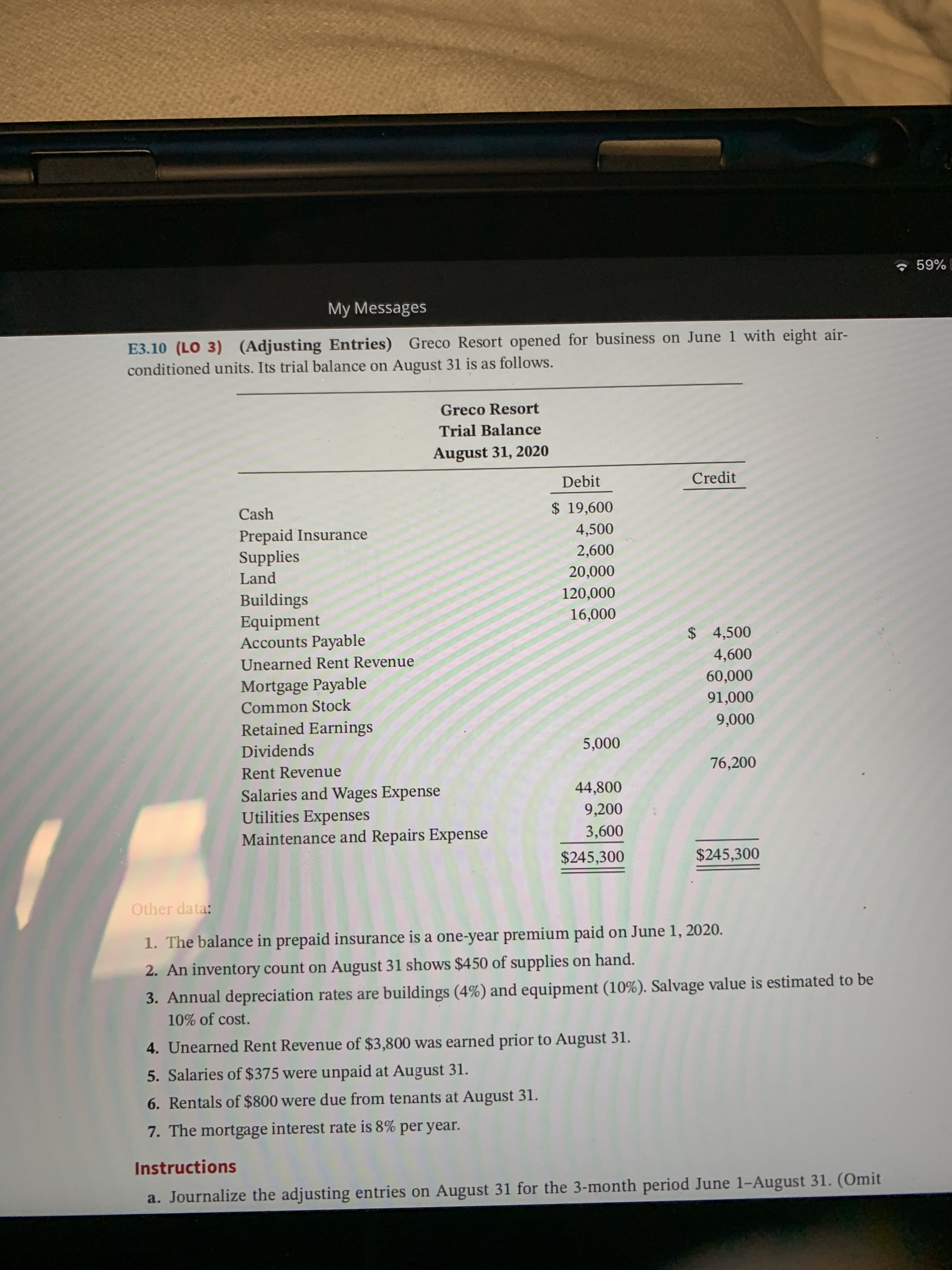

E3.10 (LO 3) (Adjusting Entries) Greco Resort opened for business on June 1 with eight air- conditioned units. Its trial balance on August 31 is as follows. Greco Resort Trial Balance August 31, 2020 Debit Credit Cash $ 19,600 Prepaid Insurance Supplies 4,500 2,600 Land 20,000 Buildings Equipment Accounts Payable 120,000 16,000 $ 4,500

E3.10 (LO 3) (Adjusting Entries) Greco Resort opened for business on June 1 with eight air- conditioned units. Its trial balance on August 31 is as follows. Greco Resort Trial Balance August 31, 2020 Debit Credit Cash $ 19,600 Prepaid Insurance Supplies 4,500 2,600 Land 20,000 Buildings Equipment Accounts Payable 120,000 16,000 $ 4,500

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.23E: Adjustment for depreciation The estimated amount of depredation on equipment for the current year is...

Related questions

Question

3.10

Transcribed Image Text:E3.10 (LO 3) (Adjusting Entries) Greco Resort opened for business on June 1 with eight air-

conditioned units. Its trial balance on August 31 is as follows.

Greco Resort

Trial Balance

August 31, 2020

Debit

Credit

Cash

$ 19,600

Prepaid Insurance

Supplies

4,500

2,600

Land

20,000

Buildings

Equipment

Accounts Payable

120,000

16,000

$ 4,500

Transcribed Image Text:My Messages

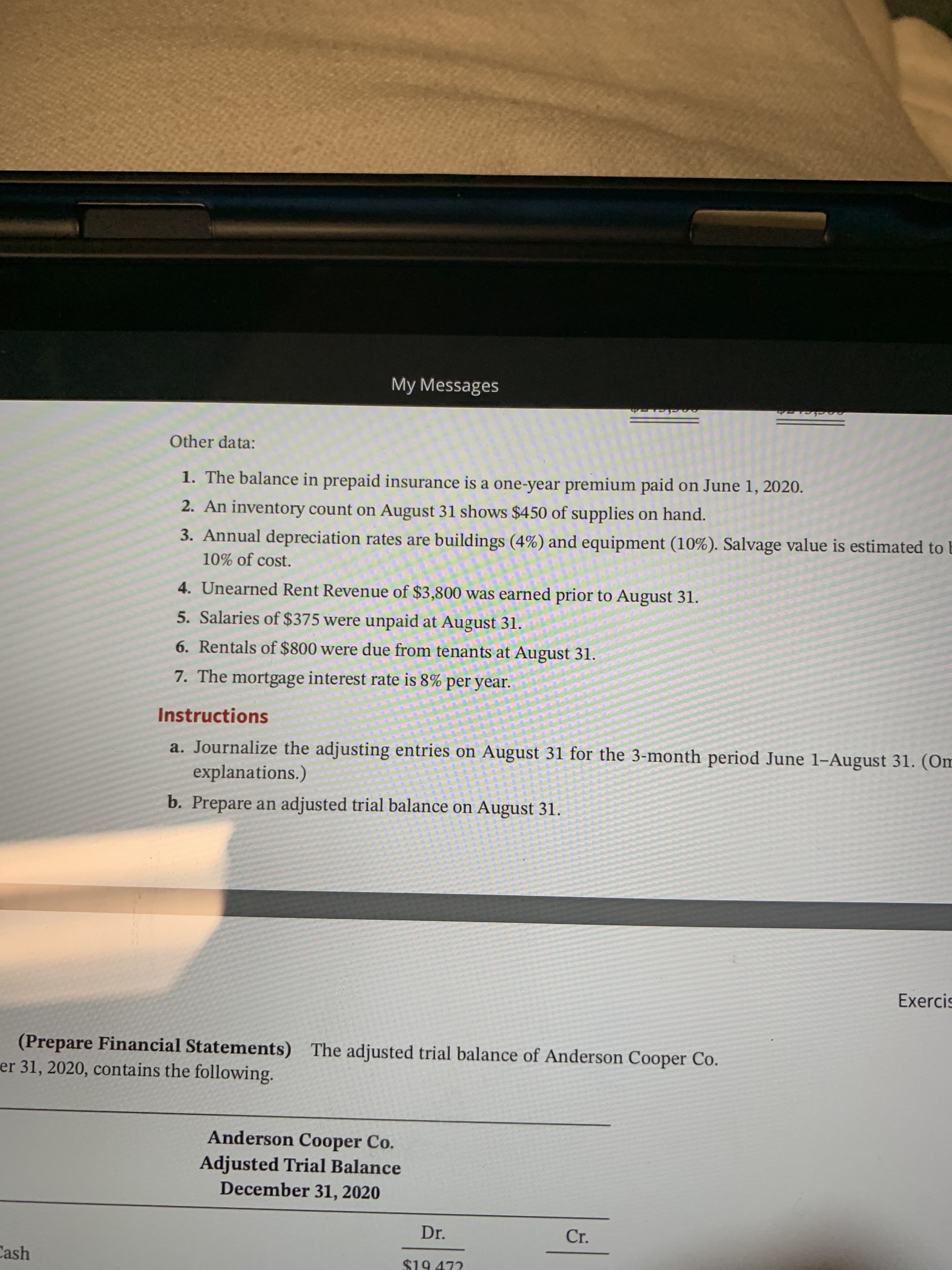

Other data:

1. The balance in prepaid insurance is a one-year premium paid on June 1, 2020.

2. An inventory count on August 31 shows $450 of supplies on hand.

3. Annual depreciation rates are buildings (4%) and equipment (10%). Salvage value is estimated to b

10% of cost.

4. Unearned Rent Revenue of $3,800 was earned prior to August 31.

5. Salaries of $375 were unpaid at August 31.

6. Rentals of $800 were due from tenants at August 31.

7. The mortgage interest rate is 8% per year.

Instructions

a. Journalize the adjusting entries on August 31 for the 3-month period June 1-August 31. (Om

explanations.)

b. Prepare an adjusted trial balance on August 31.

Exercis

(Prepare Financial Statements)

er 31, 2020, contains the following.

The adjusted trial balance of Anderson Cooper Co.

Anderson Cooper Co.

Adjusted Trial Balance

December 31, 2020

Dr.

Cr.

Cash

$19 472

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning