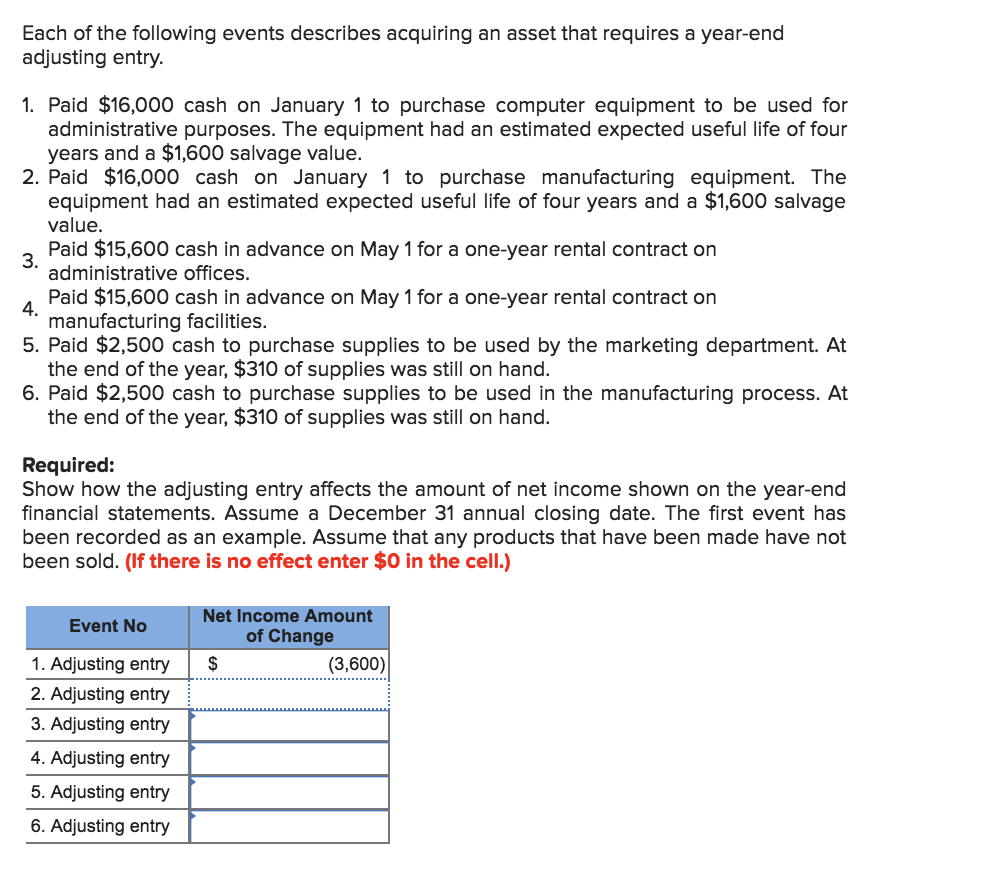

Each of the following events describes acquiring an asset that requires a year-end adjusting entry 1. Paid $16,000 cash on January 1 to purchase computer equipment to be used for administrative purposes. The equipment had an estimated expected useful life of four years and a $1,600 salvage value. 2. Paid $16,000 cash on January 1 to purchase manufacturing equipment. The equipment had an estimated expected useful life of four years and a $1,600 salvage value Paid $15,600 cash in advance on May 1 for a one-year rental contract on 3. administrative offices. Paid $15,600 cash in advance on May 1 for a one-year rental contract on 4. manufacturing facilities. 5. Paid $2,500 cash to purchase supplies to be used by the marketing department. At the end of the year, $310 of supplies was still on hand. 6. Paid $2,500 cash to purchase supplies to be used in the manufacturing process. At the end of the year, $310 of supplies was still on hand. Required: Show how the adjusting entry affects the amount of net income shown on the year-end financial statements. Assume a December 31 annual closing date. The first event has been recorded as an example. Assume that any products that have been made have not been sold. (If there is no effect enter $0 in the cell.) Net Income Amount Event No of Change (3,600) 1. Adjusting entry $ 2. Adjusting entry 3. Adjusting entry 4. Adjusting entry 5. Adjusting entry 6. Adjusting entry

Each of the following events describes acquiring an asset that requires a year-end adjusting entry 1. Paid $16,000 cash on January 1 to purchase computer equipment to be used for administrative purposes. The equipment had an estimated expected useful life of four years and a $1,600 salvage value. 2. Paid $16,000 cash on January 1 to purchase manufacturing equipment. The equipment had an estimated expected useful life of four years and a $1,600 salvage value Paid $15,600 cash in advance on May 1 for a one-year rental contract on 3. administrative offices. Paid $15,600 cash in advance on May 1 for a one-year rental contract on 4. manufacturing facilities. 5. Paid $2,500 cash to purchase supplies to be used by the marketing department. At the end of the year, $310 of supplies was still on hand. 6. Paid $2,500 cash to purchase supplies to be used in the manufacturing process. At the end of the year, $310 of supplies was still on hand. Required: Show how the adjusting entry affects the amount of net income shown on the year-end financial statements. Assume a December 31 annual closing date. The first event has been recorded as an example. Assume that any products that have been made have not been sold. (If there is no effect enter $0 in the cell.) Net Income Amount Event No of Change (3,600) 1. Adjusting entry $ 2. Adjusting entry 3. Adjusting entry 4. Adjusting entry 5. Adjusting entry 6. Adjusting entry

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 29P

Related questions

Question

Transcribed Image Text:Each of the following events describes acquiring an asset that requires a year-end

adjusting entry

1. Paid $16,000 cash on January 1 to purchase computer equipment to be used for

administrative purposes. The equipment had an estimated expected useful life of four

years and a $1,600 salvage value.

2. Paid $16,000 cash on January 1 to purchase manufacturing equipment. The

equipment had an estimated expected useful life of four years and a $1,600 salvage

value

Paid $15,600 cash in advance on May 1 for a one-year rental contract on

3.

administrative offices.

Paid $15,600 cash in advance on May 1 for a one-year rental contract on

4.

manufacturing facilities.

5. Paid $2,500 cash to purchase supplies to be used by the marketing department. At

the end of the year, $310 of supplies was still on hand.

6. Paid $2,500 cash to purchase supplies to be used in the manufacturing process. At

the end of the year, $310 of supplies was still on hand.

Required:

Show how the adjusting entry affects the amount of net income shown on the year-end

financial statements. Assume a December 31 annual closing date. The first event has

been recorded as an example. Assume that any products that have been made have not

been sold. (If there is no effect enter $0 in the cell.)

Net Income Amount

Event No

of Change

(3,600)

1. Adjusting entry

$

2. Adjusting entry

3. Adjusting entry

4. Adjusting entry

5. Adjusting entry

6. Adjusting entry

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning