013 2014 2014 2014 $10,485 = 1.41:1 1.11:1 1.68:1 .88:1 $7,436 What does the ratio actually mean? Best Buy's 2014 current ratio of 1.41:1 means that for every dollar of current liabilities, Best Buy has $1.41 of current assets, Best Buy's current ratio increased in 2014. When compared to the indus- try average of .88:1, Best Buy's liquidity seems strong. It is lower than hhgregg's but not significantly so. One potential weakness of the current ratio is that it does not take into ETHICS NOTE account the composition of the current assets. For example, a satisfactory cur- A company that has more rent ratio does not disclose whether a portion of the current assets is tied up in current assets than current slow-moving inventory. The composition of the current assets matters because a dollar of cash is more readily available to pay the bills than is a dollar of inven- liabilities by using cash to pay tory. For example, suppose a company's cash balance declined while its mer- chandise inventory increased substantially. If inventory increased because the company is having difficulty selling its products, then the current ratio might not fully reflect the reduction in the company's liquidity. liabilities can increase the ratio of current assets to current off some current liabilities. This gives the appearance of being more liquid. Do you think this move is ethical? ACCOUNTING ACROSS THE ORGANIZATION REL Consultancy Group Can a Company Be Too Liquid? excess working capital of $1.017 trillion in a recent year. This was an 18% increase, which REL said represented a "deterioration in the management of operations." Given that managers throughout a company are interested in improving profitability, it is clear that they should have an eye toward managing working capital. They need to aim for a "Goldilocks solution"-not too much, not too little, but just right. There actually is a point where a company can be too liquid-that is, it can have too much working capi- tal. While it is important to be liquid enough to be able to pay short-term bills as they come due, a company does not want to tie up its cash in extra inventory or receivables that are not earning the company money. By one estimate from the REL Consultancy Group, the thousand largest U.S. companies had cumulative Source: Maxwell Murphy, "The Big Number," Wall Street Journal (November 9, 2011). What can various company managers do to ensure that working capital is managed efficiently to maximize net income? (Go to WileyPLUS for this answer and additional Jorge Salcedo/iStockphoto questions.) Solvency Now suppose that instead of being a short-term creditor, you are interested in either buying Best Buy's stock or extending the company a long-term loan. Long- term creditors and stockholders are interested in a company's solvency-its abil- *y to pay interest as it comes due and to repay the balance of a debt due at its

E2-9 Nordstrom, Inc. operates department stores in numerous states. Selected financial statement data (in millions of dollars) for a recent year follow. Beginning of Year End of Year Cash and cash equivalents Receivables (net) Merchandise inventory Other current assets $ 72 1,942 $358 1,788 956 900 303 259 Total current assets $3,217 $3,361 $1,601 $1,635 Total current liabilities Instructions (a) Compute working capital and the current ratio at the beginning of the year and at the end of the year. (b) Did Nordstrom's liquidity improve or worsen during the year? (c) Using the data in the chapter, compare Nordstrom's liquidity with Best Buy's (see page 55). SOTO) of Myeneke Corporation requested that the ac- 55 Analyzing the Financial Statements a significantly different current ratios. Illustration 2-14 shows the 2014 and 2013 current ratios for Best Buy and for hhgregg, along with the 2014 industry average. ILLUSTRATION 2-14 Current Ratio- Current Assets Current Liabilities Current ratio Best Buy (S in millions) Industry Average hhgregg 2013 2014 2014 2014 $10,485 = 1.41:1 1.11:1 1.68:1 .88:1 $7,436 What does the ratio actually mean? Best Buy's 2014 current ratio of 1.41:1 means that for every dollar of current liabilities, Best Buy has $1.41 of current assets, Best Buy's current ratio increased in 2014. When compared to the indus- try average of .88:1, Best Buy's liquidity seems strong. It is lower than hhgregg's but not significantly so. One potential weakness of the current ratio is that it does not take into ETHICS NOTE account the composition of the current assets. For example, a satisfactory cur- A company that has more rent ratio does not disclose whether a portion of the current assets is tied up in current assets than current slow-moving inventory. The composition of the current assets matters because a dollar of cash is more readily available to pay the bills than is a dollar of inven- liabilities by using cash to pay tory. For example, suppose a company's cash balance declined while its mer- chandise inventory increased substantially. If inventory increased because the company is having difficulty selling its products, then the current ratio might not fully reflect the reduction in the company's liquidity. liabilities can increase the ratio of current assets to current off some current liabilities. This gives the appearance of being more liquid. Do you think this move is ethical? ACCOUNTING ACROSS THE ORGANIZATION REL Consultancy Group Can a Company Be Too Liquid? excess working capital of $1.017 trillion in a recent year. This was an 18% increase, which REL said represented a "deterioration in the management of operations." Given that managers throughout a company are interested in improving profitability, it is clear that they should have an eye toward managing working capital. They need to aim for a "Goldilocks solution"-not too much, not too little, but just right. There actually is a point where a company can be too liquid-that is, it can have too much working capi- tal. While it is important to be liquid enough to be able to pay short-term bills as they come due, a company does not want to tie up its cash in extra inventory or receivables that are not earning the company money. By one estimate from the REL Consultancy Group, the thousand largest U.S. companies had cumulative Source: Maxwell Murphy, "The Big Number," Wall Street Journal (November 9, 2011). What can various company managers do to ensure that working capital is managed efficiently to maximize net income? (Go to WileyPLUS for this answer and additional Jorge Salcedo/iStockphoto questions.) Solvency Now suppose that instead of being a short-term creditor, you are interested in either buying Best Buy's stock or extending the company a long-term loan. Long- term creditors and stockholders are interested in a company's solvency-its abil- *y to pay interest as it comes due and to repay the balance of a debt due at its

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 56P: The following selected information is taken from the financial statements of Arnn Company for its...

Related questions

Question

100%

Question E2-9 I'm hoping I'm doing this right.

Transcribed Image Text:E2-9 Nordstrom, Inc. operates department stores in numerous states. Selected financial

statement data (in millions of dollars) for a recent year follow.

Beginning of Year

End of Year

Cash and cash equivalents

Receivables (net)

Merchandise inventory

Other current assets

$ 72

1,942

$358

1,788

956

900

303

259

Total current assets

$3,217

$3,361

$1,601

$1,635

Total current liabilities

Instructions

(a) Compute working capital and the current ratio at the beginning of the year and at the

end of the year.

(b) Did Nordstrom's liquidity improve or worsen during the year?

(c) Using the data in the chapter, compare Nordstrom's liquidity with Best Buy's (see

page 55).

SOTO) of Myeneke Corporation requested that the ac-

Transcribed Image Text:55

Analyzing the Financial Statements

a significantly different current ratios. Illustration 2-14 shows the 2014 and 2013

current ratios for Best Buy and for hhgregg, along with the 2014 industry average.

ILLUSTRATION 2-14

Current Ratio-

Current Assets

Current Liabilities

Current ratio

Best Buy

(S in millions)

Industry

Average

hhgregg

2013

2014

2014

2014

$10,485

= 1.41:1

1.11:1

1.68:1

.88:1

$7,436

What does the ratio actually mean? Best Buy's 2014 current ratio of 1.41:1

means that for every dollar of current liabilities, Best Buy has $1.41 of current

assets, Best Buy's current ratio increased in 2014. When compared to the indus-

try average of .88:1, Best Buy's liquidity seems strong. It is lower than hhgregg's

but not significantly so.

One potential weakness of the current ratio is that it does not take into ETHICS NOTE

account the composition of the current assets. For example, a satisfactory cur- A company that has more

rent ratio does not disclose whether a portion of the current assets is tied up in current assets than current

slow-moving inventory. The composition of the current assets matters because a

dollar of cash is more readily available to pay the bills than is a dollar of inven- liabilities by using cash to pay

tory. For example, suppose a company's cash balance declined while its mer-

chandise inventory increased substantially. If inventory increased because the

company is having difficulty selling its products, then the current ratio might not

fully reflect the reduction in the company's liquidity.

liabilities can increase the ratio

of current assets to current

off some current liabilities. This

gives the appearance of being

more liquid. Do you think this

move is ethical?

ACCOUNTING ACROSS THE ORGANIZATION

REL Consultancy Group

Can a Company Be Too

Liquid?

excess working capital of $1.017 trillion in a recent year.

This was an 18% increase, which REL said represented a

"deterioration in the management of operations." Given that

managers throughout a company are interested in improving

profitability, it is clear that they should have an eye toward

managing working capital. They need to aim for a "Goldilocks

solution"-not too much, not too little, but just right.

There actually is a point where a

company can be too liquid-that is,

it can have too much working capi-

tal. While it is important to be liquid

enough to be able to pay short-term

bills as they come due, a company

does not want to tie up its cash in

extra inventory or receivables that

are not earning the company money.

By one estimate from the REL

Consultancy Group, the thousand

largest U.S. companies had cumulative

Source: Maxwell Murphy, "The Big Number," Wall Street Journal

(November 9, 2011).

What can various company managers do to ensure that

working capital is managed efficiently to maximize net

income? (Go to WileyPLUS for this answer and additional

Jorge Salcedo/iStockphoto

questions.)

Solvency

Now suppose that instead of being a short-term creditor, you are interested in

either buying Best Buy's stock or extending the company a long-term loan. Long-

term creditors and stockholders are interested in a company's solvency-its abil-

*y to pay interest as it comes due and to repay the balance of a debt due at its

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub