E5-14 Naylor Company had $210,000 of net income in 2013 when the selling price per unit was $150, the variable costs per unit were $90, and the fixed costs were $570,000. Management expects per unit data and total fixed costs to remain the same in 2014. The president of Naylor Company is under pressure from stockholders to increase net income by $52,000 in 2014. Instructions (a) Compute the number of units sold in 2013. (b) Compute the number of units that would have to be sold in 2014 to reach the stock- holders' desired profit level. (c) Assume that Naylor Company sells the same number of units in 2014 as it did in 2013. What would the selling price have to be in order to reach the stockholders' desired profit level?

E5-14 Naylor Company had $210,000 of net income in 2013 when the selling price per unit was $150, the variable costs per unit were $90, and the fixed costs were $570,000. Management expects per unit data and total fixed costs to remain the same in 2014. The president of Naylor Company is under pressure from stockholders to increase net income by $52,000 in 2014. Instructions (a) Compute the number of units sold in 2013. (b) Compute the number of units that would have to be sold in 2014 to reach the stock- holders' desired profit level. (c) Assume that Naylor Company sells the same number of units in 2014 as it did in 2013. What would the selling price have to be in order to reach the stockholders' desired profit level?

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter9: Operating Activities

Section: Chapter Questions

Problem 20PC: A large manufacturer of truck and car tires recently changed its cost-flow assumption method for...

Related questions

Question

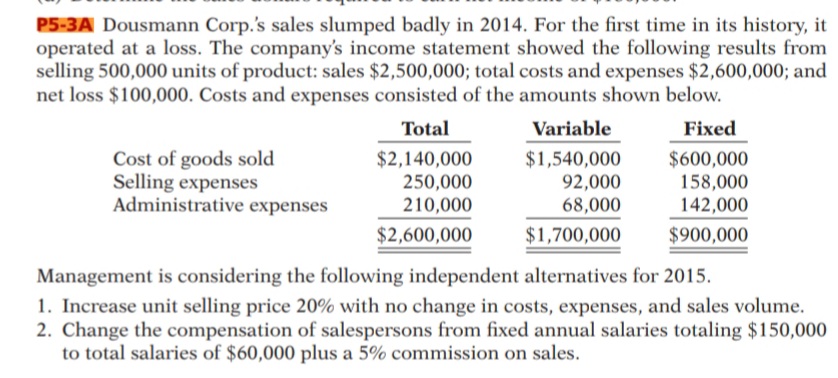

Transcribed Image Text:P5-3A Dousmann Corp.'s sales slumped badly in 2014. For the first time in its history, it

operated at a loss. The company's income statement showed the following results from

selling 500,000 units of product: sales $2,500,000; total costs and expenses $2,600,000; and

net loss $100,000. Costs and expenses consisted of the amounts shown below.

Total

Variable

Fixed

Cost of goods sold

Selling expenses

Administrative expenses

$2,140,000

250,000

210,000

$1,540,000

92,000

68,000

$600,000

158,000

142,000

$2,600,000

$1,700,000

$900,000

Management is considering the following independent alternatives for 2015.

1. Increase unit selling price 20% with no change in costs, expenses, and sales volume.

2. Change the compensation of salespersons from fixed annual salaries totaling $150,000

to total salaries of $60,000 plus a 5% commission on sales.

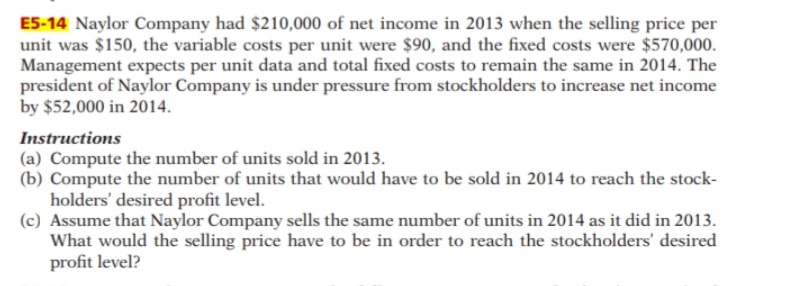

Transcribed Image Text:E5-14 Naylor Company had $210,000 of net income in 2013 when the selling price per

unit was $150, the variable costs per unit were $90, and the fixed costs were $570,000.

Management expects per unit data and total fixed costs to remain the same in 2014. The

president of Naylor Company is under pressure from stockholders to increase net income

by $52,000 in 2014.

Instructions

(a) Compute the number of units sold in 2013.

(b) Compute the number of units that would have to be sold in 2014 to reach the stock-

holders' desired profit level.

(c) Assume that Naylor Company sells the same number of units in 2014 as it did in 2013.

What would the selling price have to be in order to reach the stockholders' desired

profit level?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning